EUR/USD

The Euro was subjected to choppy trading during Wednesday and, although the currency did retreat to a five-week low against the dollar, there was buying support on dips which continued to confound many analyst expectations.

When Italian bond yields rose to above the 7.0% level, there was evidence of increased ECB buying which pushed yields lower again and supported the Euro, although the widening of spreads suggested that there was very little in the way of fundamental buying support. Spanish yields edged higher during the day and there was a further widening of yield spreads between German and French bonds to record levels as underlying tensions increased.

There were further concerns surrounding the banking sector as financing conditions continued to tighten with the Euro/dollar swap rates showing the most stress since December 2008.

Mario Monti was appointed Italian Prime Minister and will also take the key financial posts in the government. Underlying confidence was still extremely fragile, especially with fears over the banking sector. There was further strong pressure on the ECB to reverse course and increase peripheral bond buying. German Chancellor Merkel offered to relinquish some sovereignty, but remained opposed to any increased ECB role.

The US consumer inflation data was slightly weaker than expected with a headline 0.1% decline in prices, although there was still a 3.5% annual increase. The growth-orientated data was better than expected as the NAHB housing index rose to the highest level since May 2010 at 20 while there was a bigger than expected 0.7% gain for industrial production. The data should continue to spur some optimism surround the US outlook and provide some fundamental dollar support.

Risk appetite deteriorated again following Fitch’s warnings over the US banking sector with the Euro retreating to lows around 1.3420 before rallying again.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar continued to find support on dips to just below 76.90 against the yen while ranges were very narrow as the US currency failed to move above the 77.10 area. Both currencies tended to move in tandem due to the strong influence of risk appetite.

There were concerns over the threat of Bank of Japan intervention, but underlying yen selling pressure was still limited given fears over the Euro-zone outlook. There will be further speculation over capital repatriation, especially if stresses within the banking sector continue to intensify.

Continued market speculation over a raising of the Euro minimum level also provided some underlying support for the yen as an alternative safe-haven.

Sterling

Sterling was unable to sustain a move back above 1.58 against the dollar on Wednesday and tested 4-week lows below 1.57 before a partial recovery with Sterling also finding it more difficult to advance against the Euro.

The headline labour-market claimant count was better than expected with a 5,300 increase the lowest since February. The underlying data was weaker as unemployment increased to 8.3% from 8.1% while there was a further increase in youth unemployment.

In the latest inflation report, the Bank of England confirmed that it is expecting a sharp decline in inflation during 2012. In addition, there was a forecast 1.3% rate in two years time. With the bank also downgrading its growth forecasts, the implication was that there would be further quantitative easing over the next few months.

The bank continued to warn over the growth outlook and the overall tone of remarks was very downbeat with increased fears over the Euro-zone impact. Bank Governor King also voiced particularly strong concerns surrounding the banking sector with the threat of a fresh credit crunch as lending contracted further which could easily trigger recession.

Swiss franc

The dollar retreated from highs above 0.92 on Wednesday, but did find support below the 0.9150 area and advanced to re-test one-month highs on Thursday. The Swiss currency was generally weaker on the crosses as the Euro probed above the 1.24 resistance area despite underlying vulnerability.

There was further speculation that the National Bank would push for an increase in the Euro minimum level with market chatter at an increasingly high volume over the past 24 hours. This speculation continued to limit the scope for any franc support on safe-haven grounds.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

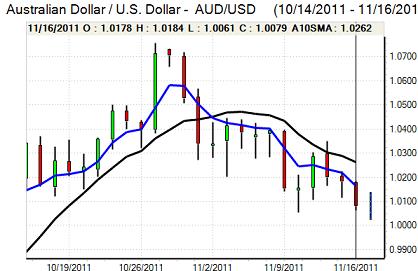

Australian dollar

The Australian dollar moves have continued to be dominated by trends in risk appetite. A recovery in the currency to the 1.0170 area was followed by a sharp retreat to lows near 1.0025 as Wall Street came under heavy selling pressure after Fitch’s warning on US banks. There were also increased fears surrounding the Asia outlook, especially if there is a tightening in credit conditions.

In this environment, domestic influences continued to have little impact with the Australian currency rallying back to the 1.01 area as the Euro also found some relief.