During the next few months, the market for EUR/USD may prove to be another example of using our Dollar forecast to identify a trade in a related market. As the Dollar Index (DX) is pushing against resistance this month, some traders may be watching for a breakout. However, we believe DX is still working through a fourth-wave correction that should include at least one more substantial downward move. That suggests a trading opportunity with the counterpart upward move in the Euro.

With this month’s Federal Reserve and ECB meetings as potential catalysts, the Dollar could reverse course to test recent lows and support in the vicinity of 92.25. That would represent an approximately 8% drop taking place between December and perhaps spring or early summer 2016. Readers can view a current chart of the major Dollar Index ETF (UUP) at our website.

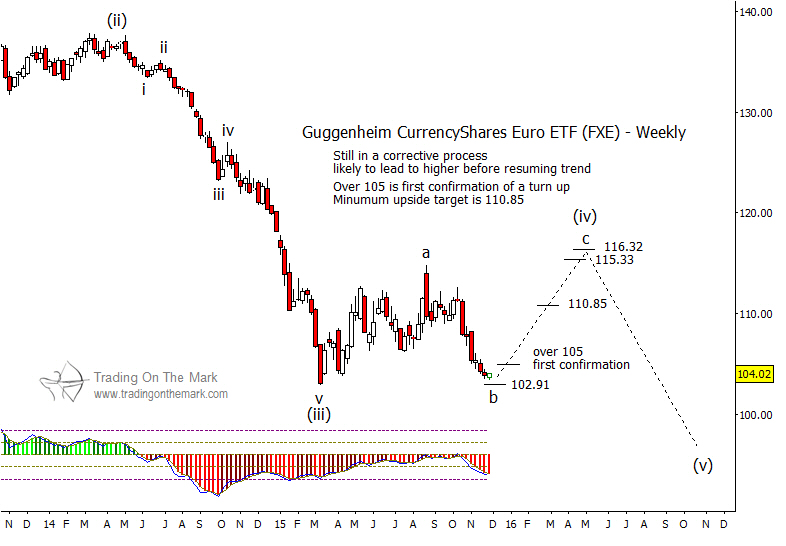

The corresponding move in the Euro (as denominated in Dollars) would be upward, and we have projected that advance on the chart below for the Guggenheim CurrencyShares Euro ETF. If the fund is in the process of tracing a relatively simple a-b-c upward correction, with the next move being wave ‘c’, then the most attractive resistance areas include a Fibonacci 1×1 extension and a 38.2% retracement at 115.33 and 116.32 respectively.

Price could also find resistance near the lower “sneaky” 1 x 0.618 extension level near 110.85, and that area probably represents the minimum distance to expect for a rally.

With FXE support at 102.91, this is an area to watch for a turn in conjunction with central bank news. The first confirmation that a rally is taking hold would be a weekly close above approximately 105.

Be sure to get on our newsletter list to receive timely analysis of turns and trends in popular markets.