EUR/USD

The Euro came under pressure again in European trading on Friday with lows below 1.4250 as fears over the Euro-zone debt crisis increased again. Peripheral yield spreads continued to widen which undermined Euro support and there reports that the EFSF would not be able to distribute funds to Greece during September. The Spanish government also announced an early General election for November which fuelled market anxiety.

The Euro rallied sharply in US trading as US fears regained prominence with economic and political fears reinforcing each other. The House of Representatives finally approved a deficit-reduction bill, but this was voted down in the Senate and there were increased fears over a US debt default as the situation remained deadlocked.

The US second-quarter GDP data was weaker than expected with an annualised increase of 1.3% compared with the 1.7% expected, but the major surprise in the data was a sharp downward revision to 0.4% for the first quarter from 1.8%. There were also revised historical estimates which indicated that the 2007-2009 recession was significantly deeper than reported previously.

In this environment, there was a sharp deterioration in US dollar confidence on growth and budget grounds while there was also a sharp deterioration in risk appetite. Despite a lack of confidence in the Euro-zone fundamentals, there was still a net move into the Euro and it strengthened to highs above 1.44.

Following a weekend of negotiations, President Obama announced that a US debt deal had been agreed which provided important relief. There were still fears that the proposed spending cuts would not be sufficient to prevent a credit-rating downgrade, especially by Standard & Poor’s, which curbed any enthusiasm for the dollar.

The latest speculative positioning data recorded the largest net short dollar position since May which may provide some degree of US currency protection from further aggressive selling.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar remained on the defensive against the yen in Europe on Friday with a further test of support close to 77.50 as safe-haven considerations dominated.

The dollar weakened sharply following the latest GDP data as US economic fears were compounded by a flight to safety and the dollar weakened to fresh four-month lows near 76.80.

There were warnings over potential intervention from the Japanese Finance Ministry, but no evidence of actual intervention in the market. There will be further speculation that G7 will look to stabilise currency markets and the dollar did gain important relief from the US debt-deal announced on Monday. The US currency spiked to a high just above 78, but failed to sustain the gains.

Sterling

Sterling again found support in the 1.6260 area against the dollar in Europe on Friday and rallied sharply during the US session with a peak around a seven-week high of 1.6470.

With a serious lack of confidence in the US and Euro-zone outlooks, Sterling was again able to secure some degree of defensive support despite UK vulnerability. There was some increase in UK political stresses and this will intensify if the economy continues to disappoint.

The latest UK consumer lending data was weaker than expected and there was a further decline in money supply which maintained fears over the outlook for bank lending and the potential negative economic impact, although the mortgage approvals data was slightly stronger than expected.

The UK PMI data will be watched very closely this week for further evidence on the economic outlook ahead of the Bank of England interest rate decision on Thursday.

Swiss franc

The dollar found support close to 0.80 against the franc in Europe on Friday, but the weak US GDP data triggered a break and there was heavy stop-loss selling with lows below 0.79. The Swiss currency also gained substantial safe-haven support as underlying risk appetite deteriorated on fears over a US debt default.

The Euro did find support close to record lows near 1.13 and rallied slightly while the dollar also gained some respite in Asian trading on Monday following the announcement of a US debt deal.

There was still an underlying lack of confidence in the US and Euro-zone areas which will maintain some underlying demand for the Swiss currency and the National Bank will remain an important focus.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Australian dollar

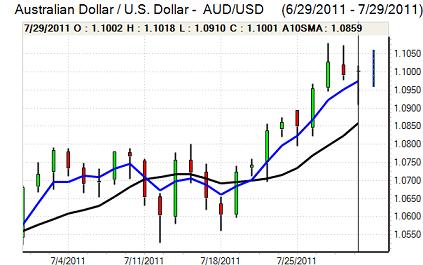

The Australian dollar remained under pressure in Europe on Friday with lows near 1.09 against the US dollar on a combination of Euro weakness and risk aversion. Although fears continued to dominate, the US currency weakness dominated the US session with Australian dollar gains back to the 1.10 area.

An improvement in risk appetite allowed further gains in local trading on Monday. The economic data was mixed as the PMI manufacturing index weakened to three-year lows at 43.4, but there was a higher than expected inflation report which maintained speculation over a further Reserve Bank interest rate hike on Tuesday as volatility remained high.