EUR/USD

Euro weakness on the crosses was still an important feature in early Europe on Tuesday and this was again an important feature in protecting the dollar against the Euro even with the US currency slightly weaker against most currencies.

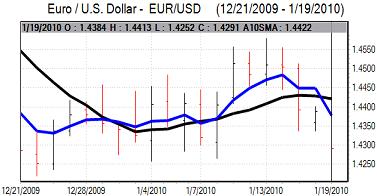

After failing to push above 1.44, the Euro weakened after a lower than expected figure for the German ZEW index. A decline to 47.2 for January from 50.4 previously, allied with cautious remarks from officials, reinforced a lack of confidence in the Euro-zone economy.

The US NAHB housing index edged lower again in December and there will be some further doubts over the sector if Wednesday’s data is weaker than expected.

Markets will remain on alert for fresh comments from Federal Reserve figures over the next few days. It is certainly the case that there will be divergent views within the FOMC which could trigger erratic trading conditions. Overall, the dollar will find it difficult to gain further strong support on yield grounds unless there is tough rhetoric from key Fed officials.

The latest US capital account flows data for November recorded a sharp increase in long-term inflows to US$126.8bn from a revised US$19.3bn the previous month. Overall inflows were still subdued, but the data will provide some degree of support to the US currency as it suggests that there is still robust underlying interest in US assets.

Euro trends tended to remain dominant and the currency dipped to 4-week lows near 1.4250 before consolidating near 1.43 as underlying confidence remained depressed.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

There was a further increase in Chinese bill yields on Tuesday which ensured a cautious tone towards global risk and this provided some degree of yen protection, especially with further doubts over the global economic recovery.

Confidence in the Japanese economy is still weak and a further decline in consumer confidence reinforced pressure on the Bank of Japan to maintain an aggressive monetary policy to ease the deflation threat.

The dollar again tested support levels below 90.50 during the Asian trading session on Tuesday while the Euro re-tested 4-month lows against the Japanese currency as some support emerged near 130.

The US currency drew support from the firm capital flows data and pushed to a high of 91.25 in New York trading.

Sterling

Sterling maintained a firm tone in early Europe on Tuesday. Confirmation that Kraft foods was to make an improved and agree bid for Cadburys reinforced expectations of investment flows into the UK.

The latest consumer inflation data was even higher than expected with a sharp increase in the year-on-year headline rate to 2.9% for December from 1.9% the previous month and this was a nine-month high for the series. The rate will increase again for the January reading and there will be additional pressure for the Bank of England to increase interest rates.

These expectations will provide some degree of support for Sterling, although there will also be some fears that the central bank will loose control of economic policy which could cause important long-term damage to the UK currency.

Comments from Bank of England Governor King were mixed and did not add to the speculation over higher interest rates as he stated that inflation would moderate during the first half of 2010.

Sterling was unable to hold above 1.64 against a firm dollar, but maintained a firm tone on the crosses with advances against the yen and it held near 4-month highs around 0.8720 against the Euro.

Swiss franc

The dollar found support below 1.0240 against the Swiss franc on Tuesday and pushed to a high just above 1.0350 in US trading before a partial retreat.

The Euro pushed to highs near 1.4780 with some speculation over National Bank action to weaken the Swiss currency, but the Euro was unable to sustain the gains and weakened back towards the 1.4750 level

The Swiss currency will continue to gain some defensive support from an underlying lack of confidence in the Euro-zone.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Australian dollar

The Australian dollarwas marginally weaker on Tuesday, but there was firm buying support on dips. There will be further speculation over a slowdown in the Chinese economy and weaker commodity prices which will tend to lessen near-term Australian dollar support.

The Australian dollar dipped to lows below the 0.92 level before rallying back to the 0.9240 level later in the US session as retreats continued to attract buying support.