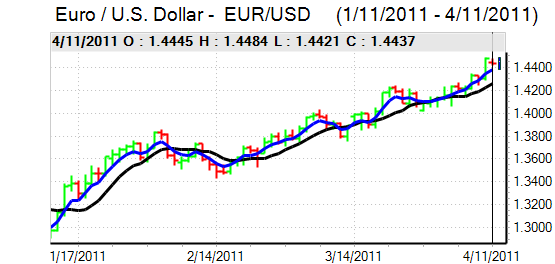

EUR/USD

The Euro was capped just below the 1.4480 level against the dollar during Monday and drifted weaker to test support close to the 1.4420 level in subdued trading conditions. There were no major economic data releases during the session to drive markets as monetary policy remained an important focus.

Comments from Fed officials remained under close scrutiny, especially given the lull in data releases. Vice-Chairman Yellen stated that inflation was a temporary problem and that pressures from higher commodity prices won’t last. She also stated that there was no need to tighten policy at this stage which curbed dollar support. The comments will remain under close scrutiny over the next few days.

There was a deterioration in risk conditions during the Asian trading session on Tuesday with falling equity prices as there was a further Japanese earthquake and an escalation in the Japanese nuclear crisis. There was also a decline in commodity prices which also curbed selling pressure on the US currency.

The Euro was subjected to selling pressure on the crosses, but it was still broadly resilient against the dollar as yield spreads remained unfavourable for the dollar. Markets have, however, priced in at least four interest rate increases for 2011 which will leave the currency vulnerable to further profit taking.

The Euro dipped to lows near 1.4380 against the dollar in Asia on Tuesday as risk conditions remained more fragile.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar was unable to make a fresh impression on resistance above 84.80 against the yen during Monday and consolidated in narrow ranges as support held firm above 84.50.

The Japanese currency strengthened sharply in Asian trading on Tuesday as risk conditions deteriorated sharply. The Japanese central bank warned over the economic outlook and the nuclear crisis at the Fukushima complex was upgraded to level 7 from level 5, the same as the Chernobyl disaster in 1986. Japanese equity markets fell sharply and there was also a reversal in commodity prices which triggered profit taking on short yen positions and also discouraged carry trade activity.

The dollar weakened to lows just below 83.50 against the yen before correcting while the Japanese currency also recovered strongly against the Euro in volatile trading conditions. Underlying confidence in the Japanese fundamentals remained weak.

Sterling

There was erratic Sterling trading on Monday as the UK currency reversed an early decline against the dollar to test resistance levels above 1.64 as selling pressure in the Euro/Sterling cross had a significant impact.

Sterling was unable to sustain the gains was subjected to renewed selling in Asian trading on Tuesday. As far as the UK economic data is concerned, the latest RICS house-price index improved slightly to -23% for March from -26% previously. There was a sharp decline in the BRC retail sales index with a like-for-like sales decline of 3.5% for March, the weakest reading since 2005.

Although potentially distorted by the timing of Easter, there will be further unease over consumer spending trends as incomes are squeezed sharply. The latest consumer prices data will be watched closely on Tuesday and an elevated reading would increase inflation fears, but there would be further doubts whether the Bank of England would be able to respond given the weakness in demand.

The UK currency retreated to lows close to 1.6280 against the dollar before correcting while the Euro re-tested resistance close to 0.8850.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

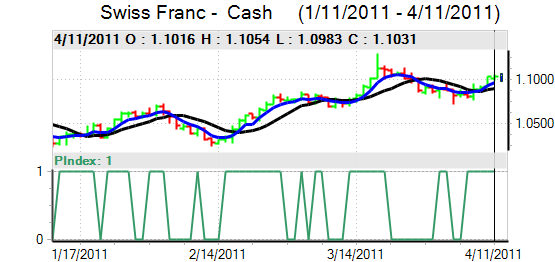

Swiss franc

The Euro was unable to make any impression on resistance levels above 1.3150 against the franc on Monday and weakened sharply in Asian trading on Tuesday with a decline to lows below 1.30. The US currency was also subjected to heavy selling and retreated to near 0.9020, pushing the currency back to near record lows seen in mid March.

The Swiss currency gained support from a fresh spike in risk aversion as Asian equity markets declined. The sharpness of the move will also increase market speculation that there had been a surge in carry-trade activity funded through the franc which were then subjected to a sharp reversal.

Australian dollar

The Australian dollar hit resistance close to 1.0580 against the US dollar during Monday and drifted back towards the 1.05 area during the US session. Selling pressure intensified in local trading on Tuesday with a brief decline to below 1.04 as volatility spiked higher.

A general deterioration in international risk appetite helped trigger the aggressive correction and selling pressure was magnified by a wider decline in commodity prices as energy prices retreated. Domestically, there was an improvement in business conditions according to the latest NAB survey, but there was a small decline in confidence.