By FXEmpire.com

EUR/USD Weekly Fundamental Analysis April 2-6, 2012, Forecast

Introduction: Out of the major currency pairs the most popular and easy to trade currency pair is the EUR/USD. It has become so popular with traders these days that even when there is no visible trade to be had it is yet traded as a matter of habit. This is of course something that should be avoided and any investor who trades this currency pair wisely can do so successfully with sizable profits at the end of the day.

The first thing with trading currencies is to realize that the EUR/USD is made up of two separate currencies although considered to be one unit when taken as a pair. The weaknesses and strengths of each currency have to be taken into consideration when trading the unit as it influences the final outcome. Another factor that is often overlooked by traders or investors is that the weakening of one currency along with the strengthening of the other currency in the pair results in the generation of pips. It is according to this that entry and exit from the Forex market has to be done in order to maintain profitability.

- The interest rate differential between the European Bank(ECB) and the Federal Reserve(FED)

- Dollar strength drives EUR/USD lower

- FED intervention to weaken the dollar the sends EUR/USD higher

Analysis and Recommendation:

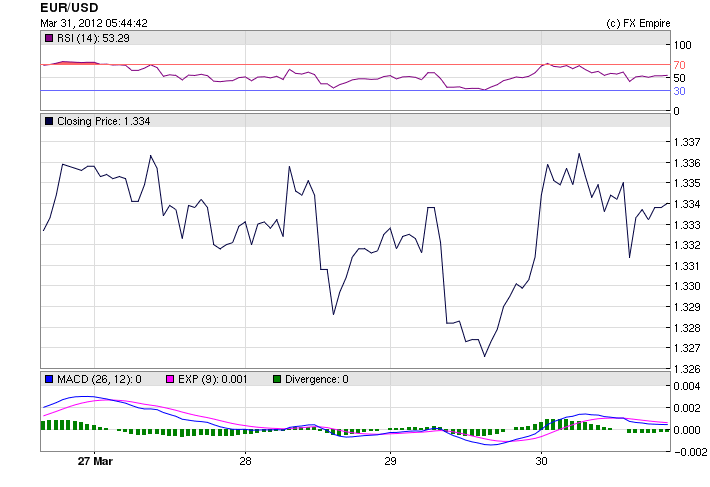

The EUR/USD ended the week and the quarter surprisingly high, at 1.3341. In earlier forecasts, the euro looked like it would fall to trade under the 1.32 range, although the common currency showed strength and resilience this week. The pair ranged from a high of 1.3386 to a low just under the 1.32 number at 1.3192. The weekly average was 1.3325.

The pair is still forecast to continue to fall.

The euro found its reprieve in the agreement reached in Copenhagen on Friday to increase the EFSF and ESM to about 1 trillion euros. This should be enough to provide the protection demanded by the G20 nations and to assure investors that the EU, ECB and IMF could not deal with any situations that arise.

Historical:

Highest: 1.5091 USD on 03 Dec 2009.

Average: 1.3709 USD over this period.

Lowest: 1.19 USD on 07 Jun 2010.

Economic Reports March 25-30, 2012 that affect the Eurozone actual v. forecast

|

EUR |

German Business Expectations |

102.7 |

102.6 |

102.4 |

|

EUR |

German Current Assessment |

117.4 |

117.0 |

117.4 |

|

EUR |

German Ifo Business Climate Index |

109.8 |

109.7 |

109.7 |

|

EUR |

ECB President Draghi Speaks |

|||

|

EUR |

GfK German Consumer Climate |

5.9 |

6.2 |

6.0 |

|

GBP |

CBI Distributive Trades Survey |

0 |

-4 |

-2 |

|

GBP |

BoE Gov King Speaks |

|||

|

EUR |

French GDP (QoQ) |

0.2% |

0.2% |

0.2% |

|

GBP |

GDP (QoQ) |

-0.3% |

-0.2% |

-0.2% |

|

GBP |

Current Account |

-8.5B |

-8.4B |

-10.5B |

|

GBP |

Business Investment (QoQ) |

-3.3% |

-5.4% |

-5.6% |

|

EUR |

German CPI (MoM) |

0.3% |

0.3% |

0.7% |

|

GBP |

Nationwide HPI (MoM) |

-1.0% |

0.2% |

0.4% |

|

EUR |

German Unemployment Change |

-18K |

-10K |

-3K |

|

EUR |

German Unemployment Rate |

6.7% |

6.8% |

6.8% |

|

EUR |

Italian 10-Year BTP Auction |

5.24% |

5.50% |

|

|

EUR |

French Consumer Spending (MoM) |

3.0% |

0.2% |

-0.4% |

|

CHF |

KOF Leading Indicators |

0.08 |

0.08 |

-0.11 |

|

EUR |

CPI (YoY) |

2.6% |

2.5% |

2.7 |

Economic Reports March 25-30, 2012 that affect the Americas actual v. forecast

|

USD |

Fed Chairman Bernanke Speaks |

|||

|

USD |

Pending Home Sales (MoM) |

-0.5% |

1.0% |

2.0% |

|

BoC Gov Carney Speaks |

||||

|

USD |

CB Consumer Confidence |

70.2 |

70.3 |

71.6 |

|

USD |

Fed Chairman Bernanke Speaks |

|||

|

USD |

FOMC Member Fisher Speaks |

|||

|

USD |

Durable Goods Orders (MoM) |

2.2% |

3.0% |

-3.6% |

|

USD |

Core Durable Goods Orders (MoM) |

1.6% |

1.5% |

-3.0% |

|

USD |

Continuing Jobless Claims |

3340K |

3365K |

3381K |

|

USD |

GDP (QoQ) |

3.0% |

3.0% |

3.0% |

|

USD |

Initial Jobless Claims |

359K |

350K |

364K |

|

USD |

GDP Price Index (QoQ) |

0.9% |

0.9% |

0.9% |

|

USD |

Fed Chairman Bernanke Speaks |

|||

|

USD |

Personal Spending (MoM) |

0.8% |

0.6% |

0.4% |

|

CAD |

GDP (MoM) |

0.1% |

0.1% |

0.5% |

|

USD |

Core PCE Price Index (MoM) |

0.1% |

0.1% |

0.2% |

|

USD |

Chicago PMI |

62.2 |

63.1 |

64.0 |

|

USD |

Michigan Consumer Sentiment Index |

76.2 |

75.1 |

74.3 |

Last week’s market highlights

The Good Stuff

- Eurozone Finance Ministers finalizes the temporary combination of the EFSF and ESM. Italy and Spain get to contribute to their own bailout fund if needed

- German unemployment falls more than expected and rate falls to lowest since reunification

- German IFO business confidence up slightly to the highest since July

- Italian business confidence up slightly from lowest since Dec ’09 and consumer confidence rises to 8 month high

- Consumer confidence rises a touch to best since Feb ’11

- Personal Spending in Feb rises .8% m/o/m, above estimates of up .6%

- UK said purchase apps rose 3.3% to a 10 week high.

- Crude finally drops but not enough

The Disappointing

- Inflation expectations in both the Michigan (3.9%) and Conference Board (6.3%)confidence figures rise to the highest since May,

- Chicago, Richmond, Dallas and KC manufacturing survey’s all fall more than expected in Mar from Feb

- Real income falls in Feb by .1%, savings rate drops to 3.7%, the lowest since Aug ’09

- Initial Jobless Claims 4 week avg 365k after benchmark revisions vs 355k prior

- Feb Durable Goods orders grow less than expected after Jan’s weakness

- UK said refinances fell 4.6% to lowest since early Dec

- Home price index falls to cheapest since Jan ’03

- Pending Home Sales in Feb unexpectedly falls .5% but from most since Apr ’10

- German retail sales in Feb fall for 4th month in past 5

- Shanghai index closes down for the 3rd straight week due to continued concerns with economic growth

- Bernanke Feds will do more, possible monetary easing

- Gasoline prices rise another .035 on the week to $3.93.

Economic Highlights of the coming week that affect the Euro, the USD and the Franc.

|

Apr. 02 |

08:15 |

CHF |

Retail Sales (YoY) |

-14.8B |

|

08:30 |

CHF |

SVME PMI |

||

|

08:50 |

EUR |

French Manufacturing PMI |

||

|

08:55 |

EUR |

German Manufacturing PMI |

||

|

09:00 |

EUR |

Manufacturing PMI |

||

|

10:00 |

EUR |

Unemployment Rate |

||

|

15:00 |

USD |

ISM Manufacturing Index |

||

|

Apr. 03 |

10:00 |

EUR |

GDP (QoQ) |

|

|

19:00 |

USD |

FOMC Meeting Minutes |

||

|

Apr. 04 |

10:00 |

EUR |

Retail Sales (MoM) |

|

|

11:00 |

EUR |

German Factory Orders (MoM) |

||

|

12:45 |

EUR |

Interest Rate Decision |

||

|

13:15 |

USD |

ADP Nonfarm Employment Change |

||

|

13:30 |

EUR |

ECB Press Conference |

||

|

15:00 |

USD |

ISM Non-Manufacturing Index |

||

|

Apr. 05 |

08:15 |

CHF |

CPI (MoM) |

|

|

13:30 |

USD |

Initial Jobless Claims |

||

|

13:30 |

USD |

Continuing Jobless Claims |

||

|

Apr. 06 |

13:30 |

USD |

Average Hourly Earnings (MoM) |

|

|

13:30 |

USD |

Nonfarm Payrolls |

||

|

13:30 |

USD |

Unemployment Rate |

||

|

13:30 |

USD |

Private Nonfarm Payrolls |

Summary of this week’s highlights for the European and US Markets

In the United Kingdom, the March purchasing manager index for manufacturing is on tap.

The same release is due in Europe for the European Monetary Union.

EU unemployment rate data for February will also be released.

PMI construction data for March is awaited in the UK, along with the BRC shop price index for the month.

EU producer price index data is also due.

In the UK, the March purchasing manager index for services is expected to be released.

The European Central Bank will wrap up a busy day with a meeting to decide on the current level of interest rates in the currency bloc.

Industrial production data for February is due in the UK, along with manufacturing production data for the period.

NIESR will release its quarterly gross domestic product estimate for March.

Elsewhere, the Bank of England will meet to discuss the level of interest rates for March.

This week in the USA

Monday sees the release of the ISM manufacturing index for March in the US. The index is expected to have risen 1.1 points during the month to 53.5.

February construction spending data is also due.

Tuesday brings US car sales data for March, along with factory orders figures for February.

On Wednesday, the ADP employment report for March will be published in the US, alongside the ISM non-manufacturing index for the month.

The weekly Energy Information Administration petroleum status report will also be announced

In the US on Thursday, jobless claims data is awaited.

The March employment situation report is due in the US, along with consumer credit change data for February.

Economists expect the jobs data to show a 230,000 lift in private sector jobs for the month, with total non-farm payrolls lifting by 225,000, leaving the jobless rate unchanged at 8.3 per cent.

On Friday, most western markets will be closed for the Good Friday public holiday.

Government Bond Auctions this week

Apr 03 09:30 Belgium Auctions 3 & 6M T-bills

Apr 03 09:30 UK Conventional Gilt Auction

Apr 04 08:30 Spain Bono auction

Apr 04 14:30 Sweden Details T-bill auction on Apr 11

Apr 05 08:50 France OAT auction

Apr 05 15:00 US Announces auctions

Apr 05 15:30 Italy Details BOT on Apr 11 & BTP/CCTeu on Apr 12

Originally posted here