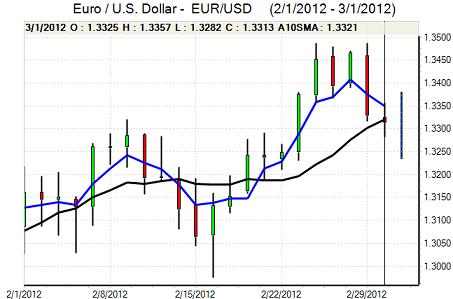

EUR/USD

The Euro was unable to gain any fresh support during Thursday and there was a significant divergence in currency trends as the Euro generally under-performed even though risk appetite was firm.

The Euro unemployment rate rose to a fresh 15-year high of 10.7% for January from a revised 10.6% the previous month, reinforcing fears that underlying demand conditions remained extremely weak. There were also further concerns surrounding the peripheral economies as there was a further slide in the Greek PMI index.

The underlying Greek situation remained an important focus as the ISDA ruled that the Greek private-sector debt swap and ECB bond swap did not constitute a credit event which would trigger credit default payments. The ISDA did warn that it was still monitoring developments and the triggering of Collective Action Clauses could still trigger action. The underlying stance increased doubts over peripheral bonds.

There were also further signs of tensions between the ECB and Bundesbank as a letter between Bundesbank Head Weidmann and ECB head Draghi revealed policy disagreements. There were also suggestions that part of the Greek loan would be withheld as required measures were still to be implemented.

US jobless claims data recorded little change at 351,000 in the latest week while there was a small increase in personal spending. Somewhat surprisingly given the regional surveys, there was a decline in the PMI manufacturing index to 52.4 for February from 54.1 previously, although there were solid readings for orders and employment which helped lessen the impact. Bernanke’s comments were broadly unchanged from Wednesday’s testimony and there was no major impact.

The US currency gained some support against the Euro on yield grounds, although the currency still found it difficult to make wider headway, especially with oil prices still at elevated levels. The Euro consolidated near 1.33 later in the session on expectations of underlying weakness.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar found support on dips to just below the 81 level against the yen on Thursday while there was resistance close to the 81.30 area as narrow ranges prevailed for much of the day.

Although the US PMI data was weaker than expected, the dollar was still cushioned by a further increase in Treasury yields later in the session.

The Japanese household spending data was weaker than expected with a 2.3% annual decline while unemployment was unchanged while core consumer prices fell 0.1% over the year. The main focus was on Bank of Japan Governor Shirakawa’s comments as he stated that the central bank would continue to ease monetary policy. The dollar moved back to the 81.50 region following the comments.

Sterling

Sterling maintained a firm tone on Thursday with support above the 1.59 technical support zone, although there was no challenge on the 1.60 area. The UK currency maintained a strong tone against the Euro with a high close to 0.8330. Further gains were curbed by expectations of strong importer demand close to this level.

The latest PMI data was slightly weaker than expected with the manufacturing index edging down to 51.2 from 52.0 previously. There was, however, some relief that the index stayed above the pivotal 50 level for the month which maintained reduced expectations of recession. There was also a monthly increase in house prices according to the latest Nationwide survey.

There continued to be a net reduction in expectations surrounding further quantitative easing which helped support the currency. There were also expectations that the ECB would be more aggressive than the Bank of England in expanding monetary policy which helped underpin Sterling.

Swiss franc

The dollar was able to resist a renewed test of support below 0.90 against the franc, although there was stern resistance above the 0.9050 area. There was a slightly firmer Euro tone against the Swiss currency as it edged higher to the 1.2060 region. There will still be the potential for capital inflows into the Swiss currency given unease over the impact of extremely expansionary G3 monetary policies.

The Swiss PMI index rose 49 for February from 47.3 previously and coincidentally was the same figure as the Euro-zone. There was a stronger than expected reading for fourth quarter GDP which also provided some degree of relief surrounding the outlook.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

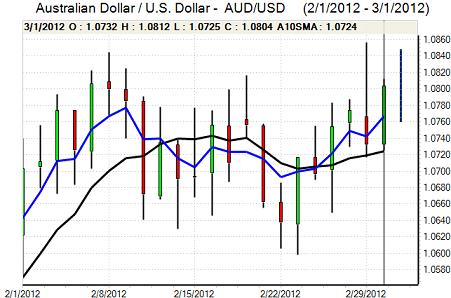

Australian dollar

The Australian dollar found support below 1.0750 against the US currency during Thursday and pushed to highs above the 1.08 level with expectations that expansionary central bank policies will help boost global liquidity. There was further support from gains in oil prices while an easing of fear surrounding the global economy also helped boost demand for risk assets.

Asian equity markets also made some headway on Friday, but there was still a sense of caution, especially as high oil prices will jeopardise the global growth outlook.