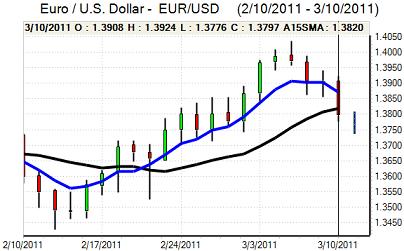

EUR/USD

The Euro generally remained under pressure during Thursday and dipped to test support below 1.38 against the dollar for the first time since early March.

Risk appetite had a mixed market impact with the US currency gaining some support from a sharp decline in equity prices, but there was a negative impact from an increase in oil prices, especially after reports that protests within Saudi Arabia had turned violent. The US currency should gain net support from reduced institutional confidence in emerging markets.

The Euro was unsettled again during the day by structural fears. A downgrading of Spain’s credit rating to AA2 from AA1 reinforced market concerns over sovereign ratings and debt-default risks, especially with a further widening of credit spreads. The widening of yield spreads will increase pressure for Euro-zone governments to secure an agreement this month on extending and improving bailout terms for EU countries which are unable to access market funds. The Friday EU summit will, therefore, be watched closely, although the impact may be lessened by the fact that no major breakthrough is expected at this meeting ahead of a bigger summit starting on March 24th.

The US economic data was weaker than expected with jobless claims rising to 397,000 in the latest week from a revised 371,000 previously, although the underlying trend remained generally favourable. The trade deficit also rose to US$46.3bn from a revised US$40.3bn the previous month. Higher oil prices will put additional upward pressure on the deficit which will maintain medium-term concerns over dollar valuation levels, but higher trade volumes will boost growth hopes.

The Euro dipped to two-week lows near 1.3775 against the dollar before rallying back to above the 1.38 level in Asian trading on Friday.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar maintained a generally firm tone against the yen during Thursday and tested resistance levels above 83 with a peak around 83.10, but it was unable to make further gains during the session.

The US data failed to support the dollar with a widening trade deficit and higher jobless claims lessening any further support on yield grounds.

Risk appetite was generally vulnerable during the session which provided support for the Japanese currency, especially with a sharp decline in global equity prices. The yen also gained support from capital repatriation flows while exporter selling remained a feature on any strong rally for the US currency. The latest Chinese economic data held no major surprises and the dollar found support just below 82.80.

Sterling

Sterling nudged towards 1.62 against the dollar ahead of the UK interest rate decision on Thursday.

The Bank of England left interest rates on hold at 0.50% following the MPC meeting and, as usual when there is no change in rates, the bank did not issue a statement. The vote breakdown will not, therefore, be known until the minutes are released in two weeks time.

The consensus was that rates would be left on hold, but there had been some speculation that the bank could raise rates and there was a substantial Sterling decline following the decision. There will be further fears that the bank is more worried about the growth outlook which will tend to undermine confidence in the UK currency and there was a general scaling back of more aggressive interest-rate expectations.

The UK currency will also tend to be more vulnerable selling pressure when there is a deterioration in risk appetite and Sterling weakened to a two-week low just below 1.6050 against the dollar while the Euro was able to hold near 0.86 despite underlying vulnerability.

Swiss franc

The dollar pushed to the 0.9350 area against the franc on Thursday, but was unable to break through this level and retreated to the 0.93 area.

There was fresh demand for the Swiss franc on safe-haven grounds as risk appetite deteriorated during the day with the Euro dipping to lows below 1.2850 as equity markets fell sharply. Strength on the crosses made it even more difficult for the dollar to advance. The Swiss currency gained support from renewed fears surrounding the Euro-zone debt fears and any increase in political tensions would increase the potential for capital flows into Switzerland.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

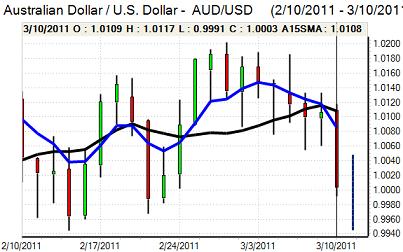

Australian dollar

The Australian dollar remained under pressure during the European session on Thursday and dipped to test support below the parity level for the first time since late February. The currency was undermined by a deterioration in risk appetite and confidence in the domestic economy also remained weaker following a series of generally disappointing data releases.

There were no major surprises from the Chinese economic releases and the Australian currency found buying support below 1.00 against the US currency with choppy trading conditions liable to persist in the short term.