By FXEmpire.com

EUR/GBP Fundamental Analysis April 18, 2012, Forecast

Analysis and Recommendations:

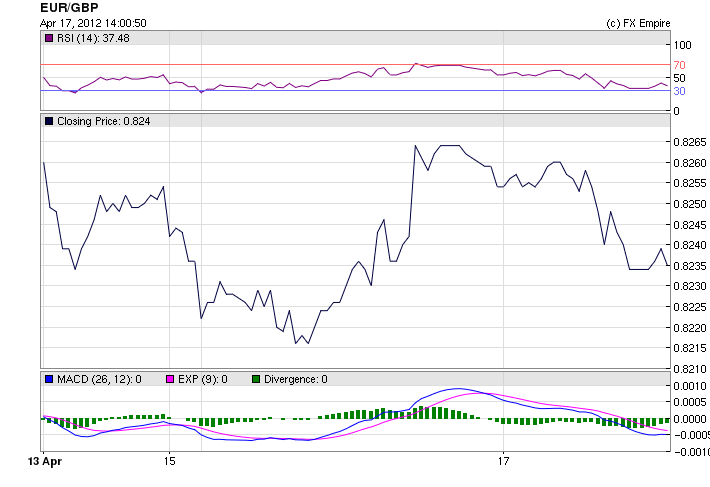

The EUR/GBP is slightly depressed at 0.8237 as the pair moved between 0.8266 and 0.8230.

The pace of inflation in Great Britain accelerated to 3.5% in March from 3.4% the previous month, the U.K. Office for National Statistics reported. On a monthly basis, inflation rose 0.3%. Economists had forecast a 0.3% monthly rise on the basis of higher energy costs.

The euro on the other hand was weighed down by Spain once again.

The euro picked up strength on the back of several positive German eco reports.

The closely-watched ZEW index of German investor sentiment released Tuesday unexpectedly rose in April for its fifth consecutive monthly gain. The indicator, which measures expectations among German investment professionals for the next six months. The indicator rose to 23.4 from 22.3 in March.

The annual rate of inflation in the euro-zone came in at 2.7% in March, unchanged from the previous month but revised upward from a preliminary estimate of 2.6%, the European Union statistics agency Eurostat reported.

Now that Greece is out of the headlines it’s all about Spain. Spain saw short-term borrowing costs rise as it sold 3.2 billion euros ($4.2 billion) of 12- and 18-month bills in a closely-watched auction Tuesday, news reports said. Spain saw the average yield on its sale of 12-month bills rise to 2.62%.

Spain’s economy is back in recession after a mild recovery in early and mid-2011, and faces an “exceptional” situation that may led to further increases in unemployment, Bank of Spain Governor Miguel Angel Fernandez Ordonez said today.

Economic Reports April 17, 2012 actual v. forecast

|

Apr. 17 |

AUD |

Monetary Policy Meeting Minutes |

||

|

JPY |

Industrial Production (MoM) |

-1.6% |

-1.2% |

-1.2% |

|

INR |

Indian Interest Rate Decision |

8.00% |

8.30% |

8.50% |

|

GBP |

Core CPI (YoY) |

2.5% |

2.4% |

2.4% |

|

GBP |

CPI (YoY) |

3.5% |

3.5% |

3.4% |

|

GBP |

CPI (MoM) |

0.3% |

0.3% |

0.6% |

|

EUR |

CPI (YoY) |

2.7% |

2.6% |

2.6% |

|

EUR |

German ZEW Economic Sentiment |

23.4 |

20.0 |

22.3 |

|

EUR |

ZEW Economic Sentiment |

13.1 |

10.7 |

11.0 |

|

EUR |

Core CPI (YoY) |

1.6% |

1.5% |

|

|

USD |

Building Permits |

0.747M |

0.710M |

0.715M |

|

USD |

Housing Starts |

0.654M |

0.705M |

0.694M |

|

Manufacturing Sales (MoM) |

-0.30% |

-1.00% |

-1.30% |

|

|

EUR |

ECB President Draghi Speaks |

|||

|

CAD |

Interest Rate Decision |

1.00% |

1.00% |

1.00% |

|

USD |

Industrial Production (MoM) |

0.0% |

0.3% |

0.0% |

Economic Events scheduled for April 18, 2012 that affect the European and American Markets

08:30:00 GBP Average Earnings including Bonus (3Mo/Yr) 1.30% 1.40%

The Average Earning Including Bonus released by the National Statistics is a key short-term indicator of how levels of pay are changing within the UK economy. Generally speaking, the positive earnings growth anticipates positive (or bullish) for the GBP, whereas a low reading is seen as negative (or bearish).

08:30:00 GBP Bank of England Minutes

The minutes of the BoE MPC meetings are published two weeks after the interest rate decision. The minutes give a full account of the policy discussion, including differences of view. They also record the votes of the individual members of the Committee. Generally speaking, if the BoE is hawkish about the inflationary outlook for the economy, then the markets see a higher possibility of a rate increase, and that is positive for the GBP.

08:30:00 GBP Claimant Count Change 7.0K 7.2K

The Claimant Change released by the National Statistics presents the number of unemployment people in the UK. There is a tendency to influence the GBP volatility. Generally speaking, a rise in this indicator has negative implications for consumer spending which discourage economic growth. Generally, a high reading is seen as negative (or bearish) for the GBP, while a low reading is seen as positive (or bullish).

08:30:00 GBP Claimant Count Rate 5%

The Claimant Count Rate released by the National Statistics is a monthly measure of unemployment in the UK It indicates the health of the UK labor market. If the rate is up, it indicates a lack of expansion within the UK labor market, while it indicates economic expansion and could spark inflationary pressures if the rate is down. Generally, a decrease of the figure is seen as positive (or bullish) for the GBP, while an increase is seen as negative.

08:30:00 GBP ILO Unemployment Rate (3M) 8.40% 8.40%

The ILO Unemployment Rate released by the National Statistics is the number of unemployed workers divided by the total civilian labor force. It is a leading indicator for the UK Economy. If the rate is up, it indicates a lack of expansion within the U.K. labor market. As a result, a rise leads to weaken the U.K. economy. Generally, a decrease of the figure is positive (or bullish) for the GBP, while an increase is negative.

09:00:00 CHF ZEW Survey – Expectations -8 0

The ZEW Survey Expectations published by the Centre for European Economic Research presents business conditions, employment conditions and other elements affecting the day to day running of a business in Switzerland. Generally speaking, a high reading is seen as positive (or bullish) for the CHF, whereas a low reading is seen as negative (or bearish).

Government Bond Auctions (this week)

Apr 18 09:10 Sweden Nominal bond auction

Apr 18 09:30 Germany Eur 5.0bn 0.25% Mar 2014 Schatz

Apr 18 14:30 Sweden Details T-bill auction on Apr 25

Apr 19 08:30 Spain Obligacion auction

Apr 19 08:50 France BTAN auction

Apr 19 09:30 UK Auctions 0.125% I/L Gilt 2029

Apr 19 09:50 France OATi auction

Originally posted here