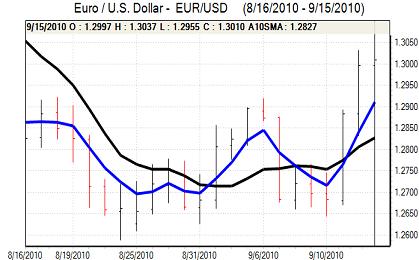

EUR/USD

The Euro found support above 1.2950 against the US dollar during European trading on Wednesday and maintained a generally firm tone with a test of resistance above the 1.30 level. Risk appetite remained generally firmer during the day which helped underpin the Euro. The underlying Euro-zone vulnerabilities were also less of a focus during the day as markets concentrated on the yen and this also helped curb selling pressure on the currency. The Euro-zone inflation data did not have a significant market impact.

The New York Empire manufacturing index was weaker than expected with a decline to 4.1 in September from 7.1 the previous month, but the underlying components were generally firmer and this helped lessen the impact. The industrial production data was in line with expectations with a 0.2% increase for August.

The data did not have a major impact on yield expectations with the US currency still finding it difficult to gain any major support. The currency also remained vulnerable on technical grounds following the break of support levels the previous day.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The Bank of Japan and Finance Ministry took advantage of increased speculative yen buying and intervened in the market during Asian trading on Wednesday with Finance Minister Noda justifying the move by stating that demand for Japanese goods had fallen. This was the first time the bank had intervened openly since 2004 and there were reports of several rounds of yen sales.

The yen weakened sharply following the move with a dollar high above 85.70 against the Japanese currency. Markets will now look to see whether the intervention is sustained before deciding where to start selling the US dollar. The Finance Ministry stated that it would be prepared to act again to sell yen on Thursday if necessary.

The attitude of G7 members will also be watched very closely in the near term. Protests against the move were generally muted, but there was also a lack of major support for the actions. The chances of sustained yen losses will be much higher if there is G7 backing for intervention and the dollar held gains late in New York trading.

Sterling

Sterling was unable to break above 1.5580 against the dollar in early Europe on Wednesday and weakened back to the 1.55 area. There was renewed support during the day on a lack of interest in the major alternatives.

The UK labour-market data was mixed and did not have a decisive impact on sentiment. There was a rise in the unemployment claimant count for the first time in 2010, but there was also a small recorded decline in the ILO unemployment figure. The net impression will be that the underlying economy has slowed slightly which will tend to curb Sterling sentiment.

Bank of England governor King stated that the banking sector was still fragile and not in good shape. Sterling will be much more vulnerable to selling pressure if there is a sustained increase in fears surrounding the banking sector.

Sterling was able to resist fresh selling pressure and strengthened to a high near 1.5650 against the dollar while it also strengthened to around 0.8320 against the Euro.

Swiss franc

The dollar found support below parity against the Swiss franc on Wednesday, but was unable to make much headway during the session as underlying dollar demand remained fragile. The Euro was able to gain ground against the Swiss currency with a move to the 1.3050 area.

The Japanese action to weaken the yen also had some impact in dampening demand for the Swiss currency as defensive demand for the currency eased.

There was a decline in the Swiss ZEW business confidence index which may raise some doubts over the economy. Nevertheless, there will still be some speculation that the National Bank could decide to increase interest rates at the Thursday meeting. If rates are held steady, the franc is liable to weaken slightly.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

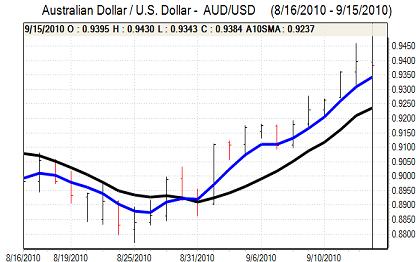

Australian dollar

The Australian dollar pushed to a peak above 0.9440 against the US dollar before hitting resistance and retreating to the 0.9340 area in Europe on Wednesday. There was still solid buying support for the currency at lower levels.

The domestic data was weaker than expected with a decline in consumer confidence, although the impact was limited. Underlying risk appetite was still firm which helped underpin the Australian currency, especially with the US currency generally remaining under pressure. The Japanese intervention to sell the yen should offer some encouragement for carry trades which may also help support the Australian dollar.