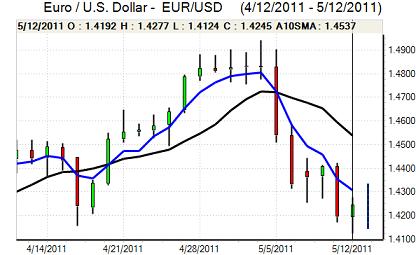

EUR/USD

The Euro remained under pressure in European trading on Thursday and retreated to a five-week low close to 1.4125 ahead of the New York open. Risk appetite remained fragile and a further decline in commodity prices triggered fresh support for the US currency as speculative positions were reduced.

As far as the economic data is concerned, US initial jobless claims declined to 434,000 in the latest week from a revised 478,000 previously while there was a modest slowdown in the rate of retail sales growth with a gain of 0.5% for April following a 0.9% increase previously. Regional Fed President Plosser repeated his calls for a modest tightening of Federal Reserve policy , but the overall market impact was limited with markets looking for any additional remarks from core Fed members before there is a substantial shift in market sentiment.

The Euro-zone structural vulnerabilities continued to be an important near-term focus with further economic and political discussion surrounding the Greek debt situation. Markets remain convinced that the current situation is unsustainable and there are major doubts whether any economic measures will be able to command political support. There will also be further political stresses within Germany as it will be extremely difficult to gain support for additional support measures.

There was some hawkish rhetoric by ECB members with further comments that markets had mis-interpreted comments by President Trichet at last week’s press conference. These comments and a recovery in commodity prices pushed the Euro back to the 1.4270 area before a correction to the 1.42 area in Asia on Friday.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar was blocked in the 81.30 area against the yen during Thursday and had a slightly weaker tone even though it did find support close to 80.50 in choppy trading conditions. The US data did not bolster the case for higher US Treasury yields or a more aggressive Fed tone which stifled additional dollar support.

The yen also continued to gain support from vulnerability in global equity markets and weakness in commodity prices with further pressure for a reduction in commodity-related carry trades funded through the Japanese currency.

There was still a lack of confidence in the Japanese fundamentals which limited yen buying with expectations that the Bank of Japan would need to maintain a highly-expansionary monetary policy at next week’s policy meeting. The dollar maintained a more fragile tone in Asia on Friday with a retreat to near 80.50.

Sterling

Sterling was blocked below 1.64 against the dollar during Thursday and was subjected to substantial selling during the European session with lows below 1.6250 against the US currency while Sterling also retreated back to beyond 0.87 against the Euro.

The latest UK economic data did not provide any currency support with a weaker than expected 0.3% increase in industrial production for March following a 1.2% decline the previous month. The latest monthly NIESR GDP data also recorded weaker than expected growth of 0.3% for April from a downwardly-revised 0.5% previously which does not suggest that the economy was able to gain any momentum at the start of the second quarter.

Overall confidence in the economy will remain weak and there will be persistent fears that underlying vulnerability within the banking sector will curb lending, prevent any significant recovery in growth and also prevent the Bank of England from raising interest rates significantly. Rallies meet selling pressure above 1.6320 and it drifted back to the 1.6250 area in Asia on Friday.

Swiss franc

The dollar hit resistance close to 0.89 against the franc during Thursday and retreated sharply to lows near 0.8820 before a renewed advance to above 0.8850. The franc resisted fresh selling pressure on the crosses with the Euro struggling to hold above the 1.26 level.

There was further pressure for a reduction in speculative commodity positions which provided support for the Swiss franc and there was some frustration that the US currency had not been able to advance further. The currency continued to gain important support from fears over capital flight from the Euro-zone.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

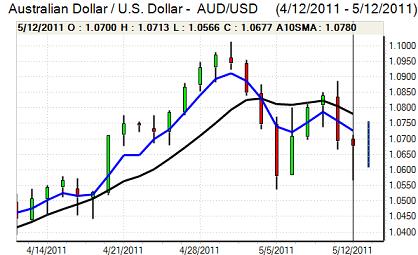

Australian dollar

The Australian dollar remained under pressure in Europe on Thursday, but found support close to 1.0570 and there was a recovery to the 1.0680 area as the US currency retreated and there was a recovery in commodity prices in choppy trading conditions.

There was renewed selling pressure for currency in local trading on Thursday as commodity prices were subjected to renewed selling, although the pace of selling was more restrained. Following the weaker than expected labour-market data on Thursday, there was reduced speculation that the Reserve Bank would increase interest rates which curbed buying support for the Australian currency.