The Golden Sunrise

The essential morning read for investors!

Golden Sunrise is the Golden Surveyor’s broad-based market and world view.

Written daily 4am-7am by markets information specialist GS John

Today’s Golden Sunrise

Friday, May 28, 2010

Hours of daily research consolidated for you

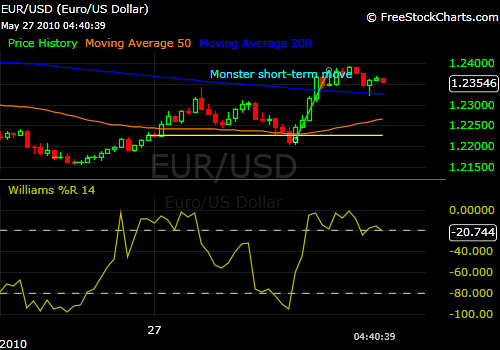

Euro saved Again

The Euro had another major rally yesterday on the news that the Chinese would be holding and supporting their Euro based debt instruments. Like before, the Euro rallied against the dollar, the risk trade came back to the fore and markets rallied jumped. At the end of the day, the Dow was up 284 points and 2.85%, the NASDAQ was up 3.73% and the S&P500 rose 3.15%. Volume wasn’t that great but 3% is a major bounce.

The Euro/USD: The turbulence is amazing, this is a 30 minute charts.

Oh by the way, my favorite politician and source of real peace of mind, Prime Minister Silvio Berlusconi of financial citadel Italy, announced that “unified European response has defeated an attack on the Euro”. I’ll sleep better tonight.

In more good news for Europe, and this much more meaningful, Iceland’s leader Grimsson announced that the second and larger volcano Katla is very close to erupting. Given the first episode, I won’t be buying British Airways or Lufthansa any time soon.

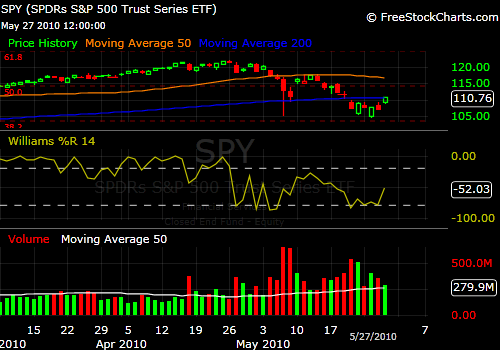

The Euro up, risk trade back on has been good for US stocks and this is the daily of the S&P500. Again, volume could be much better.

It was reported that $4.8 billion came out of equity mutual funds the last few weeks and the theory is we are running out of sellers. This is some real bravado..we’ll see soon enough.

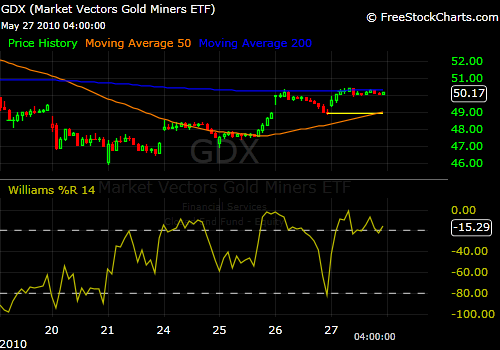

Commodities did ok but not that great considering the movement in the markets. Long way back to the 270s of a short time ago.

And volatility did decline sharply which has fit the mold: 30 min

All this going into the window dressing of last day of the month tomorrow and the flow of new money into the 401ks and IRAs the first few days next week. And gold…30 minutes here as well.

Gold has been firming up and waiting to see how the whole thing is going to move in the coming week. Long-timers like Richard Russell are very, very bearish and recommending gold and cash only. The projections to the downside are alarming and the case they are making has real validity.

There are also many bulls, of course, but not with the fervor to the upside that the bears are communicating to the down.

Like great athletes that quickly forget mistakes and move on to the next play, Mr. Market seems to have the same ability. Everything that was wrong with the Euro is over, all the PIGS are back in their pens munching sweet corn and the slaughterhouse is now closed.

The Chinese, the Germans and the bonus babies at Goldman Sachs have all pledged to serve your best interests and all is right with the world. And if you sail your yacht to close to Pyongyang, they have promised not to sink it.

Be careful. The market will be there tomorrow and next week and next month and next quarter. Capital lost is hard to replace.

JohnR

Goldensurveyor.com