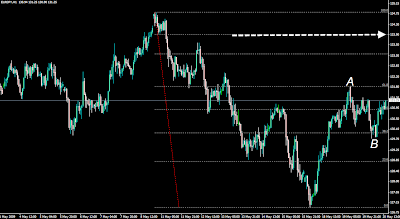

I have a troubles between the view of EurJpy and EurUsd, with first one I am bullish but with second one bearish – makes sense or conflict ?.

If my EurJpy chart is correct as there´s multiple C/3 wave options open to the upside while it retrace everything with 38.2% and 50% I am long with it, but would prefer to short EurUsd at the same time. Personally I think everyone familiar with EW find extreme difficult to stay at the long side with EurUsd with that complex correction.

However, I prefer to stick with EurJpy and leave that EurUsd do whatever it´s doing. Once again the top for it will be propably more easy to recognice from EurJpy chart when that times comes.

Eur-Usd pushed throw that doubletop without no problems at all immediately, seems it didn´t mean anything for it because it didn´t park for a second. Perhaps it´s really on the way to 1.4150 as 50% upside correction. With normal situation I would short it with RSI extreme overbought with everything between 1-30 minute charts but as far as it´s waves are too complex and EurJpy chart is bullish I´ll stick with EurJpy long trade.

I suppose this is kind of break-out for Eur-Usd and it´s working with C wave also, even doubletop is not actually EW pattern.