By FXEmpire.com

EUR/USD Fundamental Analysis April 5, 2012, Forecast

Analysis and Recommendations:

REMEMBER, MOST GLOBAL MARKETS ARE CLOSED ON FRIDAY APRIL 6, 2012 AND MANY ARE CLOSED ON MONDAY APRIL 9, 2012 ALSO. VOLUME WILL BE LIGHT AND TRADERS WILL BE POSITIONING THEMSELVES FOR THE LONG HOLIDAY WEEKEND. ECONOMIC REPORTS WILL CONTINUE TO BE RELEASED ON FRIDAY, IN THE US THE NON FARMS PAYROLL REPORTS WILL BE ISSUED ON FRIDAY

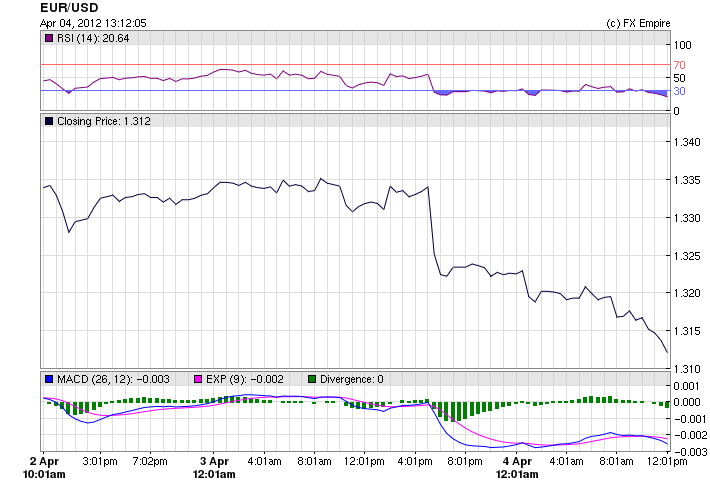

The EUR/USD could best described as a fall from grace. The euro fell from a high yesterday of 1.3368 as euro supporters were heralding the strength of the euro and were patting each other on the back that a major crisis in Europe had been averted. As investors begin to read the FOMC minutes and the realization that the Fed had little appetite for QE or other monetary easing and that in their view the economy was in a recovery mode, the reality struck speculators and traders in the head. Everyone went back to the charts and calculators to determine what the real value of the USD was and what its relationship was with its trading partners. They stopped trading the Fed. Gold tumbled, Oil fell and the USD gained. The euro hit a high today of 1.3239, or that is the point at which it fell from, after coming close to breaking through the 1.30 line, the euro found a bit of support and held at 1.3133.

The greenback was further supported by reports showing the labor market improving at a moderate pace, with private payrolls in March notching more than two years of gains, according to a monthly report released Wednesday by payrolls-processor Automatic Data Processing Inc.

The Institute for Supply Management’s services-sector index for March fell to 56.0% from 57.3% in February, the private group reported. The gauges for new orders and production fell, accounting for most of the decline. It was the only negative from the US.

Despite the moderate pace of the recovery, there were many reasons to be optimistic about the outlook, Treasury Secretary Timothy Geithner said today. In a speech to The Economic Club of Chicago, Geithner said that the economy was “making a lot of progress” working down excess debt. Household debt is down 17 percentage points relative to income since before the crisis, Geithner said. At the same time, financial sector leverage is down “substantially” and credit is expanding, he said. The challenge facing the American economy is not primarily about the health of the business community,

The number of mortgage applications filed in the U.S. last week rose 4.8% from the prior week, the Mortgage Bankers Association said Wednesday, as refinancing picked up following six straight weeks of declines.

In Europe, the European Central Bank maintained its key lending rate unchanged at 1%.

European Central Bank President Mario Draghi said Wednesday in his monthly news conference that governments in the euro zone needed to meet their responsibilities for ensuring sound structural reforms and fiscal positions, and that these were essential for economic growth. He also said that while funding conditions for banks in the region had generally improved, it was now necessary for financial institutions to strengthen their resilience further. Draghi said that any talk of an “exit strategy” in terms of ECB monetary policy is premature. Draghi said that inflation in the euro area is expected to stay above 2% in 2012.

Yields on Italian and Spanish government bonds surged on Wednesday after Spain saw borrowing costs rise in its first auction demand since presenting its latest austerity budget last week.

FXEmpire analysts have been forecasting the euro to trade under the 1.32 price for the past two weeks.

Economic Events April 4, 2012 actual v. forecast

|

AUD |

Trade Balance |

-0.48B |

1.00B |

-0.97B |

|

GBP |

Halifax House Price Index (MoM) |

2.2% |

-0.3% |

-0.4% |

|

GBP |

Services PMI |

55.3 |

53.5 |

53.8 |

|

EUR |

Retail Sales (MoM) |

-0.1% |

0.1% |

1.1% |

|

EUR |

German Factory Orders (MoM) |

0.3% |

1.2% |

-1.8% |

|

PLN |

Polish Interest Rate Decision |

4.50% |

4.50% |

4.50% |

|

EUR |

Interest Rate Decision |

1.00% |

1.00% |

1.00% |

|

USD |

Treasury Secretary Geithner Speaks |

|||

|

RUB |

Russian CPI (MoM) |

0.6% |

0.5% |

0.4% |

|

USD |

ADP Nonfarm Employment Change |

209K |

200K |

230K |

|

EUR |

ECB Press Conference |

|||

|

USD |

ISM Non-Manufacturing Index |

56.0 |

57.0 |

57.3 |

Economic Events scheduled for April 5, 2012 that affect the European and American Markets

08:15 CHF CPI (MoM) 0.4% 0.3%

The Consumer Price Index (CPI) measures the change in the price of goods and services from the perspective of the consumer. It is a key way to measure changes in purchasing trends and inflation.

08:30 EUR Dutch CPI (YoY) 2.50%

Consumer Price index is the most frequently used indicator of inflation and reflect changes in the cost of acquiring a fixed basket of goods and services by the average consumer. The weights are usually derived from household expenditure surveys.

09:30 GBP Industrial Production (MoM) 0.3% -0.4%

09:30 GBP Manufacturing Production (MoM) 0.1% 0.1%

Industrial Production measures the change in the total inflation-adjusted value of output produced by manufacturers, mines, and utilities. Manufacturing Production measures the change in the total inflation-adjusted value of output produced by manufacturers. Manufacturing accounts for approximately 80% of overall Industrial Production.

12:00 GBP Interest Rate Decision 0.50% 0.50%

12:00 GBP BOE QE Total 325B 325B

Bank of England (BOE) monetary policy committee members vote on where to set the rate. Traders watch interest rate changes closely as short term interest rates are the primary factor in currency valuation.The Bank of England electronically creates new money and uses it to purchase gilts from private investors such as pension funds and insurance companies. A higher than expected reading should be taken as negative/bearish for the GBP , while a lower than expected reading should be taken as positive/bullish for the GBP.

13:30 USD Initial Jobless Claims 355K 359K

13:30 USD Continuing Jobless Claims 3350K 3340K

Initial Jobless Claims measures the number of individuals who filed for unemployment insurance for the first time during the past week. This is the earliest U.S. economic data, but the market impact varies from week to week. Continuing Jobless Claims measures the number of unemployed individuals who qualify for benefits under unemployment insurance. Initial Jobless Claims measures the number of individuals who filed for unemployment insurance for the first time during the past week. This is the earliest U.S. economic data, but the market impact varies from week to week.

15:00 GBP NIESR GDP Estimate

The National Institute of Economic and Social Research (NIESR) gross domestic product (GDP) Estimate measures the change in the estimated value of all goods and services produced by the economy during the previous three months. The NIESR estimates GDP data on a monthly basis in an effort to predict the quarterly government-released data.

Government Bond Auctions (this week)

Apr 04 14:30 Sweden Details T-bill auction on Apr 11

Apr 05 08:50 France OAT auction

Apr 05 15:00 US Announces auctions

Apr 05 15:30 Italy Details BOT on Apr 11 & BTP/CCTeu on Apr 12

Originally posted here