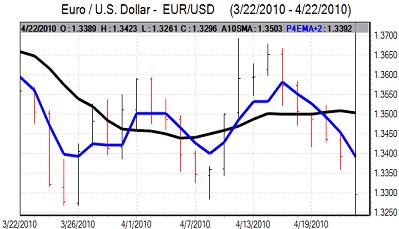

EUR/USD

The Euro attempted to hold firm in early Europe on Monday, but rallies quickly attracted selling pressure as underlying confidence remained very fragile.

The situation surrounding Greece and the wider Euro-zone debt situation remained an important market focus. There were comments from Swedish central bank governor over the risks of more serious difficulties within Europe which reinforced a lack of confidence in the region.

German Chancellor Merkel also stated that Germany would need to make further savings before it could approve aid. There was a widening of yield spreads between German bonds and peripheral bonds such as Spain and Portugal which reinforced medium-term fears over structural vulnerabilities.

There were no significant US economic data releases during the day which tended to stifle activity. There was still speculation of reduced interest in dollar-funded carry trades which provided some degree of support for the dollar, but it struggled to extend gains.

The Euro retreated to test lows below 1.33 in European trading before consolidating around 1.3330 during much of the US session with relatively narrow ranges. The Euro pushed higher to the 1.34 area towards the US close as selling abated.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

Risk appetite was generally firm in Asia on Monday with optimism over the global economy and this curbed support for the Japanese currency. There were still some reservations over the fundamental outlook with major Japanese funds still cautious over the outlook for major bond markets which will tend to dampen capital outflows.

The yen was generally weaker on the crosses with Sterling at a two-month high against the Japanese currency and this helped the dollar find solid support below the 94 level against the yen.

The dollar was trapped close to the 94 level later in the US session with the dollar finding solid support on dips as yield support remained a key market focus.

Sterling

The Hometrack organisation reported a ninth successive increase in UK house prices which helped boost confidence in the economy and Sterling moved higher to a peak near the 1.55 area against the dollar on Monday.

Even with some improvement in ratings for the opposition Conservative Party, the latest opinion polls still suggested a high risk of an indecisive general election outcome and markets will continue to fret over the outcome. Although selling pressure on political factors has eased, underlying confidence is liable to remain fragile and selling pressure could return quickly, especially if there are renewed fears over the credit rating outlook.

Sterling is still gaining protective support from a lack of confidence in the Euro-zone economy and Euro while there are also persistent doubts surrounding the US fundamentals. In this environment, the UK currency strengthened to a five-month high near 0.86 against the Euro before a corrective retreat. Sterling was unable to break above 1.55 against the dollar, but did maintain a solid tone.

Swiss franc

The dollar found support close to 1.0710 against the Swiss franc on Monday and rallied to a high around 1.0790, but the US currency was unable to take out any significant technical levels and retreated back to the 1.07 level in New York.

Although the Euro was able to resist a test of support close to 1.4320, it was unable to make much headway and settled close to 1.4350.

Confidence in the Euro-zone economy is likely to remain weak which will maintain some underlying support for the Swiss currency.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

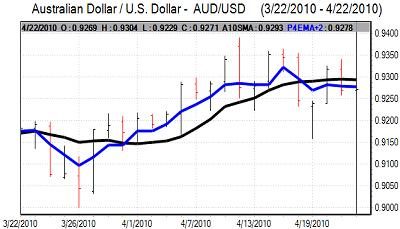

Australian dollar

The Australian dollar retained a solid tone on Monday and tested resistance levels close to 0.93 against the US dollar. There was a lack of fresh trading incentives and the currency continued to draw some underlying support from underlying firm appetite as equity markets were resilient.

Interest in the currency gradually faded and it dipped to a low near 0.9250 in New York trading with the Euro regaining some ground on the crosses.