By FXEmpire.com

EUR/GBP Fundamental Analysis March 21, 2012, Forecast

Analysis and Recommendations:

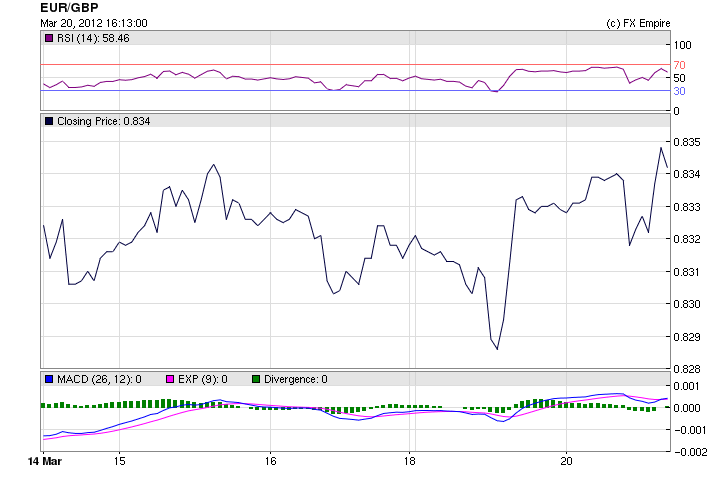

The pair EUR/GBP traded like its cousins today, up and down in rocky trading. The pair fell as the pound picked up some strength on the back of several economic reports, only to lose strength towards the end of trading and gave up early gains, only to recapture some as the markets closed. The pair ended the day, at 0.8340 slightly up from the opening at 0.8330. They traded as high as 0.8355 and as low as 0.831.

Britain’s Office for Budget Responsibility will revise its economic forecast slightly higher when the U.K. government presents its budget this week, the Financial Times reported.

Annual consumer price inflation in Britain slowed to 3.4% in February, slowing from a 3.6% annual pace in January, the Office for National Statistics reported. On a monthly basis, consumer inflation rose 0.6% from January.

Economic Releases March 20, 2012 Asia, Europe and the US

|

Mar. 20 |

00:00 |

AUD |

CB Leading Index (MoM) |

1.1% |

-0.3% |

|

08:00 |

EUR |

German PPI (MoM) |

0.4% |

0.5% |

0.6% |

|

09:15 |

CHF |

Industrial Production (QoQ) |

7.9% |

0.4% |

-2.0% |

|

10:30 |

GBP |

Core CPI (YoY) |

2.4% |

2.4% |

2.6% |

|

10:30 |

GBP |

CPI (YoY) |

3.4% |

3.4% |

3.6% |

|

10:30 |

GBP |

RPI (YoY) |

3.7% |

3.4% |

3.9% |

|

12:00 |

GBP |

CBI Industrial Trends Orders |

-8 |

-5 |

-3 |

|

12:30 |

EUR |

Spanish Trade Balance |

-3.65B |

-4.50B |

-4.50B |

|

13:30 |

USD |

Building Permits |

0.72M |

0.69M |

0.68M |

|

13:30 |

USD |

Housing Starts |

0.70M |

0.70M |

0.71M |

|

14:00 |

RUB |

Russian Retail Sales (YoY) |

7.7% |

7.3% |

6.8% |

|

14:00 |

RUB |

Russian Unemployment Rate |

6.5% |

6.7% |

6.6% |

|

16:30 |

USD |

4-Week Bill Auction |

0.100% |

0.070% |

10:30 GBP MPC Meeting Minutes

The Monetary Policy Meeting Minutes are a detailed record of the Bank of England’s policy setting meeting, containing in-depth insights into the economic conditions that influenced the decision on where to set interest rates. The breakdown of the MPC members’ interest rate votes tends to be the most important part of the minutes.

13:30 CAD Leading Indicators (MoM)

The Leading Indicators Index is a composite index based on 10 economic indicators, that is designed to predict the future direction of the economy. The report tends to have a limited impact because most of the indicators used in the calculation are released previously.

15:00 USD Existing Home Sales

Existing Home Sales measures the change in the annualized number of existing residential buildings that were sold during the previous month. This report helps to gauge the strength of the U.S. housing market and is a key indicator of overall economic strength.

Government Bond Auctions (this week)

Mar 22 10:10 Sweden I/L bond auction

Mar 22 10.30 UK Auctions 0.625% 2042 I/L Gilt

Mar 22 15:00 US

Announces auctions of 2Y Notes on Mar 27, 5Y Notes on Mar

28 & 7Y Notes on Mar 29

ground:Z

Originally posted here