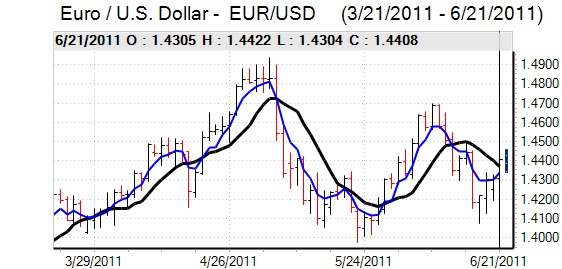

EUR/USD

The Euro found support blow 1.4320 during Tuesday and rallied during the European session as the dollar was unable to gain any fresh traction. There was a nervous tone ahead of the Greek parliamentary confidence vote, but there were strong expectations that the government would be able to secure a victory which helped underpin the Euro.

In the event, the vote was in line with expectations with the government winning by 155-143. There will now be another vote on austerity measures next week and approval here will also be critical if Greece is to secure fresh Euro-zone backing and an additional rescue package. The Euro was unable to gain additional support following the vote and retreated back to the 1.4350 area from a peak above 1.4420.

There will continue to be important longer-term concerns surrounding the Greek situation as the debt burden will remain unmanageable and there is still a very high risk of default in the medium term. There have also been signs of increased stresses within the inter-bank market and demands on the ECB for short-term funding have increased which will undermine Euro confidence.

As far as the economic data is concerned, the German IFO index weakened to -9 for June from 3.1 previously, maintaining expectations of a significant slowdown in the economy which would also make it even more difficult for peripheral economies to secure growth.

The US existing home sales was broadly in line with expectations with a decline to an annual rate of 4.81mn from 5.00mn previously, maintaining the generally subdued tone. There were strong expectations that the Federal Reserve would lower its growth forecasts following the FOMC meeting on Wednesday and would maintain a commitment to very low interest rates. These expectations continued to limit any US dollar support on yield grounds. If there is a surprise from the Fed, then dollar volatility will spike higher again.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar has remained trapped within relatively narrow ranges during the past 24 hours with support close to 80, but the US currency has not been able to move far away from this level. With Finance Minister Noda warning over the potential for bold action, there was further caution over yen buying given the possibility of intervention.

The US currency continued to be undermined by a lack of yield support with strong expectations that the Federal Reserve will maintain a highly-expansionary monetary policy.

There was some weakening of the yen on the crosses as risk appetite attempted to recover, although there was still a high degree of caution over the situation which tempered market moves.

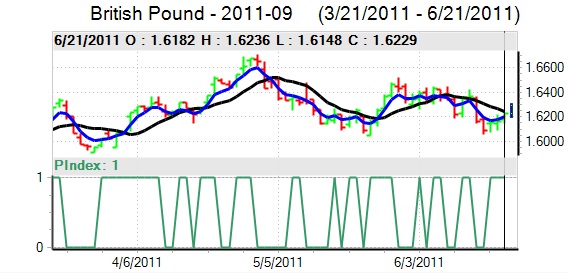

Sterling

Sterling found support on dips to the 1.6170 area against the dollar on Tuesday and rallied to a high close to 1.6250 while the Euro was blocked near 0.8880 against the UK currency. Sterling was broadly resilient despite fresh doubts over the banking sector’s potential exposure to Greece.

The headline government borrowing data for May was slightly better than expected at GBP15.2bn for the month from GBP7.7bn previously, although the underlying data, excluding financial interventions, was slightly higher compared with last year as spending rose.

Bank of England MPC member Fisher stated his concerns over the growth outlook and also stated that further quantitative easing was possible if there was a sustained threat of deflation within the economy. The remarks reinforced expectations that the central bank would maintain a very loose monetary policy over the next few months.

In this context, there were expectations that the Bank of England would take a generally downbeat tone in the June minutes due for release later on Wednesday.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Swiss franc

The dollar was unable to make any impression on the franc during Tuesday and retreated to test support near 0.84 as the US currency remained generally vulnerable. The Euro was unable to make any impression on resistance levels near 1.2150 and dipped back towards 1.21.

Even with the Greek government winning a confidence vote, there was still an underlying mood of caution towards the Euro-zone and the Euro with fears that the medium-term outlook was unsustainable. There was, therefore, still defensive demand for the Swiss currency as markets remained uneasy towards the Euro-zone outlook.

Australian dollar

The Australian dollar found support below 1.0550 against the US dollar following the Reserve Bank minutes and rallied to a high just above 1.06 as the US currency remained on the defensive.

There was selling pressure above this level and dipped to lows below 1.0580. There was still caution over global economic prospects following weaker than expected data. There was further unease surrounding the Chinese economic outlook which fuelled expectations that there would be downward pressure on commodity prices and also had some negative impact on the Australian dollar.