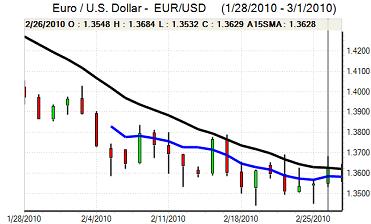

EUR/USD

The Euro continued to find solid buying support on retreats to below 1.3650 against the dollar on Thursday and rallied once again to test resistance levels above 1.3720. Although it pushed to a peak around 1.3750, there was an absence of follow-through buying.

The Euro-zone business confidence data was stronger than expected, but the main impetus for Euro support came from interest rate expectations. ECB member Bini-Smaghi warned over the impact of imported inflation and there was a clear warning over the possibility of higher interest rates. It is certainly possible that ECB officials are looking to use the threat of higher rates to influence wage expectations, but the Euro will still tend to gain from additional yield support.

The headline US economic data was weaker than expected with jobless claims rising to 454,000 in the latest week from 403,000 previously while there was a 2.5% decline in durable goods orders. The underlying data was more favourable and the unemployment data was probably distorted by adverse weather conditions.

The latest US GDP data will be watched closely on Friday and a robust reading would maintain expectations of solid growth. The impact will continue to be dampened by expectations that the Federal Reserve will maintain an ultra-low interest rate policy for the foreseeable future.

There will also be further unease over the medium-term US credit-rating outlook with Moody’s making comments that the risk of a downgrade was small, but was rising. Media attention on the issue will increase as the US Treasury approaches the debt ceiling.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar found support close to 82 against the yen on Thursday and rallied strongly in early Europe. The yen weakened sharply to lows around 83.20 following a credit-rating downgrade from Standard & Poor’s with the sovereign rating cut to AA- from AA. Confidence in the fiscal position has been gradually deteriorating and underlying confidence will remain weak with the risk of capital outflows.

The latest economic data was mixed as there was a decline in unemployment to 4.9% from 5.1%, but the retail sales and household spending data was sharply weaker than expected with a 3.3% annual spending decline.

The US economic data will be watched closely on Friday and the dollar will gain additional yield support if growth tops 4.0%. Exporter dollar selling will continue to be a near-term feature above the 83 level and the US currency edged back to the 82.70 area

Sterling

Sterling traded with a quieter tone during Thursday with an absence of major economic news following the dramatic events earlier in the week.

As far as economic data is concerned, there was another strong reading for the latest CBI retail sales survey. In contrast, the latest GfK consumer confidence was much weaker than expected with a decline to -29 from -20 taking the index to the lowest level since March 2009.

The inflation and growth debate will continue in the short term and there will be further speculation that the Bank of England will feel that it must increase interest rates to curb inflation. Given fears over the growth outlook, it remains far from certain that a rate increase would be beneficial to Sterling.

The UK currency pushed to a high near 1.60 against the dollar, before weakening back to just below 1.59 following the weaker than expected confidence data. The Euro found support close to the 0.8580 level.

Swiss franc

The franc was confined to slightly narrower ranges during Thursday with a weaker net tone, but some support close to 1.30 against the Euro. The dollar briefly retreated to below the 0.94 level before recovering to a peak around 0.9480.

National Bank Chairman Hildebrand warned over the negative consequences of a strong franc, but there was no suggestion of intervention at this stage. The franc will remain vulnerable to some net selling on yield grounds if confidence in the Euro-zone can be sustained, but there will be no room for complacency and there will be the risk of renewed volatility.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Australian dollar

The Australian dollar dipped sharply against the US currency following Standard & Poor’s downgrading of Japan and it was unable to regain momentum later in the session with a further test of support below 0.99 against the US dollar.

Domestically, there were further fears over the negative impact of flood damage and there were expectations that the Reserve Bank would not increase interest rates during the first half of 2011. Metals prices were also generally on the defensive which curbed immediate support for the Australian currency.