By FXEmpire.com

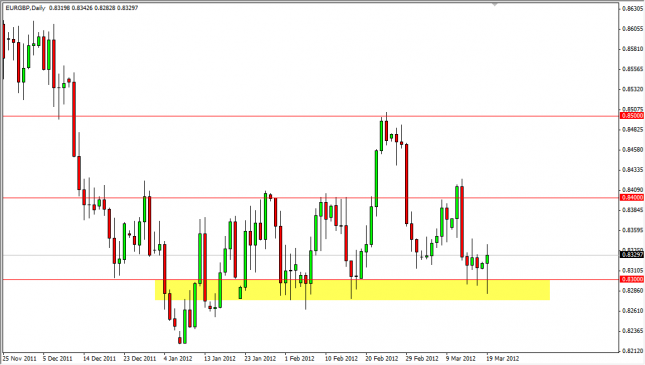

The EUR/GBP pair fell for most of the session on Monday, but bounced at the 0.83 level yet again to form another hammer. The last few sessions have produced quite a bit of a struggle, and as such we have had three hammers and one shooting star. Needless to say, this sets the area up to be a significant battleground between the bulls and bears.

The Euro had a solid day around the markets in general, and this suggests that perhaps the world is ready to stop focusing on the Euro for a few moments. Quite frankly, the less news that we see out of Europe, the better the Euro will do. However, over the longer term, we fully expect the spotlight to focus on places like Portugal, Spain, and Italy. The Portuguese bonds markets are offering astronomical rates at the moment, suggesting that it could be the next place that the markets focus on. If that is the case, it will play out much like the drama in Greece.

The ).83 level looks very solid at this point, and the fact that we have seen 3 hammers and only one shooting star over the last 4 days suggests to us that the support is going to win out. However, the “guessing” of this market isn’t how we trade. The pattern does give us particular areas to pay attention to, and as a result the trade sets up rather cleanly for us going forward.

If the market manages to break above the highs of the shooting star at roughly 0.8350, then we will see a run back to the 0.84 level. If we see a breakdown of price below the lowest point of the Monday session, this would show severe weakness in the market, and would more than likely be accompanied by Euro weakness in general. While we don’t know what the reason will be – it isn’t hard to imagine several possibilities. Because of this, we like the idea of being short, and would prefer to do so on a breakdown, or even a failure to break out and above the 0.84 level.

EUR/GBP Forecast March 20, 2012, Technical Analysis

Originally posted here