By FXEmpire.com

EUR/GBP Fundamental Analysis March 22, 2012, Forecast

Analysis and Recommendations:

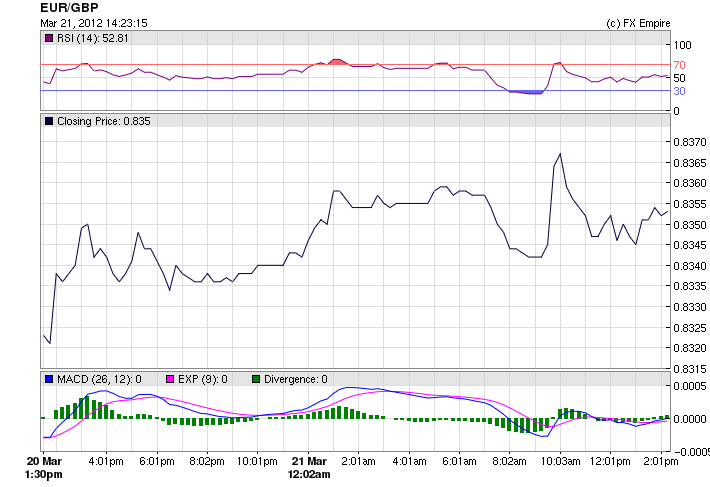

The pair EUR/GBP is trading at 0.8327 as the sterling mounted against the euro pushing it down most of the day, after opening at 0.8336. Early in the day the euro traded higher at 0.8372 until news and data from the UK was released with positive effects on the pound.

British Treasury chief George Osborne said there was no need for further fiscal tightening by the British government as he presented a 2012-13 budget plan to the House of Commons that he declared to be “neutral” over the next five. British Chancellor of the Exchequer Osborne also moved to cut the top personal rate of taxation from 50% to 45% today.

The Bank of England’s rate-setting Monetary Policy Committee voted 7-2 to hold its asset purchases at 325 billion pounds ($516 billion) at its policy meeting earlier this month.

Borrowing by Britain’s public sector, excluding financial interventions, jumped to 15.2 billion pounds ($24.2 billion) in February from 8.9 billion pounds in the same month last year, the U.K. Office for National Statistics reported.

“Europe’s financial and economic situation remains difficult, and it is critical that European leaders follow through on their policy commitments to ensure a lasting stabilization,” US Fed Chief Bernanke said.

The European Financial Stability Facility got some EUR12.5 billion demand for its EUR4 billion new five-year bond, one of the banks managing the deal said Wednesday.

This contrasts with November last year, when the euro zone’s temporary bailout fund attracted just enough demand for a EUR3 billion 10-year bond, as investors remained wary over the lack of clarity about the fund’s functions and future actions. While demand from euro-zone banks for the European Central Bank’s seven-day dollar liquidity offer fell Wednesday, a likely sign that dollar funding on the interbank market is becoming more available to euro-zone banks.

In Germany, the RWI economic institute raised its forecast for the country’s 2012 economic growth Wednesday, but warned that risks to the outlook remain significant. Germany’s economy is likely to grow 1.0% in 2012, up from a December forecast of 0.6%

Germany’s government will probably need to increase its guarantees to the euro-zone’s firewall to about EUR280 billion, much more than the EUR211 billion previously planned, German newspaper Sueddeutsche Zeitung reports Wednesday.

On Thursday, the UK retail sales are due, we will see if this supports the positive news in the UK, if so we will see the GBP push a bit harder.

Economic Data March 21, 2012 actual v. forecast

|

Mar. 21 |

00:30 |

AUD |

MI Leading Index (MoM) |

0.6% |

0.7% |

|

03:00 |

NZD |

Credit Card Spending (YoY) |

4.0% |

3.1% |

|

|

05:30 |

JPY |

All Industries Activity Index (MoM) |

-1.0% |

-0.5% |

1.6% |

|

08:30 |

THB |

Thai Trade Balance |

0.52B |

-0.10B |

-0.20B |

|

08:30 |

THB |

Thai Interest Rate Decision |

3.00% |

3.00% |

3.00% |

|

10:30 |

GBP |

MPC Meeting Minutes |

|||

|

10:30 |

GBP |

Public Sector Net Borrowing |

12.9B |

5.2B |

-10.2B |

|

11:30 |

EUR |

German 2-Year Schatz Auction |

0.310% |

0.250% |

|

|

12:00 |

USD |

MBA Mortgage Applications |

-7.4% |

-2.4% |

|

|

13:30 |

Leading Indicators (MoM) |

0.6% |

0.6% |

0.4% |

|

|

14:30 |

USD |

Fed Chairman Bernanke Testifies |

|||

|

15:00 |

USD |

Existing Home Sales |

4.59M |

4.61M |

4.63M |

|

15:00 |

MXN |

Mexican Retail Sales (YoY) |

4.4% |

4.0% |

3.5% |

Economic Events scheduled for March 22, 2012 affecting the USA and Europe

09:00 EUR French Manufacturing PMI

09:30 EUR German Manufacturing PMI

10:00 EUR Manufacturing PMI

The European, French, and German Manufacturing Purchasing Managers’ Index (PMI) measure the activity level of purchasing managers in the manufacturing sector. A reading above 50 indicates expansion in the sector; below indicates contraction. Traders watch these surveys closely as purchasing managers usually have early access to data about their company’s performance, which can be a leading indicator of overall economic performance.

10:30 GBP Retail Sales (MoM)

Retail Sales measure the change in the total value of inflation-adjusted sales at the retail level. It is the foremost indicator of consumer spending, which accounts for the majority of overall economic activity.

11:00 EUR Industrial New Orders (MoM)

Industrial New Orders measures the change in the total value of new purchase orders placed with manufacturers. It is a leading indicator of production.

13:30 USD Initial Jobless Claims

13:30 USD Continuing Jobless Claims

Initial Jobless Claims measures the number of individuals who filed for unemployment insurance for the first time during the past week. This is the earliest U.S. economic data, but the market impact varies from week to week. Continuing Jobless Claims measures the number of unemployed individuals who qualify for benefits under unemployment insurance.

17:00 EUR ECB President Draghi Speaks

Mario Draghi (born 3 September1947) is an Italian banker and economist who has been governor of the Bank of Italy and succeeded Jean Claude Trichet as President of the European Central Bank starting November 2011. As head of the ECB, which controls short term interest rates, he has more influence over the EUR value than any other person. His comments may determine a short-term positive or negative trend.

Government Bond Auctions (this week)

Mar 22 10:10 Sweden I/L bond auction

Mar 22 10.30 UK Auctions 0.625% 2042 I/L Gilt

Mar 22 15:00 US

Announces auctions of 2Y Notes on Mar 27, 5Y Notes on Mar

28 & 7Y Notes on Mar 29

Originally posted here