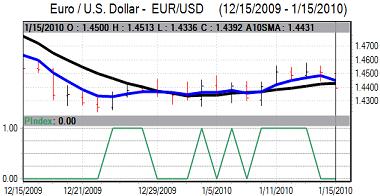

EUR/USD

The Euro weakened again to near 1.44 in early Europe on Friday, undermined in part by rumours of German Chancellor Merkel’s resignation.

Underlying confidence surrounding the Greek debt situation also remained very weak and this contributed to downward pressure on the Euro as there was a further widening in yield spreads between German and Greek bonds during the day.

The New York manufacturing index was stronger than expected with an increase to 15.9 for December from a revised 4.5 the previous month, although the series is very volatile on a monthly view. The latest University of Michigan consumer confidence data was slightly below expectations, although the impact was limited.

The consumer prices data was slightly weaker than expected with a headline increase of 0.1% for the month compared with a consensus forecast of 0.2% while core prices also rose 0.1% over the month. The immediate inflation risks remain low, but there will be medium-term fears over the situation, especially given the huge Federal Reserve balance sheet expansion seen over the past year. Policy uncertainty will persist, especially as there will be divisions within the FOMC.

The Euro trends tended to dominate during the day and the currency weakened to lows below 1.4350 against the dollar before stabilising later in the US session.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

Bank of Japan Governor Shirakawa warned on Friday that growth was likely to slow in the first quarter of 2010 which will tend to reinforce fears over underlying economic trends. There will also be fears over the deflation threat which will tend to undermine the Japanese currency with pressure for further economic support measures.

Risk appetite was slightly weaker on Friday on greater fears over a sharp slowdown in credit growth within China and this helped slow potential capital outflows from the Japanese currency. In this environment, the yen held steady against the dollar and made some significant headway against the generally weak Euro.

The dollar found support towards the 90.50 region, but was unable to sustain a move above the 91 level as risk appetite was generally weaker as equity prices came under pressure.

Sterling

Sterling held above the 1.63 level against the US dollar in Europe on Friday, but had a generally weaker tone in US trading. This reflected a generally firmer US currency and some profit taking on long Sterling positions. The UK currency remained a firm tone on the crosses, but did hit resistance close to 0.88 against the Euro.

There was no significant economic data on Friday, but the latest data will be watched closely next week with data releases on inflation and unemployment as well as the latest MPC minutes

A stronger than expected figure for inflation would reinforce speculation that the Bank of England could be forced into an earlier than expected increase in interest rates to head off inflationary pressure.

Swiss franc

The dollar found support below 1.02 against the franc on Friday and rallied to a high around 1.0285 in US trading before consolidating around 1.0265. The Euro was unable to make any headway against the Swiss currency.

Swiss producer prices rose 0.1% in December with an annual decline of 2.5%. Although the data was close to expectations, there will be some additional pressure on the National Bank to curb franc appreciation.

The Swiss currency will continue to gain some degree of support from fears over the Euro-zone outlook, especially given persistent debt fears surrounding the Greek-debt situation.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Australian dollar

The Australian dollar consolidated above the 0.93 level against the US dollar for much of the day on Thursday before weakening back to test support levels below 0.9250 on Friday. There were increased unease over the risks of a slowdown within China and the US currency was also generally firmer.

The Australian dollar was unable to regain momentum during the day and drifted back towards the 0.9220 level later in the US session as equity markets remained on the defensive.