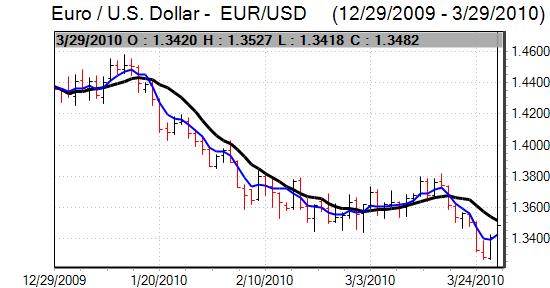

EUR/USD

The Euro jumped higher in Asian trading on Monday, due in part to to a covering of short positions, before retreating to the 1.3440 region in early Europe. The latest IMM data continued to record a near-record number of short Euro positions, maintaining the possibility of a squeeze on positions.

Provisionally, German consumer prices rose 0.5% in March to give a 1.1% annual increase, in contrast to an expected 0.3% monthly increase. The higher than expected figure could raise some unease within the ECB which could provide some degree of Sterling support.

Following the support deal agreed last week, immediate fears surrounding the Greek debt situation eased. The Greek government also launched a EUR5bn bond issue to take advantage of improved market conditions. There was still a yield premium of 325 basis points over German bunds which indicates that underlying investor confidence is still very fragile. It remains the case that fears could escalate again very quickly given the underlying stresses.

The US economic data failed to have a significant impact with the personal income and spending estimates marginally below expectations while the core PCE price index was unchanged for February.

The US Treasury market remained an important focus as yields continued to edge higher. The yield spread over German bunds rose to 73 basis points and this yield premium should provide significant underlying support, especially with confidence over a firm US payroll report late this week.

The Euro was again blocked close to the 1.35 and consolidated around 1.3475 during the US session.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

There was further optimism over the global economy on Monday which fuelled expectations of capital outflows from the Japan and a weaker yen. There was still some capital repatriation on the last day ahead of the new fiscal year and investment flows will be watched very closely over the next few days to assess the underlying strength of flows.

Domestically, retail sales rose 4.2% in the year to February which should provide some degree of support for the yen. The net outcome was a slightly weaker yen on expectations of capital outflows and the dollar edged higher to the 92.70 area while the Euro advanced towards 124.80 before exporter selling increased.

The dollar was trapped in very narrow ranges later in the US session with selling interest above the 92.50 level.

Sterling

The UK currency was slightly stronger in Asian trading on Monday, again primarily due to a weaker US dollar and there was a temporary move above the 1.50 level.

The UK consumer credit data was slightly stronger than expected with credit expansion at an 18-month high. The opposition Conservative party announced that it would propose some tax cuts if it won the election, but opinion polls are still generally inconclusive which will maintain a high degree of uncertainty.

Overall confidence in the government-debt situation is likely to remain very fragile and the forthcoming election campaign will ensure a high degree of media coverage which will also tend to contribute to Sterling volatility.

Speculative short positions remain near record levels and this will maintain the possibility of a Sterling rally, especially if risk appetite remains strong. The UK currency held a steady tone during the day, but was still hitting tough resistance close to 1.50.

Swiss franc

The dollar was unable to push above 1.07 against the franc on Monday and dipped to lows just below the 1.06 level. The Euro was able to maintain a steadier tone against the Swiss currency and held above 1.43 later in the US session.

The Euro will gain some further temporary support from the Greek debt deal, but may find it more difficult to gain sustained relief given an underlying lack of confidence.

The franc may also lose some support if global risk appetite remains firmer but, again, heavy selling pressure still looks unlikely.

Australian dollar

Following gains late in the US session on Friday, the Australian dollar extended gains in local trading on Monday with highs near 0.9150 against the US dollar.

Reserve Bank Governor Stevens suggested that interest rates would rise further over the next few months which provided some degree of support for the currency while the US currency also lost ground on the crosses. The Australian dollar was also able to gain support from firm risk appetite and pushed higher to near 0.9180 later in the US session.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here