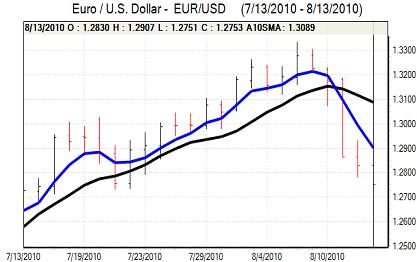

EUR/USD

The Euro moved higher in early Europe on Friday with stronger than expected German GDP data boosting confidence. There was a quarterly advance of 2.2% for the second quarter with an underlying strong performance enhanced by a rebound following first-quarter weakness. The Euro-zone economy as a whole recorded higher than expected GDP growth of 1.0%.

The Euro was unable to sustain gains following the GDP data and was subjected to renewed selling pressure during the day. There was a weak Italian bond auction with the bid/cover ratio falling to 1.27 from 1.74 in the previous sale. Lacklustre demand reinforced market unease over the weaker European economies and there was a further widening in credit-default swaps which also unsettled the Euro.

The US retail sales data was marginally weaker than expected with a 0.4% increase for July following a 0.3% decline the previous month while there was a 0.2% underlying increase. There was a 0.3% increase in consumer prices with the underlying increase at held at 0.1% while there was a small recovery in the University of Michigan consumer confidence index.

The data did not have a substantial impact on yield expectations and the dollar continued to gain support on a lack of confidence in global growth prospects. The Euro weakened to lows near 1.2750 against the dollar as the US currency secured the largest weekly advance for close to 2 years.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The latest Bank of Japan minutes recorded that officials were already uneasy over the impact of the Japanese currency before the most recent Japanese gains and these concerns will reinforce market speculation that there will be additional moves to block yen appreciation with the possibility that actual intervention will be considered.

The dollar will still be hampered by a lack of yield support while concerns over the global economy will continue to deter capital outflows. The US currency edged towards the 86.20 resistance area during a more subdued session on Friday.

The dollar found it difficult to gain support from the US data, but it did make gains in US trading with an advance to the 86.20 area.

Sterling

Sterling strengthened to a high near 1.5680 against the US dollar in early Europe on Friday, but was unable to sustain the gains. As there were renewed US currency gains, Sterling weakened to re-test support levels near 1.5550 against the dollar later in the European session.

There was significant technical support at lower levels which helped cushion the currency from further losses. Sterling also held a firm tone against the Euro and strengthened to a six-week high beyond 0.82 against the Euro.

Underlying confidence in the UK economy remained weaker and this was a negative factor for Sterling, but the impact was measured given that expectations had already shifted following the Bank of England inflation report. The latest inflation data and MPC minutes will be watched closely over the forthcoming week to assess potential interest rate trends and Sterling trends.

Swiss franc

The dollar was confined to narrower ranges against the franc on Friday with support blow 1.05 while there was no test of resistance towards 1.06. The Swiss currency maintained a very firm tone on the crosses with gains to near 1.34 against the Euro and this was the biggest weekly franc gain for 2 years.

The franc continued to gain support on defensive grounds as underlying risk appetite remained weaker given doubts over the global economy.

There was a 0.5% decline in producer prices for July which increased speculation that the National Bank could re-consider intervention, especially as Bank member Jordan stated that the intervention seen this year had been successful.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

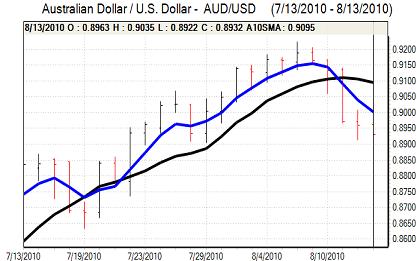

Australian dollar

The Australian dollar gradually recovered to challenge resistance levels above 0.90 against the US dollar in Asian trading on Friday. There was a stabilisation in risk conditions which helped support the currency, but underlying confidence is still likely to be very fragile given underlying doubts over the global economy. Confidence in the domestic economy is also liable to be fragile after a series of generally weak releases.

The Australian dollar was unable to sustain the advance and weakened back to the 0.8925 area later in the US session as there was renewed selling pressure on the Euro.