EUR/USD

The Euro found support on dips to the 1.37 area against the dollar on Friday as major support levels were not tested due in part to wider dollar vulnerability. Discussions between Germany and France over the EFSF structure continued on Friday and over the weekend as tensions remained high. There were reports that the French had backed down on demand for the EFSF to be made a bank with The German government unable to deliver necessary support from the Bundestag.

Reports suggest that European officials will push for the EFSF to be used as an insurance fund which would be used to back another funding vehicle. The Euro-zone would also look for investment by global sovereign wealth funds. There was also outline agreement on plans for around EUR100bn in bank recapitalisation with official assistance to banks who were unable to raise capital privately.

The EU did agree that Greece’s next loan tranche should be paid which keeps Greece on life support for another few weeks and there will be attempts to secure a bigger voluntary debt write-down by creditors. There were further concerns surrounding the European banking sector with reports that US money-market funds had withdrawn further funds from the area. The German IFO data retreated for October, but was broadly in line with expectations and did not have a major impact.

There were no US economic data releases, but there was a flurry of Federal Reserve speeches. Fed Governor Yellen stated that further quantitative easing might be required, confirming the dovish tone taken by Tarullo. Regional Fed President Fischer dissented the monetary policy stance, but the evidence suggests that the Washington-based Governors are firmly in charge.

The Euro rallied firmly during Friday as risk conditions also generally improved. The latest positioning data showed that net dollar longs had declined only slightly which will maintain the potential for a covering of Euro short positions.

The Euro initially edged lower following Sunday’s summit before rallying to the 1.39 area as risk conditions remained more favourable.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar was subjected to renewed selling pressure during the US session on Friday and retreated to fresh record lows below the 76 level before finding some relief and recovering the 76 level. Significantly, there were no significant yen loses when there was a general improvement in risk appetite.

There was disappointment that the Japanese government had not more decisive action against a strong yen with the latest package seen as offering only limited relief.

There will be increased pressure for intervention to weaken the yen and markets will remain on high alert. The Finance Ministry warned over potential intervention on Monday and, although there was no evidence of direct action in the market, the threat of intervention kept the dollar above 76 on Monday, especially with risk appetite firmer following a recovery in China’s PMI index.

Sterling

Sterling found support in the 1.5750 area against the US dollar during Friday and rallied strongly with a peak near 1.5950 as the UK currency broke above significant resistance levels.

The latest headline government borrowing data was slightly better than expected with a deficit of GBP11.4bn for September. For the second successive month, there was a significant revision to the previous month’s data which will ease fears surrounding the immediate budget outlook.

The banking sector will remain an important focus and there will be further fears over the UK outlook. A potentially toxic development would be the withdrawal of funds from the UK by European banks with a particular focus on Spanish banks given the domestic vulnerabilities.

Fears were put to one side on Friday and the UK currency was able to push to a 6-week high against the dollar and it edged towards the 1.60 level on Monday.

Swiss franc

The franc maintained a strong tone against the Euro, but there was further support in the 1.22 area which helped push the currency higher in a correction from sharp losses over the previous 24 hours.

The Swiss industrial confederation confirmed that it had held further discussions with the government over the issue of a strong franc and also voiced the opinion that the currency was still too strong. It denied that it had put overt pressure on the government and National Bank to weaken the Swiss currency further.

Some lessening of fear surrounding the Euro curbed franc demand on Monday while the dollar was trapped in the 0.8840 area due to wider losses.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

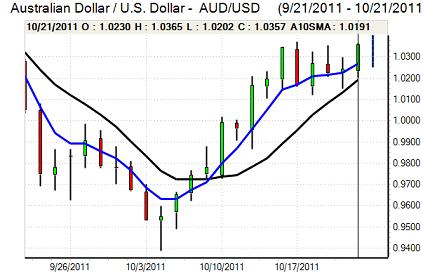

Australian dollar

The Australian dollar maintained a strong tone during Friday and pushed to highs towards the 1.0380 area before hitting resistance and there was some evidence of longer-term fund selling at higher levels, especially with concerns over the outlook for commodity prices.

Nevertheless, the currency remained strong in Asian trading on Monday as a recovery in the Chinese PMI index back to above the 50 level triggered a further improvement in risk appetite and stop-loss buy orders with a move above the 1.04 level.