EUR/USD

The Euro remained under heavy pressure on Monday, unable to gain any significant relief as negative headlines continued to dominate markets.

There were further concerns surrounding the Greek situation following the admission that the 2011 budget deficit will miss the 7.5% of GDP target, potentially reaching at least 8.5%. The admission will make it even more difficult for the troika to issue a favourable report on Greece and any decision to do so will be seen even more as a political decision. German politicians continued to warn that there would be no more concessions to Greece and there was a further setback at the Euro Group meeting on Monday with the troika delaying a decision on the next loan package until November.

There were reports that Prime Minister Papandreou was considering resigning which further unsettled market confidence.. There were also concerns that European banks would be undermined by the weight of bad loans. In this context, there was further speculation that any formal Greek default would be delayed in order to allow the banks greater time to prepare.

There was further stress within the banking sector as Belgian Bank Dexia held an emergency meeting to discuss its financing position. The Euro was unsettled by reported comments from incoming ECB President Draghi who was reported to have said that banks may have funding difficulties and confidence in the financial sector remained extremely weak.

The US economic data was stronger than expected with the PMI manufacturing index rising to 51.6 for September from 50.6 previously. The data had some positive impact on the dollar with some market talk that the US economy could start to out-perform major global rivals, although the data was still weak.

Underlying risk appetite was still very fragile on fears for the global economy and a weaker tone on Wall Street helped push the Euro to 9-month lows below 1.32 later in the US session with some support on dips to the 1.3150 area in Asia on Tuesday.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar was unable to hold above the 77 level against the yen on Monday and dipped lower during the New York session with lows towards 76.50.

The yen continued to gain support from a deterioration in risk appetite while low yields undermined the dollar. The Congressional bill alleging Chinese currency manipulation also had some impact in supporting the yen.

There were further reports of capital repatriation back to Japan with a suggestion that retail yen selling had reversed following the recent deterioration in risk appetite.

Sterling

Sterling was unable to make any headway against the dollar on Monday, primarily due to the impact of wider US currency strength.

The UK PMI manufacturing index rose to 51.1 in September from 48.9 previously which helped alleviate immediate fears surrounding the industrial outlook. Sterling dipped immediately ahead of the release, although this appears to have been a mistaken trade. The UK currency initially recovered, but w then subjected to renewed selling later in the US session as there was a wider shift into the US dollar with Sterling retreating to lows near 1.5420 before a tentative recovery.

Underlying sentiment was still extremely weak, especially given speculation that the Bank of England would sanction further quantitative easing, possibly at this week’s monetary policy meeting. The UK currency retained a firm tone beyond 0.86 against the Euro

Standard & Poor’s maintained its AAA credit rating for the UK and also confirmed the outlook as stable which provide some relief for Sterling, especially with an important focus on the Euro-zone credit ratings.

Swiss franc

The dollar continued to push higher against the Swiss franc on Monday with a peak above 0.9150 as there was wider buying support for the US currency.

The Euro recovered from lows below 1.2120 and there were reports that the National Bank had been intervening to stem franc gains. The Euro still found it hard to make much headway given the underlying stresses.

Swiss retail sales fell 1.9% in the year to August, maintaining fears over a downturn in the economy which has been exacerbated by a strong franc.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

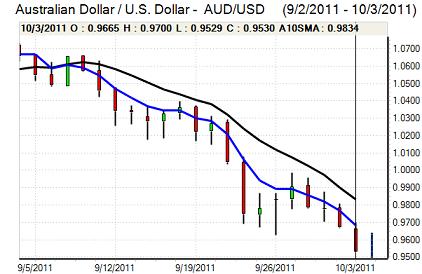

Australian dollar

The Australian dollar continued to be dominated by global factors during Monday. There was a general deterioration in risk appetite and there were increased fears surrounding the Asian economic outlook which had an important negative impact as commodity prices declined with copper at 12-month lows.

The Reserve Bank of Australia left interest rates on hold at 4.75% following the latest monetary meeting. The bank statement was much more cautious on growth and there was a suggestion that interest rates could be cut as early as November which further damaged the Australian currency. There was a decline to 1-year lows below 0.95 against the US currency before a technical recovery.