By FXEmpire.com

EUR/USD Weekly Fundamental Analysis April 16-20, 2012, Forecast

Introduction: Out of the major currency pairs the most popular and easy to trade currency pair is the EUR/USD. It has become so popular with traders these days that even when there is no visible trade to be had it is yet traded as a matter of habit. This is of course something that should be avoided and any investor who trades this currency pair wisely can do so successfully with sizable profits at the end of the day.

The first thing with trading currencies is to realize that the EUR/USD is made up of two separate currencies although considered to be one unit when taken as a pair. The weaknesses and strengths of each currency have to be taken into consideration when trading the unit as it influences the final outcome. Another factor that is often overlooked by traders or investors is that the weakening of one currency along with the strengthening of the other currency in the pair results in the generation of pips. It is according to this that entry and exit from the Forex market has to be done in order to maintain profitability.

- The interest rate differential between the European Bank(ECB) and the Federal Reserve(FED)

- Dollar strength drives EUR/USD lower

- FED intervention to weaken the dollar the sends EUR/USD higher

Analysis and Recommendation:

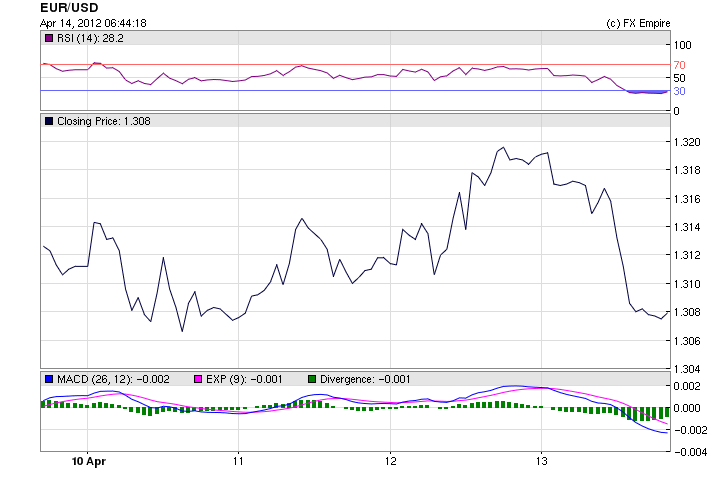

The EUR/USD fell in this week’s session. The pair closed the week trading at 1.3077 falling from 1.3109 on Monday. This has been a week of rollercoaster rides. The overall sentiment continues to focus on Spain and the eurozone, although this past week has had some surprises in store.

|

Date |

Open |

High |

Low |

Change % |

|

|

04/13/2012 |

1.3077 |

1.3189 |

1.3201 |

1.3070 |

-0.85% |

|

04/12/2012 |

1.3189 |

1.3119 |

1.3213 |

1.3102 |

0.53% |

|

04/11/2012 |

1.3119 |

1.3072 |

1.3157 |

1.3067 |

0.36% |

|

04/10/2012 |

1.3073 |

1.3110 |

1.3144 |

1.3054 |

-0.28% |

|

04/09/2012 |

1.3109 |

1.3086 |

1.3134 |

1.3034 |

0.18% |

A weaker than expected Chinese GDP, a defiant (though failed) missile launch in North Korea and ongoing fears over Europe have markets paring risk leading into the weekend. However, stronger than expected March data (IP and retail sales) from China combined with a solid earnings release from JPM and strong GDP from Singapore have offset some risk aversion. In this environment, equities and commodities are soft, safe haven bond yields are lower and the USD is mixed, but generally gaining ground. It is noteworthy that in this environment currency volume has still shifted lower, suggesting that for now most currencies are not approaching a break of recent ranges

Last week’s positives:

-Fed’s Beige Book said the “economy continued to expand at a modest to moderate pace from mid Feb thru late Mar”

-Germany continues its European economic outperformance as exports unexpectedly rise in Feb

-Chinese loan growth in March raises 1.01T yuan, well above estimates of 797.5b and the most since Jan ’11

-Chinese retail sales and IP both up

-US PPI flat m/o/m vs. forecast of up .3% but core rate rises .3% vs. expectations of up .2%

Last week’s negatives:

– Spanish and Italian bond yields jump again, IBEX and MIB stock indexes both fall more than 5% on the week, Spanish CDS at record high and not too far from Hungary

– French business confidence holds at lowest since Sept ’09 and IP and manufacturing production both less than expected

– China’s GDP grows 8.1% in Q1 vs. estimate of 8.4%, Mar CPI up 3.6%

– Initial Jobless Claims rise to 380k, a 10 week high.

– Chinese CPI rate of change in line but index at new record high and continues rising faster than wage growth

– consumer confidence down slightly but components mixed as while Current Conditions fell, the Outlook rose to the highest since Sept ’09,

– The NFIB small business optimism index falls to 4 month low

– Markets searching for some hope of QE from the Feds

Major Economic Events for the past week actual v. forecast

|

Apr. 09 |

CNY |

Chinese CPI (YoY) |

3.6% |

3.3% |

3.2% |

|

Apr. 10 |

USD |

Fed Chairman Bernanke Speaks |

|||

|

JPY |

Interest Rate Decision |

0.10% |

0.10% |

0.10% |

|

|

JPY |

BoJ Press Conference |

||||

|

Apr. 12 |

Trade Balance |

0.3B |

2.0B |

2.0B |

|

|

USD |

Trade Balance |

-46.0B |

-52.0B |

-52.5B |

|

|

USD |

Initial Jobless Claims |

380K |

355K |

367K |

|

|

Apr. 13 |

CNY |

Chinese GDP (YoY) |

8.1% |

8.3% |

8.9% |

|

USD |

Core CPI (MoM) |

0.2% |

0.2% |

0.1% |

Historical:

Highest: 1.5091 USD on 03 Dec 2009.

Average: 1.3709 USD over this period.

Lowest: 1.19 USD on 07 Jun 2010.

Economic Highlights of the coming week that affect the Euro, GPB, and the Franc

|

Apr. 16 |

08:15 |

CHF |

PPI (MoM) |

0.8% |

|

Apr. 17 |

09:30 |

GBP |

CPI (YoY) |

3.4% |

|

10:00 |

EUR |

CPI (YoY) |

2.6% |

|

|

10:00 |

EUR |

Core CPI (YoY) |

1.5% |

|

|

Apr. 18 |

09:30 |

GBP |

Average Earnings Index +Bonus |

1.4% |

|

09:30 |

GBP |

Claimant Count Change |

7.2K |

|

|

Apr. 19 |

08:30 |

EUR |

Dutch Unemployment Rate |

6.00% |

|

Apr. 20 |

09:00 |

EUR |

German Ifo Business Climate Index |

109.8 |

|

09:00 |

EUR |

German Current Assessment |

117.4 |

|

|

09:00 |

EUR |

German Business Expectations |

102.7 |

|

|

09:30 |

GBP |

Retail Sales (MoM) |

-0.8% |

Economic Highlights of the coming week that affect the US Dollar

|

Apr. 16 |

13:30 |

USD |

Core Retail Sales (MoM) |

0.6% |

0.9% |

|

13:30 |

USD |

Retail Sales (MoM) |

0.4% |

1.1% |

|

|

13:30 |

USD |

NY Empire State Manufacturing Index |

21.1 |

20.2 |

|

|

14:00 |

USD |

TIC Net Long-Term Transactions |

101.0B |

||

|

Apr. 17 |

13:30 |

USD |

Building Permits |

0.71M |

0.71M |

|

13:30 |

USD |

Housing Starts |

0.70M |

0.70M |

|

|

14:15 |

USD |

Industrial Production (MoM) |

0.5% |

Government Bond Auctions (this week)

Apr 16-30 n/a UK Re-opened 3.75% 2052 Conventional Gilt syndication

Apr 16 09:10 Slovakia Auctions floating rate Nov 2016 & 4.35% Oct 2025 & Bonds

Apr 16 09:10 Norway T-bill auction

Apr 17 08:30 Spain 12 & 18M T-bill auction

Apr 17 09:30 Belgium Auctions 3 & 12M T-bills

Apr 18 09:10 Sweden Nominal bond auction

Apr 18 09:30 Germany Eur 5.0bn 0.25% Mar 2014 Schatz

Apr 18 14:30 Sweden Details T-bill auction on Apr 25

Apr 19 08:30 Spain Obligacion auction

Apr 19 08:50 France BTAN auction

Apr 19 09:30 UK Auctions 0.125% I/L Gilt 2029

Apr 19 09:50 France OATi auction

Originally posted here