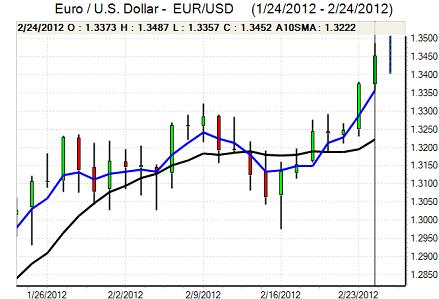

EUR/USD

The Euro found solid support on dips during Friday with initial support in the 1.3360 region and there was further strong buying during the day as the currency pushed to fresh 11-week highs against the US dollar.

There was optimism that the ECB would be able to maintain greater confidence in the banking sector through the second long-term repo operation due on February 29th which maintained underlying Euro support on expectations of strong demand from European banks.

The Greek government formally announced its private-sector swap while ECB member Nowotny stated that the Greek loan deal would be positive if enacted. The comments also illustrated important underlying doubts that the plan would be implemented and the German parliament is scheduled to vote on the deal on Monday.

Short covering remained an important influence during the day, especially on the crosses as commodity currencies underperformed. The latest speculative positioning data recorded a small net decline in Euro positions while net dollar long increased over the week to US$17.2bn from US$17bn. The positioning bias will maintain the potential for a further round of short covering which will hamper the dollar.

The US economic data did not have a major impact with new home sales at 321,000 in the latest month from 324,000 previously. Regional Fed president Bullard expressed some degree of optimism surrounding the economy and expected interest rates to be increased in 2013, but he also stated that further quantitative easing could be considered if there was a reversal in inflation.

Over the weekend, G20 members backed a stronger global firewall, potentially worth US$2trn if there was increased financial support from the Euro-zone with a commitment of funding by China if further progress was made to strengthen Euro-zone defences.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The yen remained under selling pressure on Friday and, after initially being blocked in the 80.50 area, there was a fresh dollar move higher during the US session with a test of resistance above 81 as important resistance levels near 80.50 broke. There were further reports of yen selling by importers and the Japanese currency was also vulnerable on the crosses.

The US currency continued to gain some support on yield grounds which helped propel the currency higher following firm data. It may prove difficult to extend this trend given the Fed’s stance.

The G20 pledge also helped boost risk appetite which pushed the yen weaker in early Asia on Monday as the Euro moved to near 110 and Sterling was close to the 130 area with the dollar peaking near 81.60. There was a more cautious tone later in the session as the US currency edged back towards 81.

Sterling

Sterling found support close to 1.5720 against the US dollar on Friday and pushed sharply higher during the day on wider US losses with a peak in the 1.5880 region while the UK currency was able to hold its ground against the Euro.

UK GDP was confirmed to have shrunk 0.2% for the fourth quarter of 2011 which was in line with expectations as consumer spending estimates were increased slightly. There was, however, a sharp drop in investment during the three months which will maintain fears over the underlying growth outlook, especially as the economy will need increased private-sector growth to offset the pressures of a squeeze on government spending.

Bank of England MPC member Fisher stated that he was open-mined on the potential for further quantitative easing and caution over the outlook will still tend to prevail.

Swiss franc

The dollar was unable to make any impression on the franc on Friday and there were further stop-loss related selling once the 0.90 area was broken.

The Euro also remained under some pressure against the Swiss currency and there were rumours of National Bank franc selling against the US currency as well as the Euro.

The latest bank-deposit data continues to suggest some flow of funds into Swiss banks which will maintain the potential for franc appreciation if there is any renewed intensification of the Euro-zone debt crisis.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

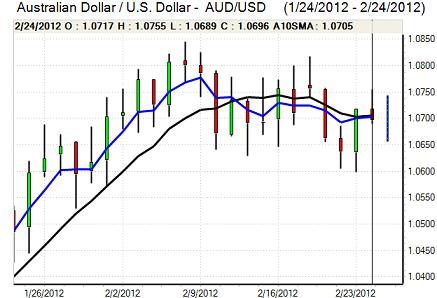

Australian dollar

The Australian dollar initially found support in the 1.07 area against the US currency and attempted to rally to the 1.0750 area before drifting weaker again. The currency was undermined by significant selling against the Euro as speculative positions were unwound.

The leadership contest within the Labour party did not have a major impact as Prime Minister Gillard won the vote comfortably, although there were underlying doubts surrounding the government’s ability to provide effective leadership which had a slight negative impact . There was also a slightly more cautious tone towards risk appetite which curbed Australian dollar buying support and it failed to hold above the 1.07 level against the US currency.