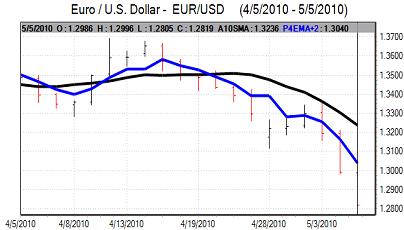

EUR/USD

The Euro dipped to 13-month lows around 1.2935 in early Europe on Wednesday before a limited corrective recovery.

The Euro-zone remained a key focus during the day as underlying stresses continued. Credit-ratings agency Moody’s warned that it could downgrade Portugal’s debt rating in a review which will take place over the next three months. There were substantial protests against austerity measures within Greece which reinforced fears that fiscal tightening within the country would be unsustainable.

There were fears that the European banking sector would be damaged and the ECB monetary policies also came under focus with some speculation that the bank would need to take more aggressive measures to support the Euro-zone economy. Trichet’s comments following Thursday’s council meeting will be watched very closely and will be important for Euro sentiment.

The US economic data was relatively close to expectations and did not have a major impact on the markets. The ADP report registered an increase in private-sector employment of 32,000 for April from a revised 19,000 gain the previous month.

The ISM report for the services sector was unchanged from the previous month at 55.4 for April which was slightly below expectations. The employment component was marginally lower than the previous month and also below the 50 level. The data overall will maintain expectations of a solid payroll figure on Friday, but will not lead to expectations of a stronger figure which will tend to curb further dollar support.

Euro fears dominated during the session and there was a fresh slide to lows near 1.2810 following the Portuguese rating warning. After a brief recovery, there was a slide back to the 1.28 area as risk appetite also remained weaker.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

Japanese markets remained closed for a holiday on Wednesday which dampened activity and exporter selling may be higher on Thursday. There were underlying doubts surrounding the Japanese fundamentals which curbed yen support, especially with the government due to release its fiscal plans next month which could influence the long-term credit ratings.

With the yen still vulnerable on yield grounds and support levels holding, the dollar advanced to 94.80 in early Europe on Wednesday.

Risk conditions remained very important during the day and the yen gained further support as European fears persisted. In this environment, the dollar weakened back to the 94 level in New York.

Sterling

The UK construction PMI index rose sharply to 58.2 for April from 53.1 the previous month which maintain some degree of optimism over near-term economic prospects.

Final opinion polls did not suggest that there was greater evidence of a decisive outcome and uncertainty remained high, but markets were slightly more confident that the opposition Conservative Party would be able to secure a mandate. The election of a majority government would tend to provide an initial Sterling boost.

The medium-term government-debt outlook will continue to be a very important cause for concern and should limit any scope for Sterling gains. There will also be fears over the credit-rating outlook, especially as the political constraints on the rating agencies will ease once the election has been concluded.

Wider European stresses continued to dominate and the UK currency pushed to a five-month high near 0.85 against the Euro. Sterling also found support below the 1.51 level against the dollar and consolidated near this level in New York.

Swiss franc

The dollar continued to advance strongly against the Swiss franc on Wednesday and pushed to fresh 12-month highs near 1.1190 in early US trading before briefly correcting back to 1.1120. The Euro was trapped close to the 1.4320 level against the franc and there will again be a strong suspicion that the Euro was being supported by National Bank intervention.

The sustained lack of confidence in the Euro-zone economy will continue to provide some protection for the Swiss currency. There is likely to be further speculation that the central bank will decide to abandon efforts to prevent the franc strengthening, especially with a generally stronger US dollar.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

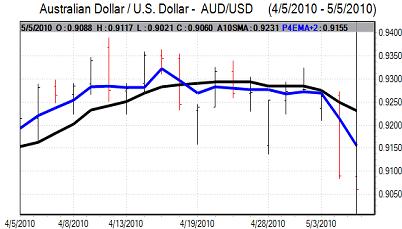

Australian dollar

The Australian dollar dipped to lows around 0.9065 in Asia on Wednesday. There was a solid reading for building approvals and optimism over the domestic economy should cushion the currency from heavy selling pressure.

As risk appetite deteriorated in early US trading, the Australian dollar weakened to lows close to 0.9020 before a recovery to the 0.9085 level later in the US session. Buying the Australian dollar on dips remains an important market feature.