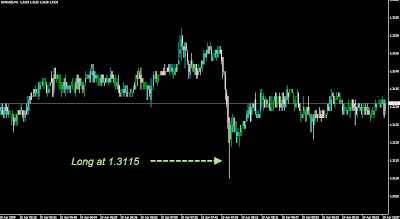

Long Entry filled, but did exit before long weekend.

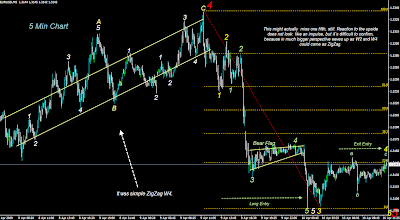

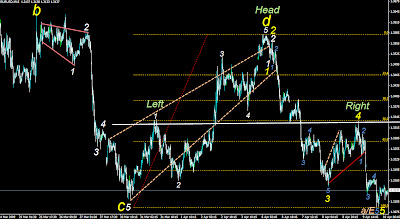

Seems to trade my count path. That HS was absolutely wonderfull, one of the best I ever had seen. Reversed (bought) that 1.3115, it left huge doji with it and also retraced it, actually bought it twice. This upleg might not be very fun or fast one, it seems to be W2 and W4 upwave, however, 5 minutes chart seems to leave still some options open for one more down, if it breakes 1.3165 then it should go up, but better be safe than sorry. However, as W2 and W4 upwaves comes to play in much bigger EW timeframe perspective we can ZigZag exotic upwave again in much larger timeframe, it´s going to be fun to fill that with right waves.

What we had witnessed during the week was first W1 impulse down of E. This impulse is likely flat ABC for this massive HS pattern.When next W2 and W4 ends to the upside, there´s much larger drop ahead and then I don´t think equites or SPX can avoid that correction either. SPX 870 area is going to be danger for long positions, but this 50% support with 1.3115 should offer some room again either it might be missing one tiny fifth….what a week behind ! May I add before everyone panics in US that this plunge will destroy the economy, that my coming summer 2009 target for Eur-Usd is at minium 1.4150, it´s just trading timeframe issue differs in here, so there´s correction at some stage ahead. I added Usa-Cad 4 hours chart which pinpoints also how far we had allready ran, but supporting idea of one more W5 upwave, if not – it was truncated b wave.

All counts updated (no change for EW view, but parameters filling & update).

Happy Eastern…

First chart is Usa-Cad, all the rest below Eur-Usd Charts.