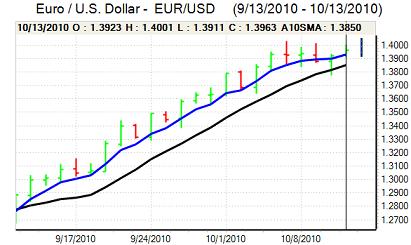

EUR/USD

The US currency maintained a weaker tone in Asia on Wednesday with markets again looking to target Euro technical resistance in the 1.40 zone.

Monetary policy within the Euro-zone area and US will remain a very important market focus in the near term. As far as the US is concerned, there will be further expectations that the Federal Reserve will embark on a second round of quantitative easing during the fourth quarter of 2010.

In contrast, there will be expectations that the ECB will resist more aggressive easing and will look to withdraw excess liquidity during 2011. These contrasting expectations will tend to provide near-term Euro support. There will, however, also be unease over the very important structural vulnerabilities, illustrated in comments from US financier Buffett on the challenges faced by the area. If there is evidence of renewed stresses within the financial sector, then Euro sentiment could deteriorate rapidly.

There were no significant economic releases during the day and markets found it difficult to gain any traction. The Euro retreated from the 1.40 area, but the dollar was also unable to gain support given weak underlying sentiment. There was consolidation above 1.3950 later in the New York session with further speculation over underlying capital flows out of the US.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The latest Japanese machinery orders data was stronger than expected with a 10.1% monthly increase which will boost optimism towards the economy to some extent, although the overall impact is likely to be limited, especially as bank lending continued to register an annual decline with the 10th consecutive year-on-year fall.

Intervention policies will inevitably remain important with a reluctance to sell the dollar aggressively given the possibility of central bank action. Finance Minister Noda stated in parliament on Wednesday that he could not answer whether there would be further intervention. The dollar continued to drift below the 82 level in early Europe on Wednesday.

The US currency was again trapped within narrow ranges during the US session on Wednesday with a rally on Wall Street providing some support for the dollar as yen buying faded while markets remained on high alert over the intervention threat.

Sterling

Sterling hit selling pressure close to 1.5880 against the dollar in early Europe on Wednesday and maintained a weaker tone with confidence unsettled by a sharp decline in the latest Nationwide consumer confidence survey.

The latest labour-market data was mixed as there was a larger than expected increase in the claimant count, but there was also a decline in the unemployment rate to 7.7% from 7.8%. The data overall suggested a slight deterioration in conditions, but no serious pressures at this point.

The latest leading indicators have registered a clear loss of momentum and there will be continuing expectations of a slowdown in the economy over the next few months as fiscal tightening takes effect.

In this context, there will be further speculation that the Bank of England will also move to a further round of quantitative easing. This possibility will tend to sap currency support and there has been some evidence of capital outflows from the UK.

Sterling did find support weaker than 0.8830 against the Euro and also rallied back to the 1.5900 area against the dollar as selling pressure eased.

Swiss franc

The Euro found support on dips to the 1.3320 area on Wednesday and strengthened to a high above 1.34 during the US session. There were some rumours of National Bank intervention as the Swiss currency weakened, but it appeared to be an order-driven move rather than central bank action. The dollar was unable to hold above 0.96 against the franc and settled just below this level.

There will be further speculation over a move by other central banks to pursue aggressive monetary policies and this will tend to provide underlying franc support.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

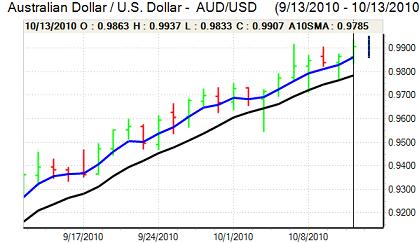

Australian dollar

There was a gain in Australian consumer confidence according to the latest data, although US currency weakness was again the dominant factor which pushed the currency to a high near 0.99 in early Europe on Wednesday. There will be further expectations of global central bank monetary policy action which will tend to support the Australian currency, especially as commodities will be seen as an attractive asset class which should spark further investor interest.

In this context, the Australian currency pushed to a high above 0.9920 against the US dollar with support also coming from an improvement in risk appetite.