EUR/USD

The Euro found support on dips to below 1.32 against the dollar in Europe on Monday and pushed significantly higher during the session with a peak near 1.3280.

There was further optimism that the Eurogroup meeting would agree on a loan package for Greece at Monday’s meeting. Over the weekend, there had been speculation that a decision could be delayed until March, but German officials were keen for the issues to be resolved at Monday’s meeting. There was also a mood of cautious optimism, in public at least, with Greek officials also expressing hopes that a deal could be finalised.

The ECB announced that it had not bought any peripheral bonds during the week for the first time since the programme was restarted in August 2011, fuelling market expectations that the ECB and Euro as a whole had moved to an important new phase with a more aggressive monetary policy the instrument for keeping bond yields down.

US markets were closed for the President’s Day holiday which had an important impact in curbing market activity during the North American session and the Euro briefly retreated back towards the 1.32 level as delays in announcing a Greek deal unsettled markets.

In the event, a deal was reached with the EUR130bn second loan package in place. The private-sector debt haircut will be 53.5% and replacement bonds will have an initial coupon of 2%. Relief over a deal pushed the Euro sharply higher and back to the 1.3280 area in Asia on Tuesday. Buying support was curbed by underlying concerns surrounding the sustainability of the situation, especially after the troika report indicated that further relief would be required.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar hit resistance close to 80 against the yen on Monday with a combination of tough resistance levels and exporter selling pushing the US currency weaker with a brief decline through the 79.50 level. There was still solid dollar buying on dips as underlying yen sentiment remained weaker.

There were expectations of further monetary easing by the Chinese central bank which helped underpin risk appetite and lessened defensive demand for the Japanese currency.

Underlying yen strength has also been sapped by the record trade deficit reported last week. The dollar pushed back to the 79.80 area in Asia on Tuesday as the Euro advanced to fresh 3-month highs near 106.

Sterling

Sterling found solid support above the 1.58 level against the dollar on Monday while it was blocked below the 1.5880 resistance level in generally cautious trading conditions. There was some positive impact from generally firm risk conditions during the day.

A run of generally favourable UK economic data continued to have some positive impact on the UK currency, although the impact was still broadly muted given a high degree of uncertainty over the situation. There was also speculation that the Bank of England minutes on Wednesday would show a split vote for the move to expand quantitative easing which would make fresh action less likely over the next few months.

Euro-zone developments tended to dominate during and from a dip to near 1.58, a renewed Euro advance pushed Sterling back to the 1.5850 area while the Euro edged higher to 0.8380.

Swiss franc

The dollar found support on dips to below the 0.91 level against the franc on Monday, but was unable to make any impression on the Swiss currency. The Euro was also unable to make any fresh challenge on resistance above 1.21 and dipped to test support below 1.2070 in choppy trading conditions.

The Greek deal should ease the immediate fears of renewed capital flows into the Swiss currency and should also lessen pressure on the Euro minimum level, although there was little initial Euro movement following the Eurogroup Greek announcement.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

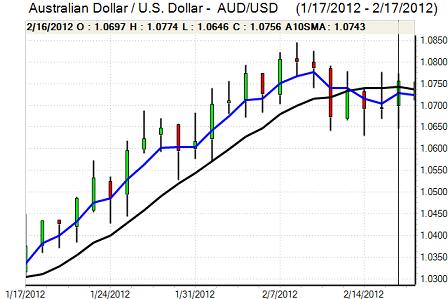

Australian dollar

The Australian dollar was unable to make a fresh challenge on the 1.08 area against the US dollar on Monday and drifted back towards the 1.0750 area with ranges generally narrow as trading incentives dried up.

The Reserve Bank minutes were slightly more dovish than expected as the central bank again stated that interest rates could be cut if necessary given a decline in inflation and this pushed the Australian dollar to lows around 1.0680 before a wider US currency retreat allowed a move back to near 1.0750. Underlying risk appetite was still firm which also helped trigger fresh buying support for the local currency.