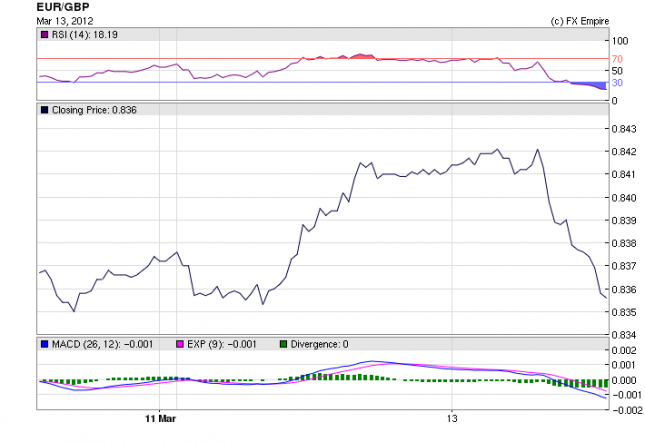

EUR/GBP Fundamental Analysis March 16, 2012, Forecast

Analysis and Recommendations:

The pair EUR/GBP is trading at 0.8330 up from 0.8314. The euro is benefiting by investors exodus from the USD. As the markets have been inundated with positive data from the US, investors have become more upbeat and are moving away from the safety of the USD into more risky assets. The euro has benefits significantly by this change in behavior.

Fitch today affirmed the UK’s AAA rating but did place it on a negative advisory suggesting if the economic situation continues for two more years, the UK might be considered for a downgrade. The markets took this with little reaction.

In the eurozone today, a data showed that real wages fell again in the 17 countries that use the euro in the fourth quarter of last year, while employment also declined; confirming consumption and confidence are likely to remain weak as the region teeters on the brink of a return to recession.

Released Economic Reports for March 15, 2012 actual v. forecast

|

Date |

Time |

Currency |

Event |

Actual |

Forecast |

Previous |

|

Mar. 15 |

09:30 |

CHF |

Interest Rate Decision |

0.00% |

0.00% |

0.00% |

|

10:00 |

EUR |

ECB Monthly Report |

||||

|

11:00 |

EUR |

Employment Change (QoQ) |

-0.2% |

-0.2% |

-0.2% |

|

|

13:30 |

USD |

Core PPI (MoM) |

0.2% |

0.2% |

0.4% |

|

|

13:30 |

USD |

PPI (MoM) |

0.4% |

0.5% |

0.1% |

|

|

13:30 |

USD |

Initial Jobless Claims |

351K |

356K |

365K |

|

|

13:30 |

USD |

NY Empire State Manufacturing Index |

20.2 |

17.4 |

19.5 |

|

|

13:30 |

USD |

Continuing Jobless Claims |

3343K |

3405K |

3424K |

|

|

14:00 |

USD |

TIC Net Long-Term Transactions |

101.0B |

29.3B |

19.1B |

|

|

15:00 |

USD |

Philadelphia Fed Manufacturing Index |

12.5 |

11.4 |

10.2 |

Economic Events for March 16, 2012

Time Currency Event Forecast Previous

13:30 CAD Foreign Securities Purchases 6.27B 7.38B

Foreign Securities Purchases measures the overall value of domestic stocks, bonds, and money-market assets purchased by foreign investors.

13:30 CAD Manufacturing Sales (MoM) 0.60% 0.60%

Manufacturing Sales measures the change in the overall value of sales made at the manufacturing level.

13:30 USD Core CPI (MoM) 0.2% 0.2%

13:30 USD CPI (MoM) 0.4% 0.2%

The Consumer Price Index (CPI) measures the change in the price of goods and services from the perspective of the consumer. It is a key way to measure changes in purchasing trends and inflation.

14:15 USD Industrial Production (MoM) 0.4% 0.0%

Industrial Production measures the change in the total inflation-adjusted value of output produced by manufacturers, mines, and utilities.

14:55 USD Michigan Consumer Sentiment Index 75.7 75.3

The University of Michigan Consumer Sentiment Index rates the relative level of current and future economic conditions. There are two versions of this data released two weeks apart, preliminary and revised. The preliminary data tends to have a greater impact. The reading is compiled from a survey of around 500 consumers.

Government Bond Auction Schedule (this week)

Mar 15 16:00 US Announces auction of 10Y TIPS on Mar 22

Originally posted here