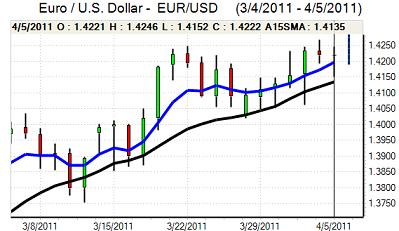

EUR/USD

The Euro was subjected to some selling pressure during the European session on Tuesday and retreated to test support near 1.4150, but the dollar was unable to gain significant traction and the Euro advanced again during the US session with a fresh challenge on resistance above 1.4250 in Asia on Wednesday.

The Euro was unsettled temporarily by another downgrade of Portugal’s sovereign rating and by a further increase in Chinese interest rates, but the currency remained resilient in the face of persistent fears surrounding the peripheral outlook.

There were strong expectations of an ECB interest rate increase on Thursday and renewed speculation that the central bank would either decide on a 0.50% increase this month or would look to signal a series of increases over the next few months. The ECB will want to sound tough on inflation, but there is also likely to be a degree of caution given the global growth outlook.

The latest ISM non-manufacturing index was slightly weaker than expected at 57.3 for March from 59.7 the previous month and suggested that the sector might be slowing.

The FOMC minutes were broadly in line with expectations as a majority were content to maintain the highly-expansionary policy. There were greater reservations from several regional Fed Presidents and these divisions are liable to increase over the next few weeks. Without any clear comments from Chairman Bernanke, markets will assume that the Fed will be very reluctant to tighten policy.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar found support close to 84.20 against the yen during Tuesday and made some advance following the FOMC minutes as US Treasury yields increased.

Dollar gains accelerated early in Asian trading on Wednesday as it pushed to a high near 85.50 which was the highest level for 2011. The yen was subjected to heavy selling pressure on the crosses as the Australian dollar and Sterling both made strong progress.

Overall risk appetite remains firmer which will maintain selling pressure on the currency in the short term. There will also be expectations that the Bank of Japan will look to maintain a highly-expansionary monetary policy at Thursday’s council meeting which will also tend to sap yen support. There will be fears that markets are becoming complacent over global risk trends which could trigger a sharp correction.

Sterling

Sterling found support close to 1.6120 against the dollar on Tuesday and advanced strongly following the latest economic data. The PMI services index rose to 57.1 for March from 52.6 the previous month. This was a 13-month high for the index and much stronger than expected, although business optimism did actually decline slightly.

The stronger than expected data will increase pressure on the Bank of England to increase interest rates, especially as inflationary pressures were also reported as intensifying in the survey. The central bank will still be very uneasy over the economic outlook as consumer spending remains under pressure. There was also a slight moderation in the latest BRC shop-price inflation index which may ease retail inflation fears slightly.

The key factor is that Thursday’s decision is likely to be very close, especially as there will certainly be a core of members who will vote for a rate increase.

The UK currency pushed to a high near 1.6350 against the dollar as it also gained support from a general improvement in risk appetite.

Swiss franc

The dollar found support on dips to below 0.9220 against the franc during Tuesday and spiked higher to a peak around 0.9290 before consolidating near the 0.9260 area later in Asian trading on Wednesday. The dollar gained from wider franc losses rather than independent strength as the Swiss currency retreated to lows beyond 1.32 against the Euro.

The improvement in risk appetite and a surge in carry-trade activity will continue to lessen potential defensive franc demand in the short term. Although there has been further evidence of capital flows from weaker European economies, there has been an increased flow into emerging markets rather than the franc. There will be no scope for complacency given the Euro-zone structural vulnerabilities.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Australian dollar

The Australian dollar dipped to lows just below 1.03 against the US currency on Wednesday, undermined by some degree of disappointment over the Reserve Bank’s policy statement, while the announcement of another Chinese interest rate increase also damaged sentiment.

There was still strong buying support on dips and wider US vulnerability, together with renewed interest in commodity prices, helped push the local currency back to highs in the 0.9370 area. The domestic data was disappointing again with a second successive sharp decline in home loans for February which is liable to trigger fresh reservations over the currency.