By FXEmpire.com

EUR/USD Fundamental Analysis April 6, 2012, Forecast

Analysis and Recommendations:

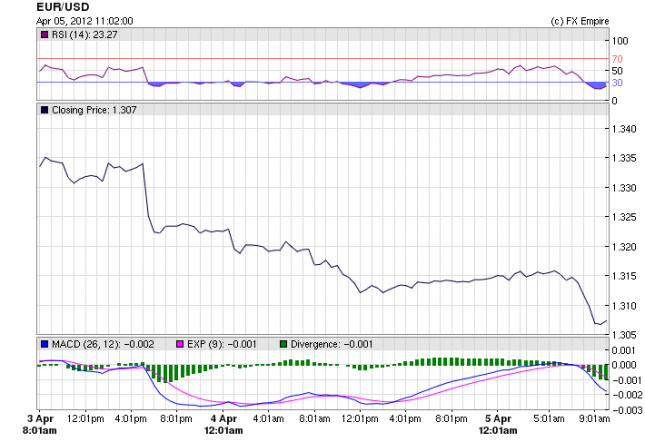

The EUR/USD continued to fall in today’s session. At present the euro is trading at 1.3060 after falling as low as 1.3036. The euro came under pressure today as a disappointing auction from Spain added to the gloomy tone set overnight after minutes from the latest Federal Reserve policy meeting hit expectations of further stimulus in the U.S. earlier in the week started the fall.

The 17-country currency fell after Spain’s borrowing costs rose at its first debt sale since the government announced its budget last week. Market participants were also disappointed by the fact Spain sold bonds totaling just EUR2.589 billion ($3.43 billion), near the lower end of its targeted range.

Spanish and Italian bond yields continued to rise on Thursday, as the broader European equity market declined. Yields on 10-year Spanish government bonds added 5 basis to 5.71%, the highest level since December last year

Spanish 10-year yield rises 8 basis points and rise to the highest level since December as the effects from the European Central Bank’s cheap lending program start to wear off.

The greenback was given additional support, by the unemployment figures released today. The number of Americans who filed requests for jobless benefits fell by 6,000 last week to 357,000, the U.S. Labor Department said Thursday. Economists had projected claims would total 360,000,

Economic Events April 5, 2012 actual v. forecast

|

CHF |

CPI (MoM) |

0.6% |

0.4% |

0.3% |

|

EUR |

Dutch CPI (YoY) |

2.50% |

2.20% |

2.50% |

|

GBP |

Industrial Production (MoM) |

0.4% |

0.3% |

-0.6% |

|

GBP |

Manufacturing Production |

-1.0% |

0.1% |

-0.3% |

|

GBP |

Interest Rate Decision |

0.50% |

0.50% |

0.50% |

|

GBP |

BOE QE Total |

325B |

325B |

325B |

|

BRL |

Brazilian CPI (YoY) |

5.2% |

5.4% |

5.8% |

|

Building Permits (MoM) |

7.5% |

3.0% |

-11.4% |

|

|

CAD |

Employment Change |

82.3K |

10.0K |

-2.8K |

|

USD |

Initial Jobless Claims |

357K |

355K |

363K |

|

CAD |

Unemployment Rate |

7.2% |

8.0% |

7.4% |

|

USD |

Continuing Jobless Claims |

3338K |

3350K |

3354K |

|

CAD |

Ivey PMI |

63.5 |

66.0 |

66.5 |

|

GBP |

NIESR GDP Estimate |

0.1% |

0.1% |

Economic Events scheduled for April 6, 2012 that affect the European and American Markets

13:30 USD Average Hourly Earnings (MoM)

13:30 USD Private Nonfarm Payrolls

Average Hourly Earnings measures the change in the price businesses pay for labor, not including the agricultural sector. Private Nonfarm Payrolls measures the change in the number of total number of paid U.S. workers of any business, excluding general government employees, private household employees, employees of nonprofit organizations that provide assistance to individuals and farm employees.

13:30 USD Nonfarm Payrolls

13:30 USD Unemployment Rate

Nonfarm Payrolls measures the change in the number of people employed during the previous month, excluding the farming industry. Job creation is the foremost indicator of consumer spending, which accounts for the majority of economic activity. The Unemployment Rate measures the percentage of the total work force that is unemployed and actively seeking employment during the previous month.

Government Bond Auctions

None scheduled until after April 10, 2012 due to holiday schedule

Originally posted here