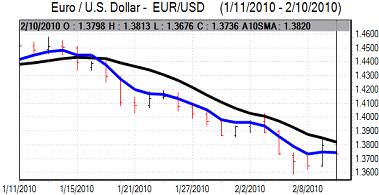

EUR/USD

The Euro remained prone to volatile trading on Wednesday as market sentiment fluctuated sharply. There was selling pressure above the 1.38 level in European trading and the currency then dipped sharply to lows below 1.37 in New York.

There were renewed doubts whether a credible budget-support package for Greece could be put together and underlying stresses continued to undermine confidence in the Euro. There were also fears that any relief measures for Greece would undermine the medium-term commitment to budget stability and weaken underlying Euro support. Thursday’s EU meeting to discuss the situation will inevitably be watched very closely and failure to agree a package would tend to put the Euro under renewed selling pressure. Any support measures may also provide only limited currency support given the medium-term reservations.

The dollar was hampered initially by a larger than expected trade deficit of US$40.2bn for December as oil imports rose strongly. The wider deficit will tend to trigger a downward revision to fourth-quarter GDP data, although the impact may prove limited.

In contrast, there was initial dollar support from Fed Chairman Bernanke’s testimony as he suggested that the Fed would need to increase the discount rate soon to help normalise market conditions. The remarks triggered increased expectations of a near-term policy tightening which boosted the US currency. Bernanke also stated that rates would need to stay low for a protracted period which dampened support for the dollar and the Euro found firm buying support below the 1.37 level.

Risk appetite improved in the Asian session on Thursday which pushed the Euro back towards the 1.3790 region in choppy trading conditions.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar dipped sharply to lows near 89.25 against the yen during US trading on Wednesday before finding support. The Japanese currency was unable to sustain the advance and the US currency was able to re-test resistance levels above 90 in Asian trading on Thursday.

Immediate yen demand was stifled by an improvement in risk appetite following stronger than expected Australian employment data and a higher than expected figure for Chinese new loans.

Trends in risk appetite will remain very important for the yen in the short term with the currency still likely to derive support from unease over US and Euro-zone fundamentals.

Sterling

Sterling pushed above 1.57 against the dollar in early Europe on Wednesday following stronger than expected industrial production data.

The UK currency was unable to hold this level and was subjected to renewed selling pressure following the Bank of England inflation report. There was a slight downgrading of GDP growth forecasts within the data while the bank also expected inflation to fall back sharply to below 1.0% in the medium term from an initial peak above 3.0%.

The comments resulted in a downgrading of interest rate expectations which undermined the UK currency while there were also some fears that the bank was being complacent over medium-term inflation risks.

Sterling dipped to lows near 1.5570 against the dollar before finding some support with the currency bolstered by a general improvement in global risk appetite. Underlying confidence is still likely to be very fragile in the short term as underlying government-debt fears persist with further speculation surrounding a credit rating downgrade likely to be a continuing feature.

Swiss franc

From lows near 1.0620 on Wednesday, the US currency strengthened sharply to highs around 1.0720, but it was unable to sustain the advance and retreated back towards 1.0620 on Thursday. Although the Euro was able to find support above 1.4650 against the franc, it was unable to make significant headway.

The franc will tend to lose some defensive support if there is a credible support package for Greece or a sustained improvement in global risk appetite, although the underlying risks suggest that a mood of caution will tend to dominate which will curb any selling pressure on the Swiss currency.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

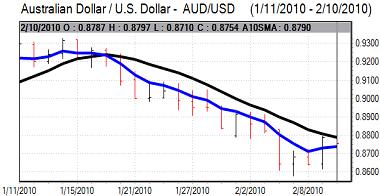

Australian dollar

The Australian currency found support above 0.87 against the US currency on Wednesday and consolidated above the 0.8750 level as risk appetite was generally stronger.

The latest employment data was much stronger than expected with an increase in employment of over 50,000 for January while unemployment declined to 5.3% from 5.5%. The data reinforced expectations that the Reserve Bank would move to increase interest rates again and the Australian dollar moved sharply higher to a peak above 0.8880 as risk appetite was also firmer.