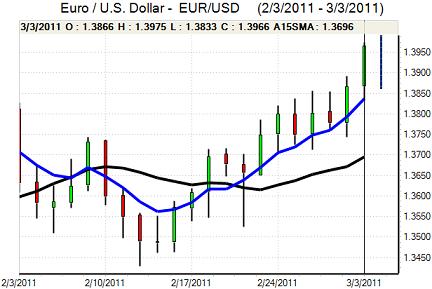

EUR/USD

There were no surprises from the ECB interest rate decision on Thursday with the main lending rate held at 1.0%. President Trichet’s press conference, however, was significantly more hawkish than expected as references to monetary policy being appropriate were dropped and he also stated that inflation risks had risen with strong vigilance needed. These were very strong hints that a near-term rate increase is likely. To reinforce the point, he stated that an increase could be considered at the April meeting, although he also stated that the bank was not looking at a series of rate increases.

Overall, the ECB has given a clear signal that rates will be increased in April unless there is some major market dislocation in the meantime and the Euro will gain further yield-related support in the near term. There will, however, also be fears that peripheral economies will suffer further damage and there will also be further political tensions surrounding sovereign debt concerns. The summit of centre-right governments will be watched closely on Friday to assess whether any compromise agreement is a realistic possibility later in March.

The US economic data received less attention than usual, but maintained a stronger tone as jobless claims fell to 368,000 in the latest week from a revised 388,000 previously. The ISM services-sector index also rose to 59.7 from 59.4 previously. The data will maintain optimism over near-term growth trends and this confidence would be reinforced by a strong payroll figure on Friday. The impact of higher bond yields will be offset by the Fed’s reluctance to tighten monetary policy.

The Euro jumped to a high above 1.3970 and maintained a strong tone in Asia on Friday as caution prevailed ahead of the payroll data.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar held steady above 81.60 support against the yen in European trading on Thursday and pushed higher following the better than expected US data. The US currency gained support as Treasury yields rose strongly and there was also important cross-related selling at the Japanese currency retreated sharply against the Euro.

Yield considerations will remain important in the short term and there will be further dollar support if there is a better than expected US employment report on Friday.

Domestically, despite recent signs of better than expected growth data, Bank of Japan Shirakawa continued to warn over the deflation threat which suggests that the bank will maintain a very expansionary monetary policy. The yen could still gain fresh support if there is a renewed deterioration in risk appetite.

Sterling

Sterling continued to challenge resistance levels above 1.63 against the dollar in Europe on Thursday, but was unable to break above 1.6320. The UK currency then dipped sharply following the CIPS services-sector data which registered a decline to 52.6 for February from 54.5 previously.

The data will increase unease over potential economic trends in the economy, especially given the dominance of the services sector and this will make it more difficult for the Bank of England to justify a tighter monetary policy in the near term.

In contrast to the clear comments made by ECB President Trichet, MPC member Bean delivered much more ambiguous comments. He stated that inflation may be more persistent than expected, but also that there were some warning signs over a slowdown in the economy. Overall, there is likely to be a high degree of uncertainty running into Thursday’s policy announcement.

Sterling dipped to lows near 1.6250 against the dollar before being rescued by a weaker US currency while it also weakened to 0.8580 against the Euro.

Swiss franc

There were sharp moves for the Swiss franc on Thursday as the Euro found very strong support following the ECB press conference. The franc weakened to beyond 1.30 from near 1.2850 and the dollar was also able to move back above 0.93 against the franc.

The National Bank will be very cautious over raising interest rates which will tend to lessen yield support if the ECB raises rates in April and the central bank will certainly not oppose any further currency retreat. The Euro-zone sovereign-debt issues will still be watched very closely as renewed tensions could lead to fresh demand for the Swiss currency.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

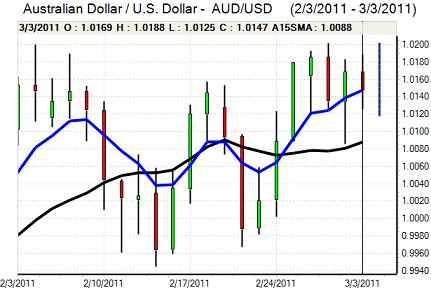

Australian dollar

The Australian dollar tested resistance close to 1.0180 against the US currency on Thursday, but was unable to break above this level even after the Euro rallied strongly. Indeed, the Australian currency weakened to lows near 1.0110 during the Asian session on Friday.

The hawkish ECB tone had a negative impact on commodity price which dampened immediate demand for the currency and there was also some negative impact from higher US bond yields. Comments from Prime Minister Gillard over the negative impact of the strong currency also fuelled unease on valuation grounds.