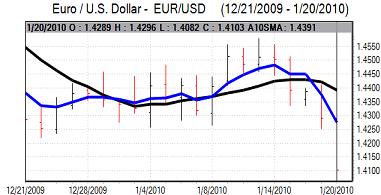

EUR/USD

The Euro gapped lower in early Asian trading on Wednesday with a 20-week low around 1.4170 against the dollar before a limited corrective recovery to the 1.42 area in early Europe.

Underlying confidence in the Euro-zone economy and Euro remained weak during the day as underlying stresses continued. There was a further widening of yield spreads between German and Greek benchmark bonds to record levels which again undermined the Euro. The French Prime Minister also stated that the dollar level was destabilising which will maintain the impression that a weaker Euro will be welcomed.

The US housing-starts data was weaker than expected with a 4% decline to an annualised level of 0.56mn for December from 0.58mn the previous month. There was, however, a monthly increase in permits to 0.65mn which will maintain some hopes for a recovery in the housing sector during 2010.

Risk appetite was generally weaker during the day on fears over a slowdown in the global economy and this also contributed to a generally stronger US currency with some defensive demand. There was a further Euro decline to fresh 2-month lows below 1.41 against the dollar during New York trading with a sharp decline on Wall Street contributing to negative sentiment.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The Japanese government held its view of the economy in its latest report while also warning over the deflation threat. There will still be pressure on the Bank of Japan for further measures to combat the risk of falling prices.

There were further warnings by the Central bank of China over the need for loan growth to be tightened during 2010 and this was significant in curbing interest in carry trades which also lessened potential selling pressure on the yen. The dollar was unable to extend an advance on Wednesday with the yen also making fresh headway against the Euro.

There was a similar pattern during the remainder of the day with the dollar blocked near 91.50 while the Euro dipped to lows below 128.50 against the Japanese currency as there was a continuing reluctance to maintain carry trades.

Sterling

Sterling maintained a firm tone in early Europe on Wednesday. The latest UK labour-market figures were again stronger than expected with a decline in jobless claims of 15,200 for December after a revised 10,800 fall the previous month while the ILO unemployment rate dipped to 7.8%. The data did mask underlying weakness as there was a decline in employment according to the latest figures which suggests that underlying labour demand is still weak, although near-term sentiment should be slightly firmer in the near term.

The Bank of England minutes recorded 9-0 votes for interest rates and the amount of quantitative easing which was in line with market expectations. The February inflation report will be very important for interest rate expectations and trading conditions are liable to be volatile over the next few weeks.

Sterling maintained a firm tone against the Euro with fresh 5-month highs while losses against the dollar were contained to the 1.6250 area.

Swiss franc

The dollar advanced strongly in Asian trading on Wednesday and pushed to a high around 1.0460 in New York. The Euro initially found support below the 1.4750 level against the Swiss currency, but failed to sustain gains and dipped to lows near 1.4730.

There will be further speculation over National Bank intervention if the Euro weakens to the 1.47 region against the franc.

There will be a persistent sense of unease over the Euro-zone internal stresses which will tend to underpin the franc on defensive demand.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

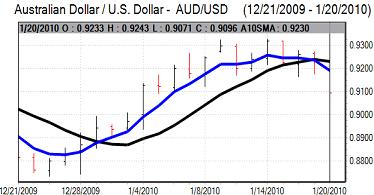

Australian dollar

There was renewed Australian dollar selling pressure in local trading on Wednesday with lows around 0.9130 against the US dollar. The US currency was generally stronger while there was also fresh concerns over a slowdown in the Chinese economy which triggered renewed selling pressure on commodity prices.

As risk appetite remained weaker, there were further sharp losses for the Australian dollar with lows near 0.9080 as there was a sharp decline on Wall Street. There will be a continuing correlation with risk appetite in the near term.