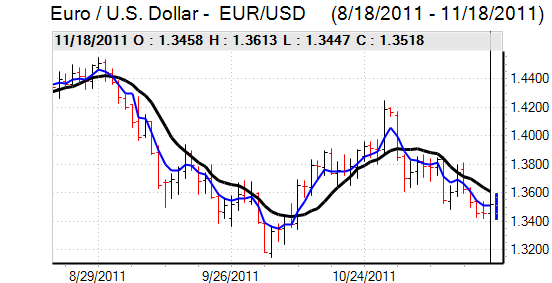

EUR/USD

The Euro continued to resist selling pressure for much of Friday with support on dips to below the 1.3480 area and there was a surge higher ahead of the US open.

There were media reports that a plan to increase ECB lending to the IMF which would then allow the IMF to buy peripheral bonds was gaining traction. This speculation, in turn, increased optimism that there would be relief for peripheral economies and pushed the Euro higher.

There will, however, be strong opposition to such plans within the ECB and the German government and underlying sentiment remained extremely fragile with the Euro unable to sustain gains towards the 1.36 level as key officials played down the reports.

There was a further increase in money-market tensions during the day as 3-month dollar Libor rates continued to climb with a rate of 0.49% compared with 0.48% previously. Swap rates for inter-bank Euro purchases continued to widen to the highest levels since 2008 and there were increased fears surrounding the US money-market funds’ exposure to Euro-zone debt. In this environment, risk appetite remained extremely fragile and there was a further increase in Euro selling in the options market

The weekend Spanish election result was in line with market expectations as the opposition PP party secured an overall majority in parliament. There will be some optimism that the administration will be able to take decisive action, butt here will also be fears that there are no viable policy options.

There were reports from the US that the Congressional Super Committee had failed to agree budget cuts and this will have some negative impact on confidence, although the net market impact is liable to be subdued at this stage as Euro-zone and risk appetite continues to dominate.

There has been a renewed increase in speculative dollar positions which will make it more difficult for the US currency to advance and the Euro held just above 1.35 in Asia on Monday.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar dipped to lows near 76.60 during Friday before recovering back to the 77 area late in the US session as the yen maintained a strong tone on the crosses.

The latest trade data recorded a move back into deficit for October as exports declined which will increase competitiveness fears within Japanese industry. Confidence will also be eroded by Singapore’s forecast of much slower growth during 2012 and there will be increased pressure for yen gains to be resisted.

Risk considerations will continue to be extremely important in the short term and there will be further defensive flows into the yen as confidence both in the Euro-zone and global financing sector continues to decline. There will also be additional pressure on the Bank of Japan to intervene with little dollar change on Monday.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

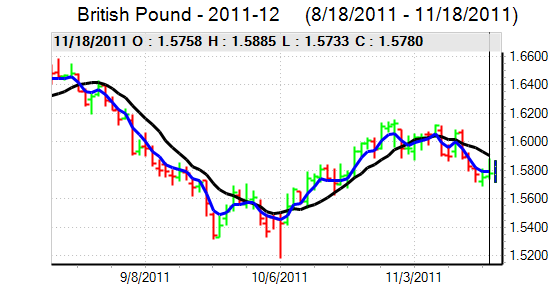

Sterling

Sterling found support close to 1.5750 against the dollar on Friday and pushed sharply higher to a peak above 1.5850 ahead of the US open as there was a wider loss of dollar support. Sterling was unable to sustain the gains and weakened back to the 1.5750 area on Monday.

Underlying confidence in the UK economy will remain extremely fragile in the short term and the Rightmove organisation reported a sharp 3.1% decline in asking prices for November while there were also reports of a weaker labour market.

The UK is continuing to gain defensive support from a position outside the Euro-zone and there will be further support from an intensification of Euro-zone stresses.

These support could prove to be extremely fragile given the UK debt overhang and dependence on overseas funding for the banking sector. In this context, sentiment toward Sterling could reverse rapidly.

Swiss franc

The franc strengthened sharply against the Euro on Friday with a brief move to the 1.2340 area as the dollar also dipped to below the 0.91 level. The franc was unable to sustain the gains and the dollar moved back above 0.9150 as the Euro recovered opening levels.

There was further speculation that the National Bank would push the Euro weaker and the bank tactic of maintaining uncertainty has been extremely effective in curbing any sustained franc demand. The Bank could still be tested very severely if money-market tensions continue to intensify over the next few weeks.

Australian dollar

The Australian dollar pushed to highs near 1.01 against the US dollar on Friday in line with a general realignment in US currency levels, but it was unable to sustain the gains and re-tested support below parity on Asia on Monday.

Underlying risk appetite continued to deteriorate which undermined Australian dollar demand, especially as bank funding pressures continued to increase. There was a further downgrading of Asian growth forecasts which also had a negative impact on the Australian currency with the potential for downward pressure on commodity prices and domestic growth.