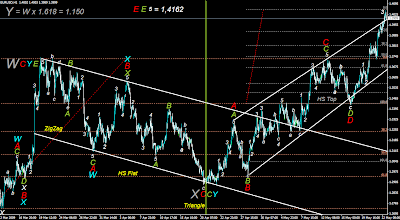

With 1.4050 as friday top price subminuette W3 impulses likely ended allready. Expecting roll down to the 1.3800 or 1.3900 area as W4 pretty immediately on next week, but then the rest up as W5 for 1.4162 where bigger shorting opportunity should knock. Channel was seriously violated in here for which reason I believe this is reasonable safety area to go short.

UsaCad likely is key in here to start more powerfull downroll from allover, once .618 is hit – this market starts to take steps down as do equities as well and that´s close now. Either it´s going to be very boring 2 months difficult sideways market down or then 2-3 weeks snap hit to the SPX 800 area.

Also much bigger question raises hands in here, as this runaway is impulse also it might pinpoint later to the 1.5150 area as Y wave, however, before than happens market likely considering sell these “trees”, each of 1000 pips uproads as they come similir sizes with 1.4150. Oscillators do not provide extreme falling method yet even after this high run, but would expect subminuette W4 correction for it on next monday (thuesday).