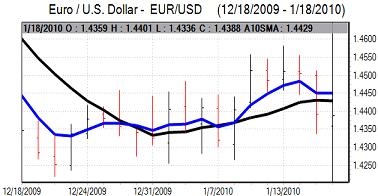

EUR/USD

The Euro remained fragile in early Asian trading on Monday, but found support below the 1.4350 level against the US currency and edged back towards 1.44 in early Europe in cautious trading.

There were still important underlying fears surrounding the Euro-zone economy as the Greek debt situation remained a key market focus. There was tough talk surrounding the deficit from European officials, but the markets had already discounted a substantial amount of bad news which curbed further selling pressure on the Euro, at least in the short term. Underlying sentiment is still liable to be weak given stresses in other weaker economies.

There were no significant US developments during the day as the US market was closed for the Martin Luther King holiday.

Markets will remain on alert for fresh comments from Federal Reserve figures over the next few days. It is certainly the case that there will be divergent views within the FOMC which could trigger erratic trading conditions. Overall, the dollar will find it difficult to gain further strong support on yield grounds.

The Euro maintained a firmer tone during the day, but was unable to push above the 1.44 level.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

Underlying confidence in the Japanese economy remains weak with further concerns following the weak industrial reported data last week. The November industrial production data was also revised down which unsettled the yen to some extent and maintained expectations that the Bank of Japan would have to sanction a further easing of monetary policy. There are also still fears over the Japanese government debt situation with markets looking to sell the yen.

In this environment, there was some interest in carry trades funded through the yen and the Euro found support close to 130 which also curbed wider yen support. The dollar was still hitting selling pressure close above the 91 region in Asian trading on Monday.

The dollar dipped to lows around the 90.60 level as markets looked to trigger stop-loss levels, but the US currency resisted further losses as underlying yen sentiment remained weak.

Sterling

The Rightmove organisation reported a small increase in house prices for January and Sterling again found support below the 1.6250 level against the US currency on Monday and edged higher in European trading. Sterling gained some support from speculation over further investment inflows into the UK.

A stronger than expected figure for inflation would reinforce speculation that the Bank of England could be forced into an earlier than expected increase in interest rates to head off inflationary pressure. Interest rate speculation would, in turn, be likely to provide some degree of Sterling support.

There are still extremely important underlying Sterling vulnerabilities, especially given the government-debt situation. Standard Life, for example, stated that the UK AAA credit rating is extremely vulnerable with the current economic and political situation described as toxic. Sterling was unable to hold above 1.6350 against the dollar and the Euro also found support below 0.88.

Swiss franc

The dollar was unable to push above the 1.03 level against the franc on Monday and weakened towards 1.0240 as the Swiss currency remained firm against the Euro with a test of Euro support below 1.4750.

The ECB announced that it would stop the Swiss franc liquidity auctions at the end of January as market conditions had improved. This is likely to provide some net support for the Swiss currency on reduced franc supply.

There will be further pressure on the National Bank to curb franc appreciation, especially if Swiss currency makes net gains against the dollar.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

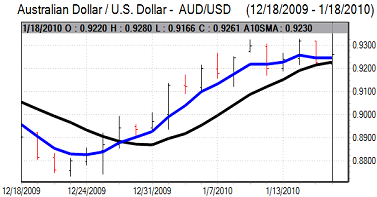

Australian dollar

The Australian dollar was unable to regain momentum on Friday, undermined by a general deterioration in risk appetite, and it dipped to lows below 0.92 against the dollar in early Asia on Monday before regaining this level. Caution is likely to dominate in the near term, especially with continuing fears over a sharp slowdown within the Chinese economy.

Trading ranges were narrow during the day with the Australian currency able to consolidate above the 0.9250 level later on Monday.