EUR/USD

The Euro continued to find strong buying support on dips during Tuesday and there were renewed gains in New York as the US dollar remained under pressure.

The US PMI manufacturing index rose to 60.8 for January from 58.5 previously and this was the highest reading for 7 years with the prices component also very strong. The data helped maintain optimism over near-term US growth trends, but there was also an important global impact with greater confidence over international growth. This confidence helped improve risk appetite and also curbed defensive demand for the dollar, especially with expectations that the Fed would not shift towards any policy tightening.

The Euro-zone data remained generally encouraging with an upward revision to the PMI manufacturing data while there was a decline in German unemployment. Inflation pressures remain an important focus and there was further speculation that the ECB would reinforce its shift towards a tighter policy at Thursday’s council meeting.

With the ECB also stopping its emergency buying of Euro-zone bonds, there were additional expectations that the bank would focus more on price stability and force the burden of rescuing weaker members on to national governments. The Euro will gain further support if a framework for stronger support mechanisms can be agreed at Friday’s summit. There is, however, also the possibility that the bank is concerned over such bond buying being declared outside the Maastricht Treaty and any such decision from the German courts would cause serious stresses within the Euro area.

Weaker US defensive demand pushed the dollar to a 12-week low on a trade-weighted basis and the Euro also pushed to a three-month high just above 1.3850.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar remained on the defensive against the yen during Tuesday and dipped to test support below 81.50. Despite a recovery following the US data, the US currency was again under pressure on Wednesday and weakened to lows near 81.30 before stabilising. The yen was, therefore, broadly resilient on the crosses despite the fact that improved global risk appetite should tend to weaken demand for the currency.

There were some reports of European bond-repatriation flows back to Japan which provided underlying support for the Japanese currency.

Japanese Finance Ministry comments will need to be watched very closely as there will be speculation over verbal intervention to weaken the Japanese currency if it advances towards the pivotal 80 level over the next few days. The US economic data will also be watched closely with the ADP employment release due on Wednesday.

Sterling

Sterling probed resistance levels above 1.6060 against the dollar ahead of the UK economic data on Tuesday and then pushed sharply higher with an 11-week high above 1.6150 while Sterling was slightly weaker against the Euro.

The manufacturing PMI index rose to 60.8 for January from 58.5 the previous month and this was the highest reading since the survey started in 1992. There was also a very strong reading for the prices component which will maintain pressure for higher interest rates.

The services-sector data will be watched very closely on Thursday and a strong recovery from December’s depressed reading would increase speculation over an early Bank of England tightening move. At present, markets have priced in around a 70% chance of higher interest rates by May. Comments from Bank of England officials will also be monitored very closely ahead of next week’s policy meeting.

Swiss franc

The Euro pushed to a high near 1.30 against the franc on Tuesday as internal Euro-zone yield spreads continued to narrow, but it was unable to break above this level and retreated back to below 1.2950. The US dollar failed to break above 0.9460 and retreated to near 2011 lows below 0.9350 during Asian trading on Wednesday.

National Bank member Jordan stated that massive franc gains were a threat to growth and there will certainly be persistent alarm within the bank. For now, they will primarily see an improvement in Euro sentiment rather than intervention as the key to weakening the Swiss currency, but verbal opposition to franc gains is likely to be seen.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

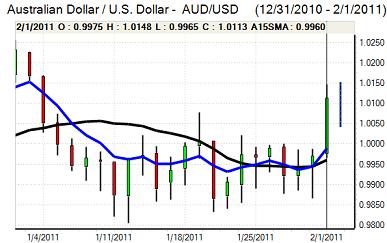

Australian dollar

The Australian dollar resisted pressure for a correction on Tuesday and advanced steadily to a 1-month high near 1.0150 before edging slightly lower. The currency continued to draw strength from a generally vulnerable US currency during the session.

The improvement in risk appetite and strength in commodity prices triggered by robust manufacturing data also helped support the Australian currency. Buying support was restrained to some extent by reports that a cyclone was posing a threat to Queensland and there will also be unease over the implications of further monetary tightening within Asia.