EUR/USD

The Euro maintained a generally firm tone ahead of the ECB meeting on Thursday and consolidated above 1.3150 against the dollar with risk conditions generally more stable.

As expected, the ECB left interest rates on hold at 1.00% and the main focus was on the Chairman’s press conference. Trichet announced that the special liquidity measures to support the banking sector would be extended until at least April 2011 in order to combat liquidity difficulties and this was broadly in line with market expectations.

There was no mention that the central bank would buy additional bonds and this lack of action undermined the Euro with an immediate decline to test support below 1.31. Despite a lack of comment on additional bond buying, there was evidence of strong buying of peripheral bonds by the ECB. The buying helped narrow yield spreads and also stabilised risk appetite which reversed trends and pushed the Euro to a high around 1.3240. Underlying confidence will remain very fragile and the Euro will still be vulnerable in the short term.

The US jobless claims data was slightly weaker than expected with an increase to 436,000 from a revised 410,000 the previous week. In contrast, there was a strong 10.0% increase in pending home sales. The US payroll data will be watched closely on Friday and confidence in the US economy would be boosted to some extent by a stronger than expected figure.

The impact would be mixed as a solid release would also tend to boost risk appetite which would curb defensive dollar demand. The Euro consolidated close to 1.32 in Asian trading on Friday.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar was unable to break above 84.30 against the yen during Thursday and dipped sharply during the US session with a decline to lows just above 83.50 where solid US support emerged.

Although immediate fears surrounding the Euro-zone have eased to some extent, there is still an important element of caution and there has been further evidence of capital repatriation which has helped underpin the Japanese currency.

The Korean situation will continue to be watched closely and will also have a mixed yen impact as any yen selling from an increase in tensions would be offset by a general deterioration in risk appetite.

The dollar gained some protection on yield grounds with benchmark Treasury yields rising to the 3% level for the first time for over four months, but the yen maintained a firm tone in Asia on Friday.

Sterling

Sterling hit resistance close to 1.5640 against the dollar on Thursday and was generally on the defensive during the session with lows below 1.5520 during the US session.

The domestic data did not have a major impact with a slightly stronger than expected PMI index reading for the construction sector. The domestic influences will tend to remain of secondary importance in the very short term, but will return to prominence over the forthcoming week with the Bank of England MPC meeting on Thursday.

An easing of Euro-zone tensions will tend to lessen any defensive demand for Sterling and this will tend to have a negative impact on the UK currency. The UK currency will be much more vulnerable if there are any signs of renewed stresses within the UK banking sector. Sterling edged back towards 1.56 against the dollar in Asia on Friday in subdued conditions.

Swiss franc

The Euro came under renewed pressure against the franc following the ECB meeting on Thursday. Significantly, the Swiss currency maintained a generally firm tone later in the session even when the Euro rallied against the dollar. The US currency hit pressure above parity against the franc and dipped to lows near 0.99.

An easing of immediate Euro-zone fears would lessen defensive franc demand to some extent, but the overall impact is likely to be limited as underlying Euro-zone fears will persist.

A weaker than expected inflation release on Friday would increase pressure on the National Bank to resist franc gains.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

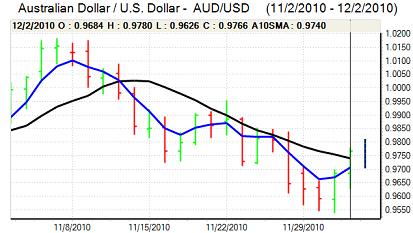

Australian dollar

The Australian dollar found support on dips towards 0.9620 against the US currency on Thursday and rallied strongly in US trading. The US currency was generally weaker which helped underpin the Australian currency and there was strong demand for commodity currencies, especially as risk appetite stabilised.

There are still important fears surrounding the dollar and Euro outlooks and this will maintain underlying demand for alternatives such as the Australian dollar, but risk conditions could deteriorate again quickly.

Domestically, the manufacturing PMI index sloped back to significantly below the 50 level which will maintain important unease over the domestic economic trends.