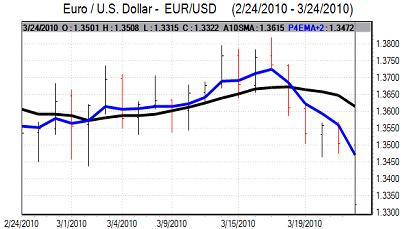

EUR/USD

The Euro was subjected to fresh selling pressure in Asia on Wednesday as a persistent lack of confidence surrounding the Greek situation triggered further selling from regional funds. The Euro weakened to fresh 10-month lows close to 1.34 and was unable to make any significant recovery in early Europe with fresh losses to near 1.3360.

The Euro-zone economic data was stronger than expected with gains for the PMI indices while the German IFO index rose to 98.1 for March from 95.8, but the Euro was able to secure only very short-lived relief.

Later on Wednesday, the Euro was subjected to further downward pressure as there was further negative news from the Euro-zone. Fitch announced a downgrading of Portugal’s credit rating to AA- from AA due to structural budget deficit fears. The downgrading reinforced a lack of confidence towards the Euro with particular fears that tensions would spread to Spain. A wider sense of unease over sovereign ratings also tended to increase defensive demand for the US dollar.

There was also further uncertainty over Greek debt negotiations which undermined confidence. The German government appeared to be willing to supply aid to underpin the Greek budget only if there was IMF involvement and tight conditions.

The headline US durable goods data was marginally weaker than expected, but the underlying data was still robust and there was an upward revision to the previous month’s data. The existing home sales data was marginally weaker than expected, but this did not have a notable impact.

The Euro remained under pressure, weakening to a fresh 10-month low near 1.3320 while the dollar advanced over 1% during the day on a trade-weighted basis.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The Euro tended to be the main focus on Wednesday which dampened yen moves and the dollar edged higher to just above 90.50 against the yen. The commodity currencies were holding firm against the US dollar while the Nikkei index tested 2-month highs during the Asian session and this maintained a flow of funds out of the yen.

The dollar then advanced strongly in European trading on Wednesday with highs near 92.20 against the Japanese currency. The US currency gained some benefit from a weaker Euro, but there was also independent yen weakness as it also lost ground against the Euro with a rise in US bond yields triggering a flow of funds out of the yen. The depreciation will also reinforce speculation over carry-related outflows from the Japanese currency.

Sterling

Sterling edged lower against the dollar in early Europe on Wednesday, but advanced to 0.8965 against the generally weak Euro.

The UK budget was broadly in line with market expectations. The government downgraded slightly its GDP growth estimates for 2010 and 2011, but was also able to project slightly lower government borrowing estimates for the next two years. The deficit was still forecast to be near 12% of GDP over the next two fiscal years which will continue to expose Sterling to the risk of renewed selling pressure.

Markets were generally unconvinced and uneasy over the lack of budget detail which prevented any significant support for Sterling. Renewed sovereign debt fears will also tend to be a negative factor for the UK currency over the next few weeks.

Sterling dipped to lows around 1.4875 against the dollar, as the US currency secured wider gains, but it held firm against the Euro.

Swiss franc

The dollar found support close to 1.0550 against the franc on Wednesday and pushed to a high close to 1.0720 against the Swiss currency as the dollar secured wider gains.

The Euro found support below the 1.4250 level against the franc and rallied slightly to the 1.4280 region, but was still unable to make much headway.

National Bank member Jordan repeated recent comments that the central bank would act decisively to curb excessive franc appreciation, but the currency-market impact was still limited as markets took less attention of verbal intervention.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

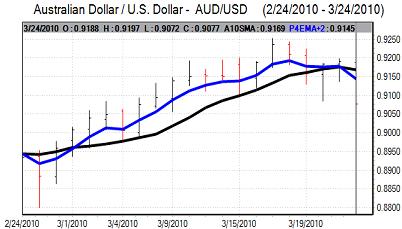

Australian dollar

The Australian dollar initially returned to its best levels near 0.92 against the US dollar in early Asian trading on Wednesday before retreating back towards 0.9140.

Wider US currency strength continued to sap the Australian currency during the day and it weakened to lows near 0.9080 in US trading, although it was broadly resilient on the crosses, especially against the yen.

The currency will continue to gain some near-term support from a stabilisation in near-term confidence towards the global economy, although wider sovereign ratings fears could be a significant negative factor.