EUR/USD

The Euro was confined to narrower ranges during Monday as support levels near the 1.36 region against the dollar held while there was resistance above the 1.37 level.

Underlying sentiment towards the Euro-zone economy and Euro certainly remained generally weak as debt fears surrounding Greece and the other peripheral countries persisted. Spanish bonds rallied strongly during the day on a statement of reassurance from the government and this also provided some wider relief to the Euro.

The EU summit, due to be held on Thursday, will be watched very closely and any positive move surrounding a support package for Greece could provide further near-term currency relief. It will be much more difficult for the Euro to secure sustained relief as underlying tensions persist. There is also likely to be some speculation that the ECB could be forced to cut interest rates which will remain a negative factor for the currency. There will also be unease over a decline in the Sentix business confidence index to a four-month low as any deterioration in economic conditions would tend to intensify budget pressures.

There has already been a big shift in market positioning towards selling the currency which may offer some significant degree of Euro protection given the scale of recent losses.

There were no significant US developments during the day with dollar moves still determined to a large extent by degrees of defensive demand. Fears over the US budget situation is still likely to unsettle the dollar to some extent and the Euro looked to consolidate above the 1.3650 level.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar found support on dips towards the 89 level against the yen during Tuesday, but was unable to make much headway and was blocked in the 89.50 region. The Euro remained very fragile, but found some support below the 122 level.

Degrees of risk appetite will remain a key short-term focus for the markets and a lack of confidence in global equity markets will continue to provide some defensive support for the Japanese currency.

Yen support is still likely to be limited by a fundamental lack of confidence in the Japanese economy, especially given the very serious government-debt situation faced by Japan.

Sterling

Sterling remained on the defensive against the dollar during Monday and struggled to rebound far from 8-month lows near 1.5520, although there was a move back to the 1.56 region. Sterling also found some support close to the 0.88 level against the Euro.

Government-debt fears remained an important element in the markets with fears that political stalemate could be an important factor in delaying measures to curb the deficit. The persistent fears surrounding Europe could offer some degree of relative protection to the currency, but will also tend to highlight UK vulnerability.

The latest economic data was mixed as the RICS reported a further increase in house prices for January while there was a weaker retail sales report from the BRC. The spending data is liable to have a bigger impact given doubts over the economic recovery and forthcoming reports will be watched closely.

Swiss franc

The dollar was unable to make any move towards resistance in the 1.08 region against the franc during Monday and, although still broadly resilient, it retreated to the 1.0720 region on wider franc gains. The Euro retreated again with lows below 1.4650 against the Swiss currency.

The underlying market forces are still for a battle between fears over National Bank intervention to weaken the Swiss currency and defensive demand for the franc triggered by the persistent lack of confidence in the Euro-zone. These conflicting pressures are liable to continue in the near term and high intra-day volatility will remain a key threat.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

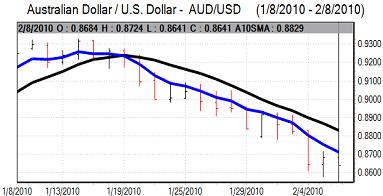

Australian dollar

The Australian dollar was unable to sustain a move above the 0.87 level against the US dollar during Monday and dipped sharply to a low near 0.8610 following a late retreat on Wall Street. There was buying support close to this level and it rallied to the 0.8650 region.

A general deterioration in risk appetite, allied with fears over a further decline in commodity prices, will tend to undermine the Australian dollar, especially with speculation that the Chinese authorities will move towards a further tightening of monetary policy.