EUR/USD

The Euro was able to resist heavy selling pressure during Wednesday and again rallied to test resistance in the 1.3360-80 band against the dollar, but was unable to break though this region as underlying sentiment remained negative.

There was further speculation over a recapitalisation of European banks which helped underpin the currency. German Chancellor Merkel suggested that the EFSF could be used to help support the banking sector while she reaffirmed that Greece should stay in the Euro. IMF European Head Borges suggested that the IMF could buy Euro-zone peripheral bonds, although this was played-down by Washington. There was no EFSF vote in Slovakia which helped maintain a tone of uncertainty.

There was further speculation over ECB policy ahead of Trichet’s last council meeting as President on Thursday. There were still strong expectations that the ECB would move to provide greater liquidity through longer-term repo operations. Markets were, however, less convinced that the bank would sanction a cut in interest rates. Volatility is likely to spike higher following the rate decision and press conference.

As far as the US data is concerned, the ADP survey recorded net private-sector job gains of 91,000 for October which was marginally higher than expected, although the impact was limited, especially as the latest Challenger data recorded a sharp increase in layoffs.

The US ISM index for the non-manufacturing sector recorded a slight decline to 53.0 from 53.3 the previous month. There was relief that that a severe deterioration was avoided, but the employment index dipped to below 50 for the first time in over 12 months which dampened confidence towards the Friday payroll data. The Euro consolidated around 1.3325 ahead of the ECB meeting.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar was again confined to very narrow ranges against the yen on Wednesday with support on dips towards the 76.50 area while it remained blocked near 77.0.

The US currency secured some support from a rise in benchmark Treasury yields following the US data, although the impact was still modest.

Both currencies were undermined to some extent by a general recovery in risk appetite as equity markets attempted to rally further and the Euro attempted to move away from 10-year lows against the yen. The Japanese currency was still broadly resilient as underlying fears over the global growth outlook persisted.

Sterling

Sterling was unable to make any move above 1.55 against the dollar during Wednesday, but did find support above 1.54 as the underlying tone was one of consolidation with a slight improvement in risk conditions also offering support.

The PMI services-sector data was stronger than expected with an recovery to 52.9 for September from 50.5 previously which eased fears over a rapid deterioration in the economy, although the impact was offset by a decline in business confidence to a 30-month low.

There was further speculation over additional quantitative easing by the Bank of England at Thursday’s policy meeting. Most analysts expect that the bank will decide on additional bond buying either at the October or November policy meetings and there would be no surprise if there was an announcement of additional action on Thursday. Sterling volatility is liable to increase and there will be initial Sterling gains if the bank holds steady

Swiss franc

The dollar found support on dips to the 0.9160 area against the franc during Wednesday and generally held above the 0.92 level. There was a favourable tail-wind for the US currency as the franc weakened to its lowest level against the Euro since late May with a test of support in the 1.2350 area.

There was further speculation that the National Bank would look to weaken the franc further and aim for a minimum Euro rate of 1.30. The bank’s task will be complicated if there is any ECB interest rate cut at Thursday’s policy meeting, especially as underlying Euro confidence remains extremely weak.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

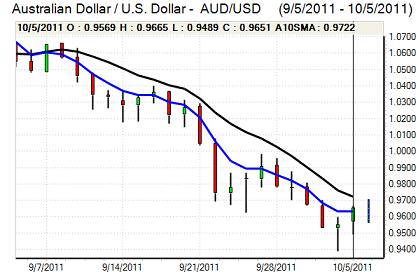

Australian dollar

The Australian dollar found support below 0.95 against the US currency on Wednesday and rallied to highs near 0.9660 late in the US session as there was a further underlying improvement in risk appetite. Equity markets looked to rally for the second successive day which boosted sentiment and triggered a flow of funds back into the Australian dollar.

Confidence is likely to be very fragile in the short term, especially as unease surrounding the global economy has increased with particular fears over the threat of a hard landing in China which would also have an important impact in weakening commodity prices.