EUR/USD

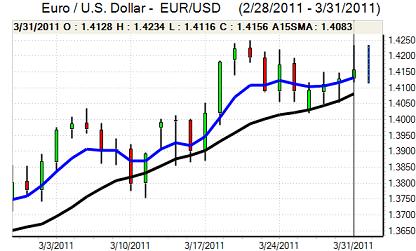

The Euro maintained a strong tone in European trading on Thursday, but it was unable to break resistance levels above 1.4230 and drifted weaker with short-term players unwilling to commit to positions.

The flash Euro-zone inflation rate rose to 2.6% for March from 2.4% previously as energy costs continued to spike higher. The data will reinforce inflation fears within the ECB and will also make the central bank even more determined to raise interest rates next week. There will also be additional speculation that the bank will plan a series of rate increases, although this will certainly be more contentious, not least as it will exacerbate political tensions surrounding weaker Euro-zone members.

Portugal revised up the 2010 budget deficit following a change in accounting methods and a general election will be held in early May. At current yields, Portugal remains effectively shut out of bond markets and there will be further expectations that a bailout package is inevitable. There were no further surprises from the Irish banking-sector stress tests, but the situation remains perilous and structural fears remained a very important market issue which will certainly unsettle the Euro.

US jobless claims fell to 388,000 in the latest reporting week from a revised 394,000 previously while the Chicago PMI index edged lower to 70.6 from a revised 71.2 previously and remained at very high levels. The data will reinforce expectations of solid economic growth and confidence will remain firm if there is robust payroll data on Friday.

Comments from Fed officials remained generally more hawkish with Regional President Kocherlakota stating that interest rates may need to rise before the end of 2011 and the rhetoric provided some dollar support. The Euro consolidated just above 1.4150 ahead of the US employment data.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar found support above 82.50 against the yen during Thursday and rallied to test resistance near 83.20. A break above this level triggered further selling pressure on the yen as it weakened to lows near 83.70 in Asia on Tuesday.

The yen remained vulnerable against the dollar on yield grounds, especially with further speculation that the Fed will shift towards a tighter monetary policy. There was also further interest in carry trades funded through the yen as markets looked to take a positive attitude towards risk.

The Japanese Tankan report was broadly in line with market expectations with a rise to 6 in the first quarter from 5 previously. The impact was limited, especially as a high proportion of the responses were received before the March 11 earthquake. There was some disappointment that capital spending plans were scaled back and underlying confidence in the Japanese fundamentals remains weak.

Sterling

Sterling pushed to a high around 1.6140 against the dollar during Thursday, but was unable to sustain the advanced and quickly retreated back to below 1.61 and dipped further to test support near 1.6020 in US trading, although the UK currency did find support near 0.8850 against the Euro.

Underlying confidence in the economy remained fragile with further concerns that weaker consumer spending would have a negative impact on the wider economy as fiscal tightening takes effect. The latest PMI surveys will be watched closely with the manufacturing data due on Friday and the series has proved strong over the past few months. At this stage, markets are expecting the Bank of England to keep interest rates on hold next week, but there will be caution ahead of the decision.

The UK banking sector will remain an important focus and there is likely to be concern over exposure to bad debts within the European banks which could have a serious impact in undermining Sterling.

Swiss franc

The dollar remained generally on the defensive against the franc in European trading on Thursday, but it found support below 0.9150 and rallied back to a peak above 0.92 as the Swiss currency came under wider pressure.

There was further international interest in carry trades which had an important negative impact on the franc with the Swiss currency seen as an attractive funding currency if there is a sustained improvement in risk appetite.

There were still be fears over the Euro-zone structural vulnerabilities which tempered franc selling to some extent and volatility levels are liable to remain high.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Australian dollar

The Australian dollar has maintained a strong tone over the past 24 hours and pushed to fresh 29-year highs around 1.0370 against the US currency before drifting weaker on profit taking. There has been further market interest in carry trades which has boosted demand for the local currency.

The manufacturing PMI index weakened to 47.9 for March from 51.1 previously, maintaining the run of fragile survey data and the weaker than expected Chinese PMI data also had some impact in curbing Australian dollar demand.