EUR/USD

After finding support in the 1.35 region against the dollar on Monday, the Euro secured a corrective recovery in very choppy trading conditions. The currency was over-sold following very sharp losses over the previous few days and was overdue at least a limited technical recovery.

The Greek announcement that it would introduce fresh austerity measures also lessened immediate fears that the Greek government would abandon the austerity programme and look to default instead. Underlying confidence remained extremely weak amid expectations that default is still unavoidable within the next few weeks.

There was further strong rhetoric from some elements within the German government calling for Greece to leave the Euro area and the official line was still that the next loan tranche would not be paid unless there was a favourable report from the IMF-led troika. There was a further widening in Greek credit-default swaps indicating that underlying fears were continuing to increase.

There were further concerns over the European banking sector with a particular focus on France given its exposure its Greek debt. There were suggestions that the Chinese would buy Italian debt and this had some positive Euro impact, although there was also a high degree of scepticism. The Italian government faces an important bond auction on Tuesday and weak demand would further undermine confidence.

There were no major US developments during the day as the US Treasury market continued to gain defensive support. At one stage, benchmark 10-year yields fell to a record below the 1.90% level.

From a longer-term perspective, there was further speculation over US reform of corporate taxes which could encourage a flow of funds back to the US and support the dollar. Europe is still dominant for now with the Euro moving to the 1.3680 area in Asia on Tuesday.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar dipped to lows near 76.80 against the yen on Monday before finding support and was blocked in the 77.40 area during the New York session.

The decline in US Treasury yields had an important impact in curbing support for the dollar and the reduction in yield premium will continue to have an important negative dollar impact. The yen will also continue to gain defensive support with the risk of accelerated capital repatriation from the Euro-zone banking sector.

Markets will remain on high alert over the potential for Bank of Japan intervention and co-ordinated moves to weaken the Japanese currency. There will certainly be a reluctance to buy the yen aggressively with the dollar consolidating in the 77 area in Asia on Tuesday.

Sterling

Sterling briefly dipped to support below 1.58 against the dollar on Monday before recovering to the 1.5850 area. Cross-related moves remained very important for Sterling as the Euro recovered strongly from a dip to below the 0.8550 level with a move back to 0.8625. There was still some residual support from Sterling’s position outside the Euro-zone as sentiment in the bond market held firm.

The latest RICS housing indicator reported that a net 23% of surveyors reported a drop in prices for August compared with 22% the previous month which suggests that the grind lower in house prices is continuing.

The latest consumer inflation report will be released on Tuesday and a weaker than expected release would increase speculation that the Bank of England will move to additional quantitative easing within the next few months and would also tend to undermine Sterling.

Swiss franc

The dollar was blocked near 0.8880 against the franc on Monday and retreated to test support just below 0.88 as there was a wider US correction against European currencies. The Euro was unable to make any impression on the franc and was generally trapped below the 1.2050 level despite some slight easing in immediate fears.

National Bank policies will remain extremely important in the short term, especially with the Euro not far from the 1.20 level defended by the bank. There will be concerns that any increase in market pressure on the Euro could force the central bank into a humiliating and extremely damaging policy reversal which would also lead to very heavy financial losses for the central bank.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

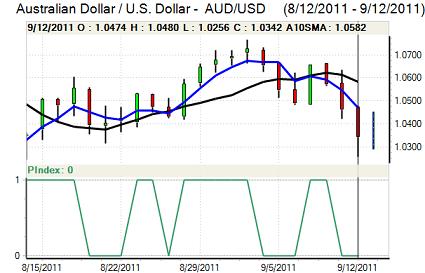

Australian dollar

The Australian dollar remained under pressure on Monday and retreated to 1-month lows close to 1.0250 against the US currency before finding some degree of support and rebounding to the 1.0370 area. The currency was undermined by a general deterioration in risk appetite as fears surrounding the Euro-zone and global economy increased. There were also fears that weaker Asia demand would put downward pressure on industrial commodity prices.

There was a decline n the latest NAB business confidence index to -8 from 2 previously, reinforcing expectations of a domestic slowdown and there has been an increase in business leaders calling for a cut in interest rates.