Trading forex during the month of August can often be choppy and frustrating.

Having said that, it is time to lay a persistent myth to rest: while August historically has euro/dollar (EUR/USD) volatility a little lower than the typical month, it is generally perfectly tradable.

August has historically shown a strong tendency towards price seasonality: the U.S. dollar typically strengthens. I mention this statistic because it looks like the best trading opportunities during the next few days are likely to be short trades.

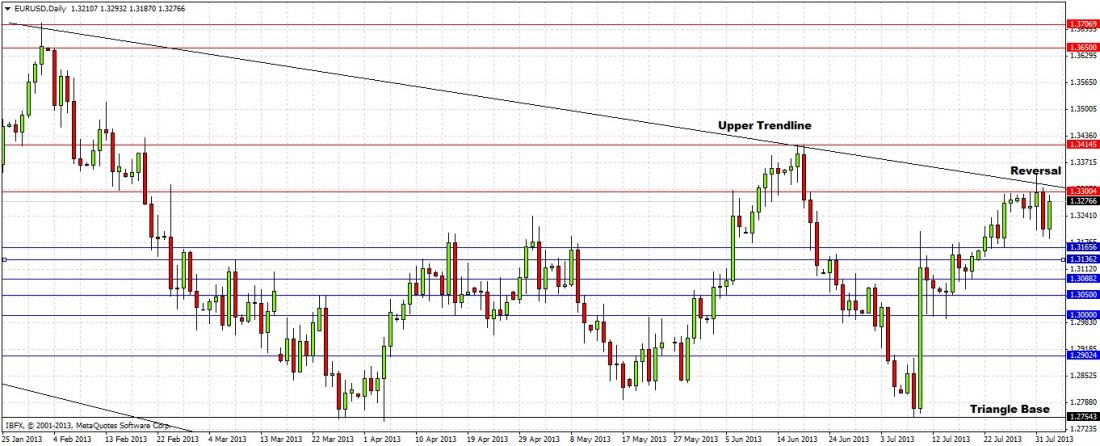

This calendar year has seen the formation of a long-term triangle with a descending upper trendline, but a pretty flat lower support. We just hit the upper trendline a few days ago, and the price reversed quite strongly from this point, before pulling back closer to it after the U.S. non-farm payrolls report (NFP), as can be seen in the daily chart below.

Until last week, momentum was seriously bullish, with bullish reversal candles being printed frequently on monthly, weekly and daily timeframes. Significantly, last week showed the opposite, with Thursday bearishly taking out Wednesday, after Tuesday did the same to Monday, showing a push down followed by a stronger push down: a classic bearish sign. At the time of writing, there has been a move up following the NFP, but I believe this will fade provided last week did not close above 1.33.

The best possible trading scenario would be a failure to break 1.33 upwards; this would give the highest probability and highest reward to risk ratio scenarios possible during the coming days. Shorts from around 1.33 are a good level to start.

Looking at the blue support levels, it can be seen there is plenty of resistance below that was established during the recent bullish momentum, and it is unlikely the price will cut easily through these on its way down. Expect bounces at these levels and opportunities for short-term longs with very conservative profit targets.

Should the pair manage to close out a New York session strongly above 1.33, this would be a signal that 1.34 is in sight, but it is hard to see much more upwards room. There is strong resistance at 1.34 and especially strong confluent resistance at 1.35 with a 50% Fibonacci level. In the unlikely event the price makes it up to either of these levels this week; these would be excellent shorting opportunities.

Keep the emphasis short this week, and be prepared to sit tight with as much of the position as possible.