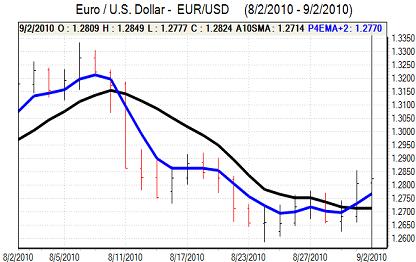

EUR/USD

The Euro found support below 1.28 against the dollar during Thursday and markets generally were looking to test resistance levels, but ranges were narrow. There was evidence of option positions being defended which curbed the potential for further Euro gains.

There were no surprises from the ECB with interest rates left on hold at 1.0% following the latest council meeting. The central bank also announced extra liquidity auctions in line with previous signals and emphasised that these were not policy signals. President Trichet was slightly more optimistic over the growth outlook and also warned that inflation could be higher which provided some underlying Euro support.

The Euro also gained support from successful bond auctions in Spain and France, together with an improvement in risk appetite. Nevertheless, confidence could still unwind quickly given the underlying structural vulnerabilities.

There was a stronger than expected The US jobless claims data recorded a small decline to 472,000 in the latest week from a revised 478,000 previously which maintained some expectations that a deterioration in the labour market has slowed. There was still a high degree of caution ahead of the monthly payroll data due on Friday and the dollar was unable to gain much support.

The Euro was unable to break above the 1.2850 level and consolidated around 1.2820 ahead of Friday’s US data.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar resisted a further test of support below 84 against the yen on Thursday with the better than expected US data providing some underlying support for the currency and there was also a high degree of caution ahead of the US payroll data.

The Japanese capital spending data was better than expected for the second quarter which provided some yen support, although the impact was limited.

Potential Prime Minister candidate Ozawa stated that intervention to stem yen gains was a possibility, but markets will be watching the actions of current senior officials much more closely to assess near-term policy actions. There will be some speculation over action to weaken the yen over the weekend and this will tend to underpin the dollar to some extent unless there is a very weak payroll figure. The dollar consolidated just above 84.20 in Asian trading on Friday.

Sterling

Sterling remained generally on the defensive in European trading on Thursday as confidence in the economy remained fragile. The PMI construction report was weaker than expected with a decline to 52.1 for August from 54.1 and confidence will weaken further if there is a weak services-sector report on Friday.

The housing data has remained weak and there will be persistent fears that weakness will spread to other sectors of the economy. Sterling will be particularly vulnerable if there is any evidence of a renewed credit crunch.

The UK currency gained some degree of support from an improvement in risk appetite while a generally weaker dollar also helped provide protection. Sterling found support below 1.5350 against the dollar and regained the 1.54 level as fundamental US concerns persisted.

Swiss franc

The Euro was able to withstand further selling pressure against the franc on Thursday and strengthened to challenge the 1.30 level during the US session. The dollar was unable to move above the 1.02 level.

There was an underlying easing of risk aversion and the Euro-zone bond auctions also curtailed defensive franc support to some extent.

There is evidence of aggressive speculative plays in the franc and this is liable to trigger further substantial volatility in the near term, especially if the US economic data is a long way from expectations.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

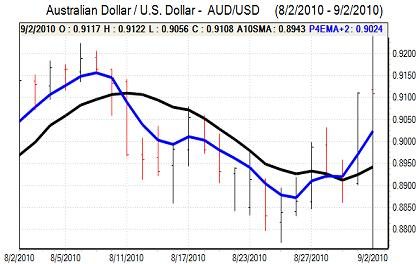

Australian dollar

The Australian dollar has been able to maintain a firm tone over the past 24 hours with a further challenge on resistance levels above 0.91 against the US currency. Risk appetite has stabilised while there have been gains for commodity prices.

The domestic data remained disappointing as the PMI services-sector index remained below the pivotal 50 level and underlying confidence in the economy is liable to falter which could prove an important barrier to further Australian dollar gains and the currency was unable to hold above the 0.91 level.