By FXEmpire.com

EUR/GBP Weekly Fundamental Analysis April 23-27, 2012, Forecast

Introduction: The cross tends to move in ranges, with relatively clear barriers. The narrower ranges made it somewhat harder, but it seems to return to wider ranges. The GBP is does not seem to move in response to the EUR as directly currently. The UK austerity program vs. The EU debt crisis seems to have them moving in opposing distances. They are developing new trading personalities and there is a good deal of profit to be made trading this pair. They can be volatile.

- The interest rate differential between the European Bank(ECB) and the Bank of England(BoE)

- European and UK economic data

- Growth differentials between the Euro zone and UK

Analysis and Recommendations

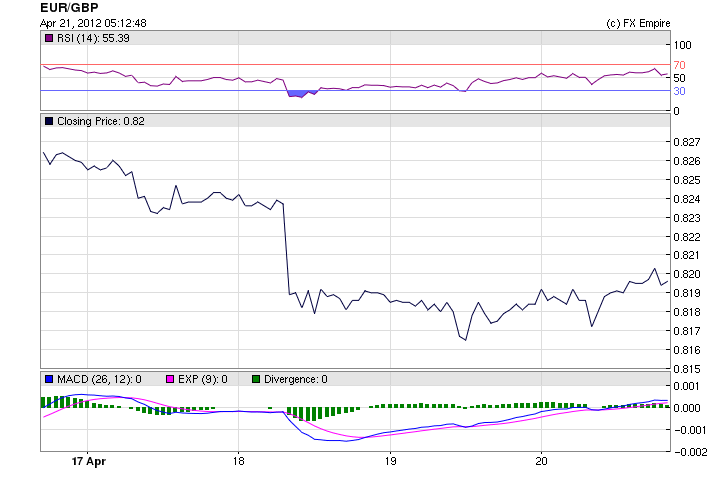

The EUR/GBP is trading at

European markets traded on a positive note today on the back of unexpectedly rise in German business confidence. Asian markets traded on a mixed note and US stock futures are trading in the green territory. G-20 meeting continued for the second day today and has advised European nations to fix its debt crisis which is prolonging since past two years and still threatens the global growth. German Ifo Business Climate unexpectedly rose to 109.9-mark in April from previous level of 109.8 in the last month. German Producer Price Index (PPI) increased to 0.6 percent in March as against a previous rise of 0.4 percent in February. Economic data from UK indicated that, the country’s retail sales rose by 1.8 percent in March compared to previous decline of 0.8 percent in February.

Economic data from UK indicated that, the country’s retail sales rose by 1.8 percent in March compared to previous decline of 0.8 percent in February.UK retail sales for March came in stronger than anticipated, expanding by 1.8% m/m including auto fuel sales and 1.5% if auto fuel sales are stripped out of the number. That is much stronger than had been forecast particularly in terms of the core ex-auto fuel number. While fuel sales were up by a very robust 4.6%, they still only account for 0.3% of the 1.8% gain. The strong retail sales number has positive implications for UK GDP as retail sales had been tracking negatively for the quarter (+0.4% m/m in January, -0.8% in February). While one implication of the unusually high retail sales growth is that some amount of spending normally done is April was brought forward to March due to very warm weather (particularly spending at garden centers), in the final analysis, consumption for Q1 – which looked like it might drag on overall growth – now looks like it will be fairly positive. Despite the solid print, however, pound sterling only put in a middle of the pack performance against the USD overnight.

British retail sales volumes grew at their fastest pace since January 2011 last month, posting a 1.8% monthly rise in March and a 3.3% rise compared to the same month last year, the U.K. Office for National Statistics reported Friday.

The pace of inflation in Great Britain accelerated to 3.5% in March from 3.4% the previous month, the U.K. Office for National Statistics reported. On a monthly basis, inflation rose 0.3%. Economists had forecast a 0.3% monthly rise

Major Economic Events for the past week actual v. forecast

|

USD |

Retail Sales (MoM) |

0.8% |

0.3% |

1.0% |

|

USD |

Core Retail Sales (MoM) |

0.8% |

0.6% |

0.9% |

|

AUD |

Monetary Policy Meeting Minutes |

|||

|

EUR |

ECB President Draghi Speaks |

|||

|

Interest Rate Decision |

1.00% |

1.00% |

1.00% |

|

|

GBP |

MPC Meeting Minutes |

|||

|

GBP |

Claimant Count Change |

3.6K |

7.0K |

4.5K |

|

CAD |

BoC Monetary Policy Report |

|||

|

USD |

Initial Jobless Claims |

386K |

370K |

388K |

|

USD |

Existing Home Sales |

4.48M |

4.62M |

4.60M |

|

GBP |

Retail Sales (MoM) |

1.8% |

0.5% |

-0.8% |

|

GBP |

Retail Sales (YoY) |

3.3% |

1.4% |

1.0% |

|

CAD |

Core CPI (MoM) |

0.3% |

0.4% |

Historical:

Highest: 1.2336 EUR on 29 Jun 2010.

Average: 1.1548 EUR over this period.

Lowest: 1.0686 EUR on 13 Oct 2009

Economic Highlights of the coming week that affect the Euro, GBP, and Franc

|

EUR |

Industrial New Orders (MoM) |

-0.5% |

-2.3% |

|

USD |

New Home Sales |

320K |

313K |

|

USD |

CB Consumer Confidence |

70.3 |

70.8 |

|

GBP |

GDP (YoY) |

0.3% |

0.5% |

|

GBP |

CBI Industrial Trends Orders |

-20 |

-8 |

|

USD |

Durable Goods Orders (MoM) |

-1.5% |

2.4% |

|

USD |

Core Durable Goods Orders (MoM) |

0.5% |

1.8% |

|

USD |

Interest Rate Decision |

||

|

GBP |

Nationwide Consumer Confidence |

44 |

|

|

GBP |

CBI Distributive Trades Survey |

-4 |

|

|

CHF |

KOF Leading Indicators |

0.26 |

0.08 |

Click here to read EUR/GBP Technical Analysis.

Originally posted here